- The crypto market cap has lost over 6%, dropping to $3.37 trillion.

- Bitcoin has rolled back to $99K from $105K.

The cryptocurrency market encountered turbulence, falling by 6.31%, bringing the total market cap down to $3.37 trillion. This decline follows a series of events, including the rise of the Chinese AI app, Donald Trump and Bitcoin.

DeepSeek, a Chinese AI application, has disrupted the market by outperforming ChatGPT, despite being developed for under $10 million. In contrast, ChatGPT boasts a $157 billion valuation. The app quickly became the top free app, causing a ripple effect across U.S. tech markets.

DeepSeek’s open-source model, which offers a high level of functionality with minimal cost, raises concerns that American tech stocks—particularly those tied to AI—may be overvalued.

It also created anxieties in the AI market in which massive sell-offs occurred in US equities. This panic strongly impacted AI-based tokens, losing more than 20% of their market capitalization.

Trump’s Influence on the Crypto Market

Donald Trump had a notable role in fueling the cryptocurrencies and AI technologies. It has contributed to the inflation of market valuations, particularly in the tech and crypto sectors.

Having steered the global crypto economy with his agenda, Trump’s campaign for interest rate cuts has exerted added pressure on the Federal Reserve. His policies and public pronouncements have, on their own, helped to create the unpredictability that involves the crypto and stock markets, which is in turn driving further liquidation and downward movement in prices of assets.

The market uncertainty that is developing has caused mass liquidation, wherein investors are fleeing from their assets in response to declining market prices. As such, it has been a volatile time frame for cryptocurrencies. Particularly, Arthur Hayes is predicting a possible financial meltdown, and forecasting a cut of $70K to $75K in the price of Bitcoin.

“I am calling for a $70k to $75k correction in $BTC, a mini financial crisis, and a resumption of money printing that will send us to $250k by the end of the year.”

The Federal Reserve’s decisions on interest rates and the broader market response to global economic conditions will play a crucial role in determining the direction of the crypto market.

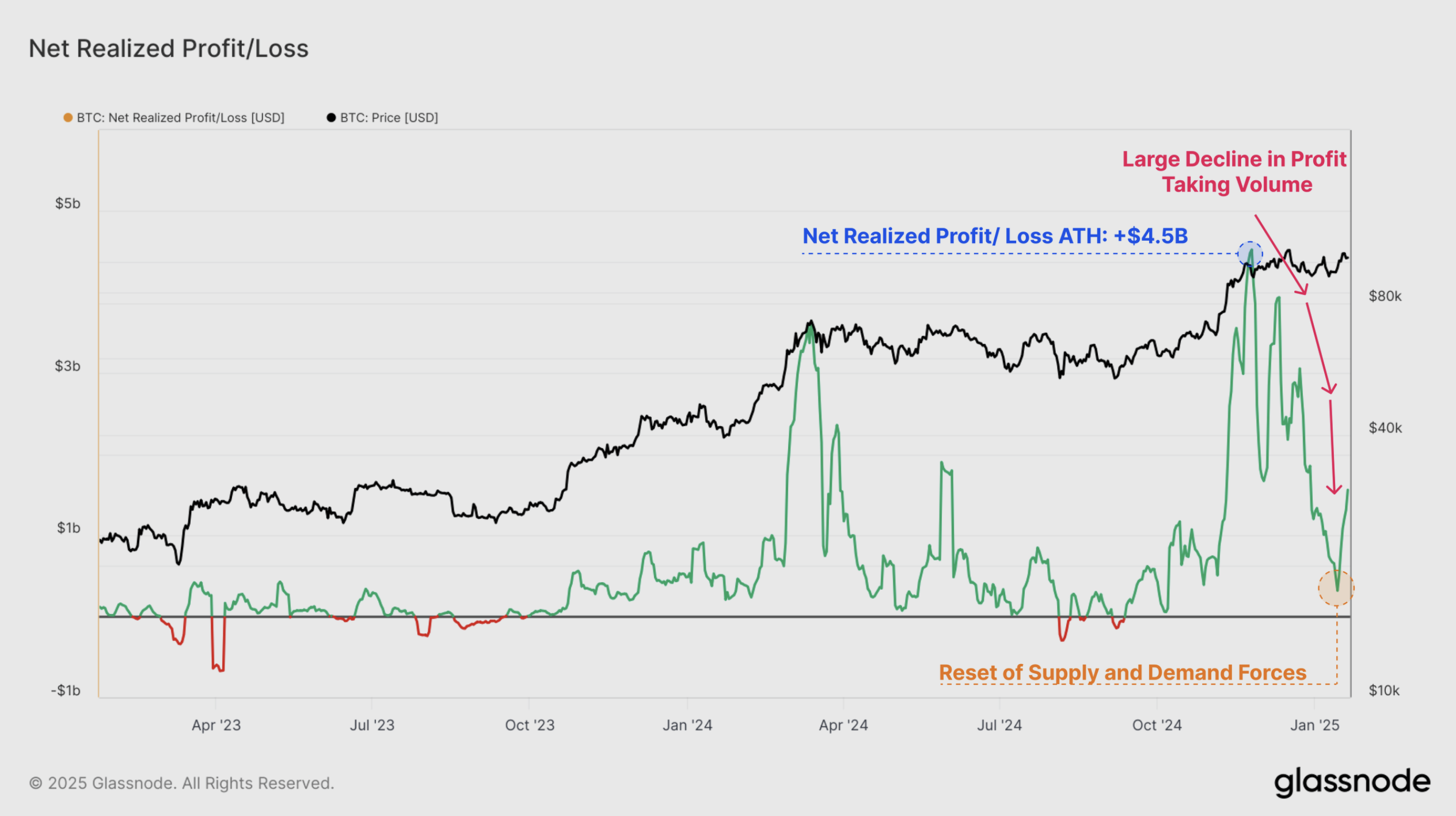

Struggle of Bitcoin

The largest cryptocurrency, Bitcoin has sharply dropped by over 5% and is trading at around $99K. In the early hours, BTC traded at $105K and currently, the $100K level acts as a critical support level. If Bitcoin falls below this mark, it could likely trigger further losses.

Broader economic factors are contributing to Bitcoin’s price action, including U.S. interest rate decisions and the upcoming Federal Open Market Committee (FOMC) meeting. This week, the Federal Reserve is expected to maintain interest rates in its first policy meeting since former President Donald Trump took office.

Highlighted Crypto News

Are SUI Bears Gearing Up For A Bigger Crash?