Polygon (MATIC), a prominent player in the cryptocurrency market, faced a volatile journey in July, as it initially cleared significant gains but encountered setbacks that have left investors and enthusiasts eager for signs of a resurgence.

As of the latest data from CoinGecko, the MATIC price stood at $0.66, reflecting a 24-hour slump of 0.4% and a seven-day decline of 4.7%. While the token’s price performance has been fluctuating, technical indicators suggest the potential for a rebound.

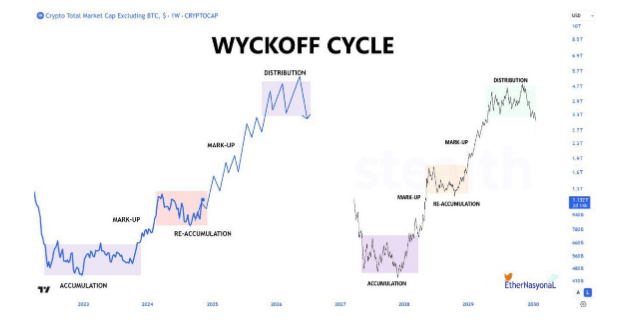

A crucial tool in analyzing MATIC’s price movement has been the Fibonacci retracement tool, which evaluates the retracement levels between the June low and July high. The 50% Fibonacci level, situated at $0.70, failed to uphold the pullback, raising concerns about the sustainability of the gains. The recent activity has seen the token testing the 38.2% Fibonacci level at $0.655, which has been retested twice, demonstrating its significance as a support level.

Presently, MATIC has bounced off the 38.2% Fibonacci level, indicating potential for recovery. However, the overall market structure on higher timeframes remains bearish, and the interplay with Bitcoin’s performance can play a pivotal role. As Bitcoin exhibited weakness, a price rejection at the 50% Fibonacci level is a feasible scenario.

The key intrigue lies below the 38.2% Fibonacci level, where bullish order blocks on both daily and weekly charts are positioned. These blocks, particularly the daily one which has already shown its impact, could mitigate further price decline should the 38.2% Fibonacci support give way. Both the 38.2% and 23.6% Fibonacci levels are emerging as critical interest points for bullish traders.

While the Network Profit and Loss (NPL) data seems to suggest that MATIC might have reached a price bottom, a closer analysis of its on-chain performance raises concerns about a potential additional drop in value.

This intricacy mirrors the broader struggles of the crypto market, which has been grappling with various regulatory, environmental, and adoption challenges. Amidst this backdrop, MATIC’s future remains uncertain.

On a brighter note, Polygon’s collaboration with Amazon Prime presents an optimistic angle. Amazon Prime’s vast subscriber base, totaling around 200 million globally, offers an enticing prospect for the cryptocurrency’s adoption.

Specifically, the Mojo Melee NFT-based gaming project built on the Polygon network is now offering free Polygon NFTs to Amazon Prime subscribers. This partnership could potentially boost demand for Polygon’s network and contribute to its market resilience.

While challenges persist, the Polygon and its native coin’s potential to adapt and thrive cannot be underestimated, making it a compelling asset to watch in the coming days.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Crazy Stats

As of the latest data from CoinGecko, the MATIC price stood at $0.66, reflecting a 24-hour slump of 0.4% and a seven-day decline of 4.7%. While the token’s price performance has been fluctuating, technical indicators suggest the potential for a rebound.

Polygon: Testing Retracement Levels

A crucial tool in analyzing MATIC’s price movement has been the Fibonacci retracement tool, which evaluates the retracement levels between the June low and July high. The 50% Fibonacci level, situated at $0.70, failed to uphold the pullback, raising concerns about the sustainability of the gains. The recent activity has seen the token testing the 38.2% Fibonacci level at $0.655, which has been retested twice, demonstrating its significance as a support level.

Presently, MATIC has bounced off the 38.2% Fibonacci level, indicating potential for recovery. However, the overall market structure on higher timeframes remains bearish, and the interplay with Bitcoin’s performance can play a pivotal role. As Bitcoin exhibited weakness, a price rejection at the 50% Fibonacci level is a feasible scenario.

The key intrigue lies below the 38.2% Fibonacci level, where bullish order blocks on both daily and weekly charts are positioned. These blocks, particularly the daily one which has already shown its impact, could mitigate further price decline should the 38.2% Fibonacci support give way. Both the 38.2% and 23.6% Fibonacci levels are emerging as critical interest points for bullish traders.

Complex On-Chain Dynamics And Amazon’s Role

While the Network Profit and Loss (NPL) data seems to suggest that MATIC might have reached a price bottom, a closer analysis of its on-chain performance raises concerns about a potential additional drop in value.

This intricacy mirrors the broader struggles of the crypto market, which has been grappling with various regulatory, environmental, and adoption challenges. Amidst this backdrop, MATIC’s future remains uncertain.

On a brighter note, Polygon’s collaboration with Amazon Prime presents an optimistic angle. Amazon Prime’s vast subscriber base, totaling around 200 million globally, offers an enticing prospect for the cryptocurrency’s adoption.

@Weareplanetmojo Welcomes @AmazonPrimeMembers!

1st FREE offer includes: -Gwyn Rockhopper Digital Collectible -850 ORE

The adventure begins NOW. Come & Get It!

Come & Get It!

https://t.co/9Dvzk8CAaT pic.twitter.com/OZbuXUoEed

pic.twitter.com/OZbuXUoEed

— Planet Mojo| Mojo Melee SEASON TWO is LIVE! (@WeArePlanetMojo) August 2, 2023

Specifically, the Mojo Melee NFT-based gaming project built on the Polygon network is now offering free Polygon NFTs to Amazon Prime subscribers. This partnership could potentially boost demand for Polygon’s network and contribute to its market resilience.

While challenges persist, the Polygon and its native coin’s potential to adapt and thrive cannot be underestimated, making it a compelling asset to watch in the coming days.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Crazy Stats