- HYPE price surged 977% in just three weeks, hitting a $10B market cap.

- Current trading volume is up 50%, with strong bullish technical indicators.

Hyperliquid (HYPE) recently achieved a new all-time high of $35.02. It is currently trading at $33.36, reflecting a 1.17% gain over the last 24 hours. With a market cap of $9.03 billion and a trading volume of $462.02 million (up 27.96%), the token’s volume-to-market cap ratio stands at an impressive 5.2%.

Beating the odds of the crypto market crash, Hyperliquid’s native token, HYPE, has remained on a strong bullish run. Over the past week, the token’s price has surged by 63%. Launched just three weeks ago as the native token of the layer-one blockchain Hyperliquid, HYPE has demonstrated remarkable performance.

Since its debut, the token has soared by an impressive 977%, capturing widespread attention within the crypto community. While currently in a phase of minor consolidation, HYPE is trading at $34.47, with its 24-hour trading volume surging by 50% to $655.01 million.

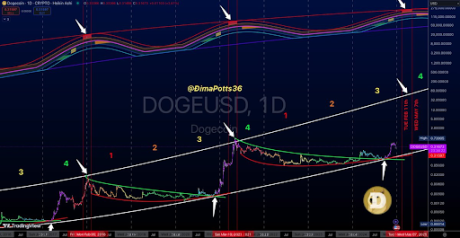

Bullish Indicators for HYPE

HYPE faces resistance at $35, a critical psychological level. If it breaks this, the next target could be $38. Conversely, support rests at $32.80. Falling below this level could trigger a drop toward $30. Key price action near these levels will determine future momentum.

The chart shows a clear uptrend, but recent price consolidation indicates caution. The Relative Strength Index (RSI) at 61.34 and its average suggest HYPE remains in bullish territory but is nearing overbought conditions.

The 9-day moving average (MA) stands at $32.65, while the 21-day MA is $28.59. The recent bullish crossover indicates short-term momentum favors buyers. This setup often signals an upward trend, but traders should watch for confirmation. If the 9-day MA remains above the 21-day MA, HYPE could sustain its upward trajectory. However, a reversal might indicate fading momentum.

The RSI at 61.34 reflects positive market sentiment. The RSI average remains above 50, signaling that buyers dominate the market. A break above 70 would confirm overbought conditions, potentially leading to a pullback. Conversely, a dip below 50 might signal bearish pressure.

HYPE’s recent performance shows strong investor interest and market activity. The bullish moving average crossover and RSI position suggest a potential upside. However, traders must monitor support and resistance levels for any breakout or reversal.

Highlighted Crypto News Today

Quantum Computing is Not an Immediate Threat to Bitcoin