The price of Bitcoin has fluctuated over the past month, but BitMEX co-founder Arthur Hayes is the latest crypto expert to make a bullish forecast for the asset. According to the former CEO of the cryptocurrency exchange BitMEX, Bitcoin could reach $70,000, and the only reason the asset is not yet at this price is because investors are fixated on the Fed’s nominal rate.

Various predictions have come in regarding Bitcoin, with some being more bullish than others. As for Hayes, he made his case regarding BTC in his Crypto Trader Digest blog post in light of various actions by the US Federal Reserve to curb inflation.

Since March 2022, the Fed has raised interest rates multiple times, causing many investors like Hayes to reconsider their predictions regarding the outlook of Bitcoin.

In the blog post, Hayes shared several metrics relating to the US treasury yield and GDP growth. Hayes began adjusting his forecasts by disputing the widely held belief that BTC’s value is negatively correlated with rising interest rates.

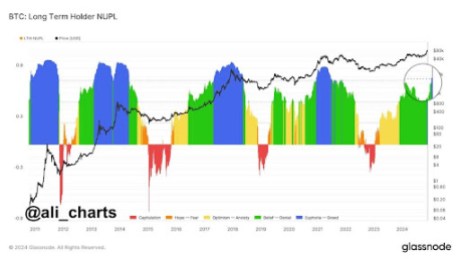

A new outlook shows that the government’s spending rates and the current growth of GDP have driven down the actual treasury yield on 5% government bonds closer to 4%, making risky assets like BTC and stocks still attractive.

Hayes believes the Fed will be able to continue down this path of raising rates, and investors’ search for positive real yields in response to this has translated into a bullish market for Bitcoin which began in March 2023.

However, although Bitcoin is up by close to 29% since then, most of the market is still yet to catch on as everyone is focused on the nominal Fed rate and not the real rate.

“The reason why we aren’t at $70,000 is that everyone is focused on the nominal Fed rate, and not on the real rate when compared to the U.S.’s eye-poppingly high nominal GDP growth.”

While speaking at the Korea Blockchain Week, Hayes mentioned that the next Bitcoin bull market started on March 10, the day the Federal Deposit Insurance Corporation (FDIC) took over Silicon Valley Bank (SVB).

Hayes has actually made similar predictions regarding Bitcoin. Back in March 2020, the pundit made a prediction Bitcoin could rise from $8,000 and reach $20,000 by the end of the year. BTC’s price would later close the year 2020 at around $27,000.

The BitMEX co-founder has previously expressed his discomfort on Spot Bitcoin ETF, from investment companies like BlackRock, calling them “crypto gatekeepers” who are only looking to balance their deposit base. However, Hayes believes a catchup by the market would Bitcoin survive more interest rate raise from Fed to skyrocket more than 150% from its current level by early 2024.

At the time of writing, Bitcoin is trading at $26,320 and is up by 2.27% in a seven-day timeframe.

Bitcoin Can Still Rise 150%

Various predictions have come in regarding Bitcoin, with some being more bullish than others. As for Hayes, he made his case regarding BTC in his Crypto Trader Digest blog post in light of various actions by the US Federal Reserve to curb inflation.

Since March 2022, the Fed has raised interest rates multiple times, causing many investors like Hayes to reconsider their predictions regarding the outlook of Bitcoin.

What happens if the Fed keeps raising rates? Can the $BTC bull market gain steam? “Are We There Yet?” is an essay exploring that question.https://t.co/OGkVQreIBg pic.twitter.com/FTYR3HBq1a

— Arthur Hayes (@CryptoHayes) September 11, 2023

In the blog post, Hayes shared several metrics relating to the US treasury yield and GDP growth. Hayes began adjusting his forecasts by disputing the widely held belief that BTC’s value is negatively correlated with rising interest rates.

A new outlook shows that the government’s spending rates and the current growth of GDP have driven down the actual treasury yield on 5% government bonds closer to 4%, making risky assets like BTC and stocks still attractive.

Hayes believes the Fed will be able to continue down this path of raising rates, and investors’ search for positive real yields in response to this has translated into a bullish market for Bitcoin which began in March 2023.

However, although Bitcoin is up by close to 29% since then, most of the market is still yet to catch on as everyone is focused on the nominal Fed rate and not the real rate.

“The reason why we aren’t at $70,000 is that everyone is focused on the nominal Fed rate, and not on the real rate when compared to the U.S.’s eye-poppingly high nominal GDP growth.”

BTC Price To $70,000?

While speaking at the Korea Blockchain Week, Hayes mentioned that the next Bitcoin bull market started on March 10, the day the Federal Deposit Insurance Corporation (FDIC) took over Silicon Valley Bank (SVB).

Hayes has actually made similar predictions regarding Bitcoin. Back in March 2020, the pundit made a prediction Bitcoin could rise from $8,000 and reach $20,000 by the end of the year. BTC’s price would later close the year 2020 at around $27,000.

The BitMEX co-founder has previously expressed his discomfort on Spot Bitcoin ETF, from investment companies like BlackRock, calling them “crypto gatekeepers” who are only looking to balance their deposit base. However, Hayes believes a catchup by the market would Bitcoin survive more interest rate raise from Fed to skyrocket more than 150% from its current level by early 2024.

At the time of writing, Bitcoin is trading at $26,320 and is up by 2.27% in a seven-day timeframe.