- President Trump signed orders promoting AI and crypto, and the SEC repealed SAB121, allowing banks to hold and manage crypto assets.

- Illinois, Arizona, and Texas are setting up Bitcoin reserves, showing increasing institutional interest in Bitcoin as a stable asset.

- Major companies like BlackRock are investing heavily in Bitcoin, and Ripple (XRP) is becoming a key reserve option despite volatility warnings from the IMF and World Bank.

A week and a half into Trump’s presidency, significant things are occurring in AI and cryptocurrency. These moves demonstrate a strong drive to integrate digital assets into the mainstream financial sector, which might spur the crypto market in the next few years.

Trump issued executive orders to foster the development of both AI and crypto. The orders will facilitate innovation and modernize the regulations to maintain pace with new technologies. This brings the US closer to digital finance and emerging technology leadership.

SEC Eliminated SAB121

The fundamental shift is that the SEC eliminated SAB121, a guideline that prevented banks from holding and dealing in crypto assets. Currently, banks have the ability to provide crypto custodial services, which simplifies the process for traditional financial firms to integrate with crypto. The move fosters trust and gives more individuals reason to invest in digital assets.

Fed Chairman Jerome Powell is also in favor of the crypto industry. According to him, banks are well equipped to provide services to customers of cryptocurrency. This encouragement coupled with the repeal by the SEC is good for crypto in banks. It instills confidence among investors that their crypto assets will be dealt with securely by banks.

Illinois is introducing House Bill 1844 to establish a Strategic Bitcoin Reserve. The bill mandates that Bitcoin must be kept in a state fund for a minimum of five years before it can be sold or utilized. Arizona and Texas are also considering Bitcoin reserves, and other states may soon follow suit. Experts are confident that Bitcoin can stabilize state finances as a stable financial asset.

Large corporations such as BlackRock are investing heavily in Bitcoin, which is an indicator of faith in its long-term worth. Ripple (XRP) is also becoming popular as a reserve choice for the US due to its robust infrastructure and application in cross-border transactions. Such investments legitimize cryptocurrencies and increase adoption.

IMF and World Bank

Yet, institutions such as the IMF and World Bank caution against Bitcoin price volatility. They advise that even though cryptocurrencies are full of potential, their volatile prices expose them to major risks.

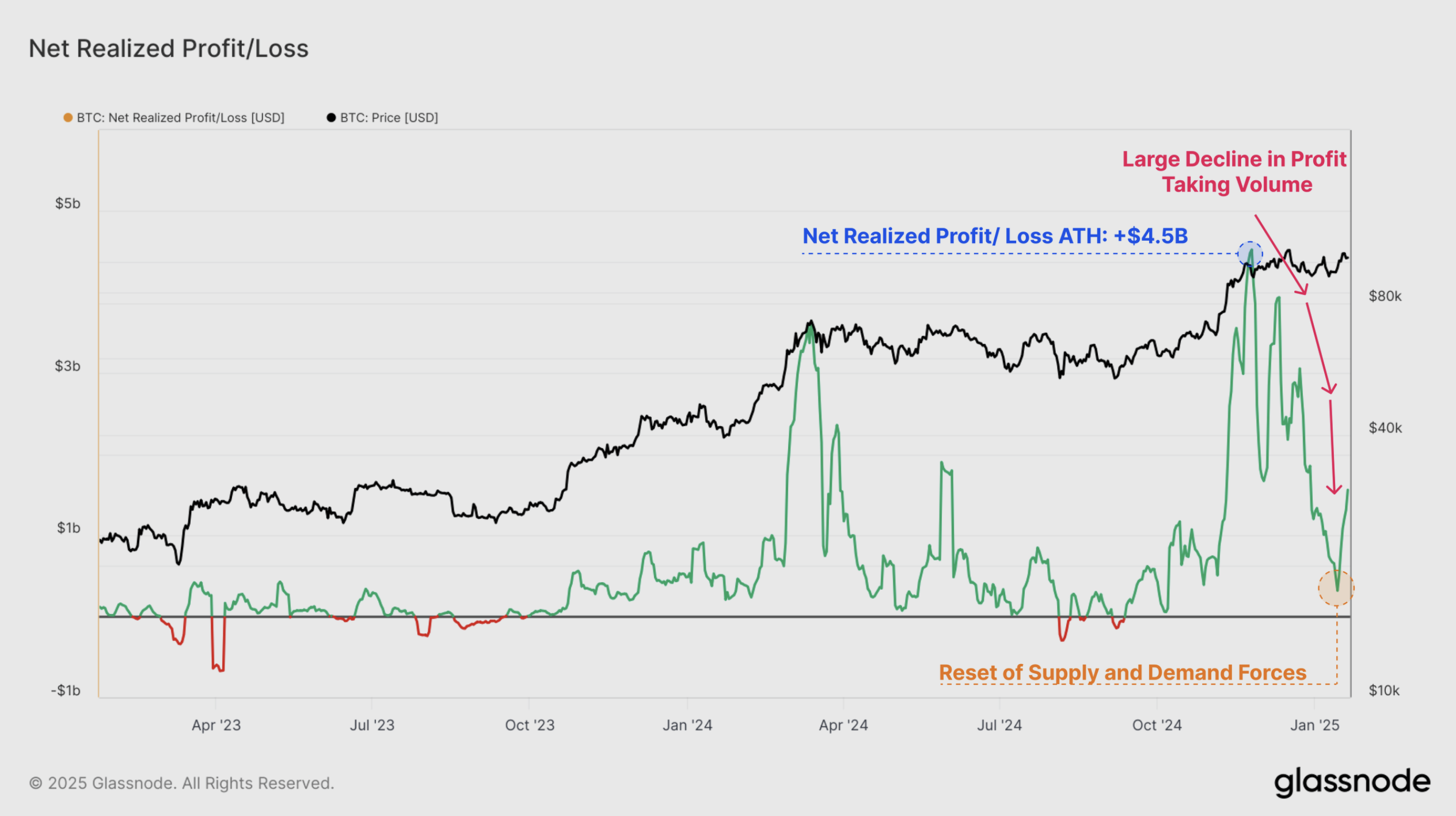

When regulations and the economy support riskier assets, Bitcoin and other cryptocurrencies should increase. Investors should be holding a combination of Bitcoin and altcoins such as XRP in order to take advantage of this increase.

Overall, President Trump’s initial actions are creating a rosy future for cryptocurrencies. With friendly policies, eased regulations, and full support from finance leaders, the crypto market is destined for enormous growth. With additional states and top companies investing in digital currencies, owning Bitcoin and other altcoins may be an intelligent choice for investors. Despite some volatility concerns, the future of cryptocurrency in Trump’s government is looking good, providing new prospects for financial growth and innovation.

Highlighted Crypto News Today

Illinois Proposes Bitcoin Reserve to Hold Bitcoin in State Fund for 5 Years