- Traders were hoping that XRP would be able to stay above the psychological level of $0.50.

- At the time of writing, XRP is trading at $0.4982, down 2.46% in the last 24 hours.

There has been no shift in the status quo of the ongoing legal dispute between Ripple and the US Securities and Exchange Commission (SEC), yet institutional investors are becoming more interested in XRP. There seems to be a shift in viewpoint within the sector, as seen by the increasing backing from prominent financial players.

An XRP-focused exchange-traded fund (ETF) has been recently proposed by 21Shares; if greenlighted, it would be listed on the Cboe BZX exchange. Significant support is shown by the proposal to have Coinbase Custody Trust Company serve as the fund’s custodian. In light of the current regulatory climate, the filing emphasizes 21Shares’ determination to grow its XRP-focused investment products.

Bitwise and Canary Capital are among the other companies that have applied for XRP ETFs. Despite Ripple’s ongoing legal troubles with the SEC, these moves demonstrate that institutional players are becoming more confident in XRP’s potential as an investment.

Bears Domination Continues

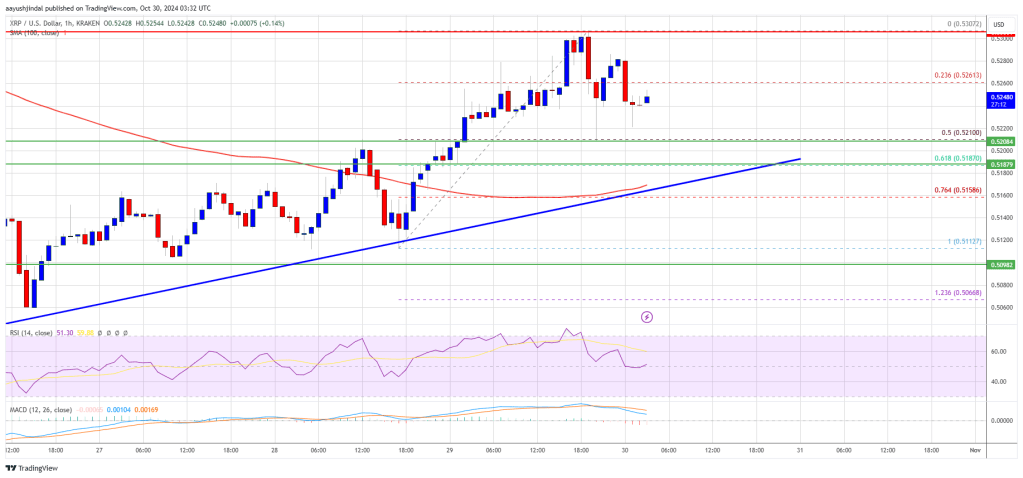

Traders were hoping that XRP would be able to stay above the psychological support level of $0.50. However, given the current market conditions and the ongoing downward trend, $0.50 failed to be a sufficient barrier, raising the prospect of more decline.

The $0.48 zone, which has shown signs of buying activity in the past, might be the first resistance level as the price has broken below $0.50. At the time of writing, XRP is trading at $0.4982, down 2.46% in the last 24 hours as per data from CMC. Moreover, the trading volume is up 33.51%.

If the price manages to break above $0.51 level, then it will likely climb further to test $0.53 resistance level. Breaking above this level, will likely see an extended rally towards the $0.56 mark. However, if the bears continue to dominate and push the price below $0.48 level, then it will likely test $0.42 support level.