XRP attempt to break past the $2.7 resistance level has been met with strong selling pressure, forcing the price into a fresh decline. Its failure to sustain bullish momentum has shifted market sentiment, with bears seizing control and pushing the altcoin lower. As a result, traders are now eyeing key support levels to gauge the next move.

With technical indicators hinting at growing weakness, further losses risks remain high. If bearish pressure continues, XRP could see an extended drop, testing lower support zones. However, a swift recovery above critical levels could reignite bullish hopes and prevent a deeper correction.

XRP’s upside run has lost momentum following a strong rejection at the critical $2.7 resistance level, shifting market control back into the hands of the bears. The inability to sustain an upward breakout has triggered increased selling pressure, forcing the price into a downward trajectory. With bearish sentiment strengthening, XRP is now edging closer to key support zones that might determine the next phase of price action.

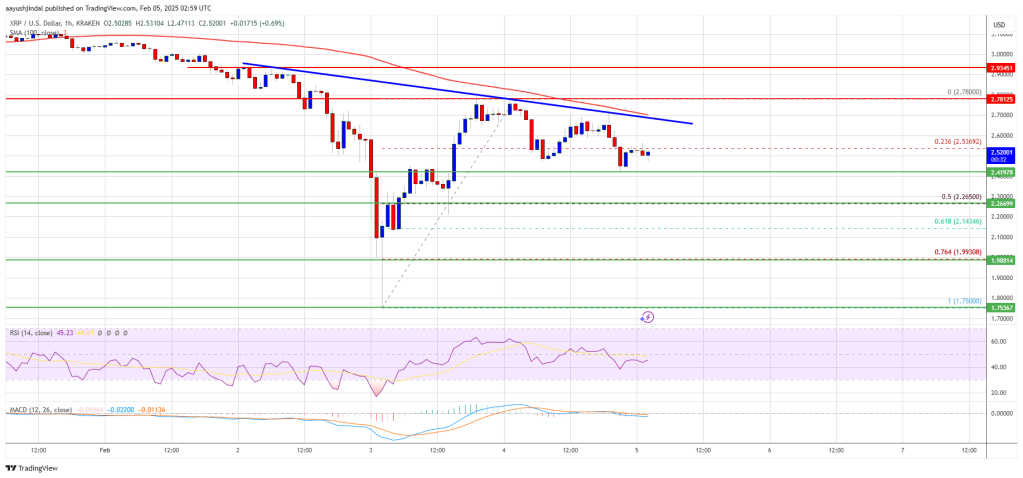

Technical indicators provide additional confirmation of XRP’s bearish outlook, particularly the fact that the price is trading below the 100-day Simple Moving Average (SMA). The 100-day SMA is often viewed as a crucial long-term trend indicator, and when the price is consistently below this level, it suggests that the overall trend is weakening or shifting to a bearish phase.

In conjunction with this, the RSI, which had been attempting to recover, has started to decline again after failing to reach the 50% threshold. This suggests that sellers are gaining the upper hand. If the downward trend continues, XRP could face a test of lower support zones, making the next few trading sessions crucial in determining its direction.

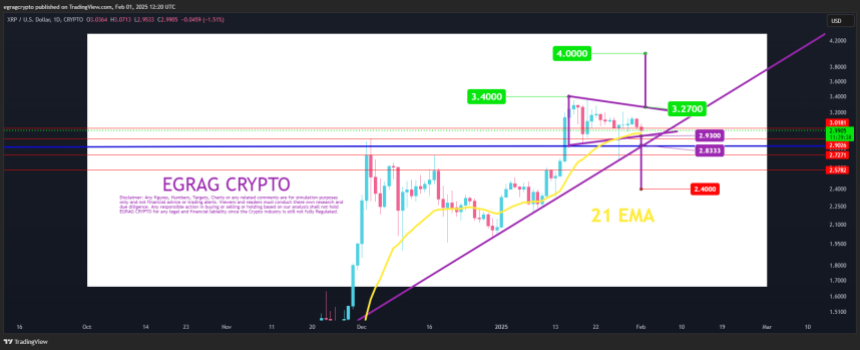

As selling pressure intensifies, monitoring key support levels that could determine XRP’s next move has become crucial. The first significant level to watch is the $1.9 support zone, which has previously provided a cushion for the price during pullbacks.

A break below this level would signal an acceleration of the negative trend, leading to a test of the $1.7 mark, another critical support area. Should the price fall below $1.7, XRP may find itself in a deeper correction, potentially heading toward the $1.3 support region.

However, a surge in bulls’ strength from any of these key support levels would trigger the beginning of a possible reversal for the altcoin. A bounce from the $2.2 or $2.0 support zones might indicate that buyers are stepping in to defend these critical levels, providing enough strength to push the price back toward key resistance zones.

With technical indicators hinting at growing weakness, further losses risks remain high. If bearish pressure continues, XRP could see an extended drop, testing lower support zones. However, a swift recovery above critical levels could reignite bullish hopes and prevent a deeper correction.

Bears Take Control: XRP Move Toward Lower Support Levels

XRP’s upside run has lost momentum following a strong rejection at the critical $2.7 resistance level, shifting market control back into the hands of the bears. The inability to sustain an upward breakout has triggered increased selling pressure, forcing the price into a downward trajectory. With bearish sentiment strengthening, XRP is now edging closer to key support zones that might determine the next phase of price action.

Technical indicators provide additional confirmation of XRP’s bearish outlook, particularly the fact that the price is trading below the 100-day Simple Moving Average (SMA). The 100-day SMA is often viewed as a crucial long-term trend indicator, and when the price is consistently below this level, it suggests that the overall trend is weakening or shifting to a bearish phase.

In conjunction with this, the RSI, which had been attempting to recover, has started to decline again after failing to reach the 50% threshold. This suggests that sellers are gaining the upper hand. If the downward trend continues, XRP could face a test of lower support zones, making the next few trading sessions crucial in determining its direction.

Key Support Levels To Watch If Selling Pressure Intensifies

As selling pressure intensifies, monitoring key support levels that could determine XRP’s next move has become crucial. The first significant level to watch is the $1.9 support zone, which has previously provided a cushion for the price during pullbacks.

A break below this level would signal an acceleration of the negative trend, leading to a test of the $1.7 mark, another critical support area. Should the price fall below $1.7, XRP may find itself in a deeper correction, potentially heading toward the $1.3 support region.

However, a surge in bulls’ strength from any of these key support levels would trigger the beginning of a possible reversal for the altcoin. A bounce from the $2.2 or $2.0 support zones might indicate that buyers are stepping in to defend these critical levels, providing enough strength to push the price back toward key resistance zones.