- Whales add 350M XRP tokens in 48 hours

- Social dominance jumps to 5.61%

- Bull flag pattern suggests potential push to $3.25

XRP has kicked off 2025 with remarkable momentum, posting a 10% gain in the first 24 hours of the year. This surge from $2.12 to $2.36 has positioned XRP as the top performer among major cryptocurrencies, suggesting a potential shift in market dynamics as we enter the new year.

Understanding The XRP Whale Activity

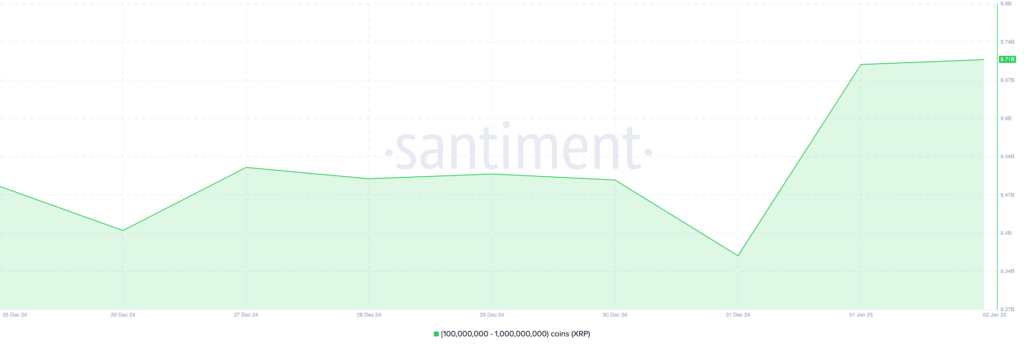

The surge in large holder activity presents a fascinating window into institutional confidence in XRP’s prospects. When we examine the on-chain data, we see that addresses holding between 100 million and 1 billion Ripple coins have increased their collective balance by 350 million tokens, representing an $826 million investment at current prices.

Source: Santiment

This substantial accumulation suggests these sophisticated investors anticipate further price appreciation. This whale activity coincides with a significant uptick in social dominance, which has reached 5.61%. Social dominance serves as a valuable metric because it measures the cryptocurrency’s share of conversation relative to other top assets.

When social dominance increases alongside whale accumulation, it often indicates growing market awareness that could translate into broader buying pressure.

The technical picture adds another layer of validation through the formation of a bull flag pattern on the daily chart. This technical structure, which typically follows strong upward movements, suggests potential continuation toward $3.25.

However, traders should remain mindful of the $1.80 support level, as any significant deterioration in buying pressure could trigger a test of this zone.

The convergence of substantial whale accumulation, increased social engagement, and supportive technical patterns creates a compelling case for continued upward momentum, though careful monitoring of support levels remains crucial for maintaining bullish market structure.