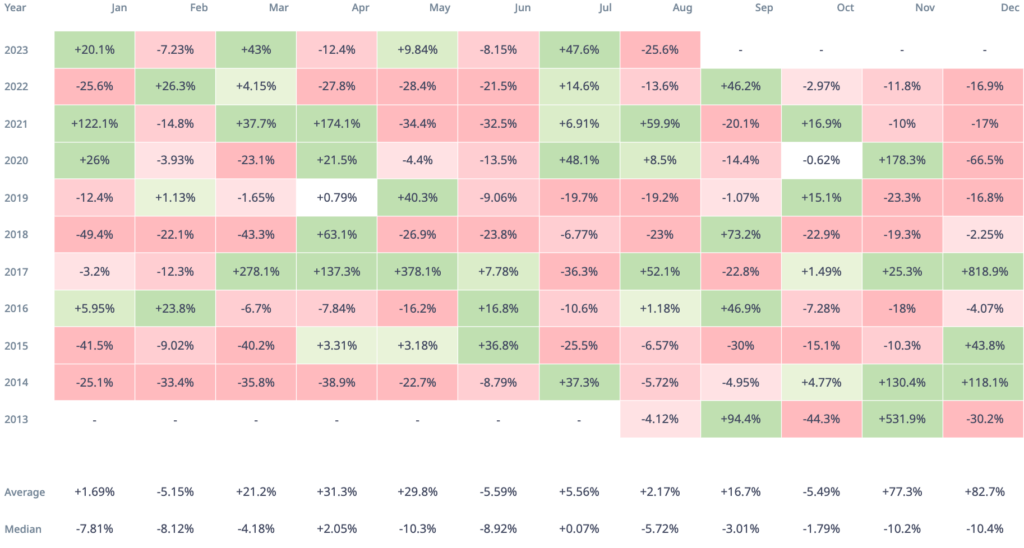

- XRP surged 47% in July after a favorable court ruling but now faces its biggest ever August price.

- XRP’s market cap already sank $10 billion in August, currently sitting around $27 billion.

- History shows September is also weak for XRP, so it remains to be seen if bullish momentum returns.

XRP rallied strongly in July, surging 47.6% on the heels of a favorable court ruling in Ripple’s ongoing legal battle with the SEC. But the winds have now shifted for the fourth-largest cryptocurrency by market capitalization.

Despite logging its second-best July price performance on record, Ripple appears on track for its worst-ever August returns based on data from CryptoRank. The analytics firm predicts that it could plunge 25.4% this month, exceeding its prior August downturn record of 23% set back in 2018.

XRP market cap plunged below $10 billion

XRP’s market capitalization has already sunk by $10 billion since August began, now totaling $27.49 billion. With August nearing its end, the looming question is whether XRP can avoid cementing a new monthly loss record.

History shows September often concludes weakly for XRP as well, with returns frequently in negative territory, barring some past outliers. The coming monthly close will determine whether bulls can muster a rally to counter bearish technicals.

For XRP investors, the abrupt change in fortune following July’s court-fueled euphoria spotlights the unpredictable volatility inherent to crypto markets. Despite fundamentals remaining strong, unpredictable forces like broader macro conditions and speculative trader sentiment can rapidly shift the winds from tailwind to headwind.

With the SEC lawsuit set to intensify in the coming months, uncertainty still dominates the outlook. But dedicated XRP supporters remain confident the crypto asset’s utility and legal standing will win out over time, regardless of intermittent volatility.