- SEC appeals Ripple case, focusing on proceedings involving executives.

- XRP price drops to $0.54, with NVT ratio reaching yearly high of 634.

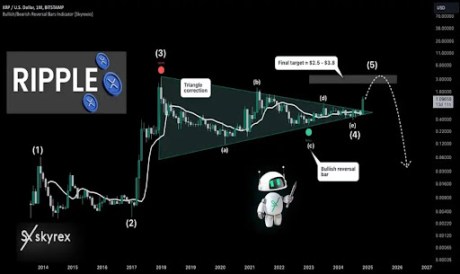

- Potential targets: $0.38 if bearish trend continues, or $0.65 if bullish momentum emerges.

Ripple’s XRP finds itself at a critical juncture following the U.S. Securities and Exchange Commission’s (SEC) official appeal in its case against Ripple Labs.

This legal development has triggered a decline in XRP’s price over the past 24 hours, raising questions about the cryptocurrency’s short-term trajectory and long-term implications.

The SEC’s appeal, detailed in an October 17 civil appeal pre-argument statement, seeks clarification on the proceedings involving Ripple CEO Brad Garlinghouse and co-founder Chris Larsen.

Notably, the regulator is not challenging the ruling that XRP sales to retail investors through exchanges are not securities, a point emphasized by Ripple’s chief legal officer, Stuart Alderoty.

XRP price reacts to this development

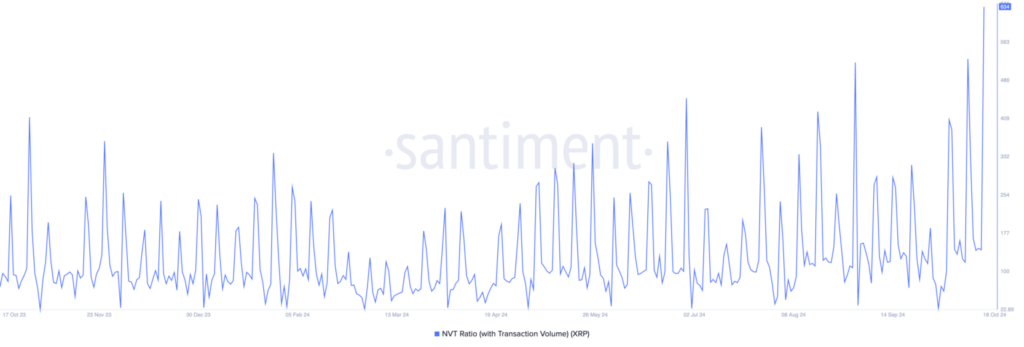

XRP’s market reaction to this development has been swift, with the token currently trading at $0.54. Accompanying this price drop is a significant increase in XRP’s Network Value to Transactions (NVT) ratio, which has reached a yearly high of 634.

This combination of falling price and rising NVT ratio presents a bearish signal, suggesting potential overvaluation even as buying pressure weakens.

Source: Santiment

Interestingly, long-term XRP holders appear unfazed by these developments. The age-consumed metric, which tracks the movement of long-held coins, has shown no significant spikes in the past 24 hours.

This stability implies that most of the current selling activity is concentrated among short-term traders, while long-term investors maintain their positions.

Looking ahead, XRP’s price action may hinge on the balance between short-term selling pressure and potential new demand. The token currently trades just above a crucial support level at $0.52.

A failure to maintain this support could potentially trigger a more significant decline towards $0.38, representing a 30% drop from current levels.