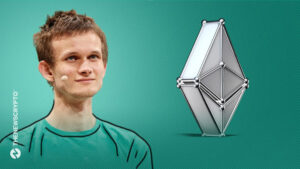

- Vitalik Buterin highlighted the flaws in MPC based Externally Owned Account wallets.

- Buterin emphasized that Smart Contract Wallets are the superior option compared to MPC-based EOAs.

Ethereum founder Vitalik Buterin drops a bombshell on Twitter, he claims that MPC-based EOAs are fundamentally flawed because they cannot revoke keys, “Smart Contract Wallets are the only option”

In a recent Twitter Ask Me Anything (AMA) session conducted by Vitalik Buterin, he made a significant revelation regarding the flaws of Multi-Party Computation (MPC)-based Externally Owned Account (EOA) wallets. Buterin emphasized the superiority of Smart Contract Wallets (SCWs) and their potential to revolutionize the crypto landscape.

MPC-based EOAs are fundamentally flawed because they cannot revoke keys (and no, re-sharing doesn't count; the old holders can still recover the key). Smart contract wallets are the only option.

— vitalik.eth (@VitalikButerin) June 28, 2023

During the AMA, Yuga, a senior software engineer from a prominent cryptocurrency exchange Coinbase, sought Buterin’s perspective on the benefits and drawbacks of MPC-based EOA wallets compared to SCWs. In response, Ethereum CEO unequivocally asserted that SCWs are the optimal choice for users. One of the key advantages highlighted by Buterin was the flexibility provided by SCWs.

Benefits of Smart Contract Wallets

Unlike MPC-based EOA wallets, SCWs enable users to pay gas fees using any ERC-20 token. This convenience is particularly beneficial for individuals who hold diverse tokens and wish to utilize them for transactions seamlessly.

In addition, SCWs streamline transaction processes by simplifying the approval and signing steps. Rather than repeating these actions for multiple transactions, SCWs empower users to approve and sign their transactions with a single click. This enhanced efficiency promises a more user-friendly experience for Ethereum network participants.

Further, Smart Contract Wallet opens avenues for disciplined investment strategies in the volatile cryptocurrency market. Similar to Systematic Investment Plans (SIPs) in traditional finance, users can automate the regular purchase of tokens at predetermined intervals. This automated approach provides a structured and controlled method for investing in cryptocurrencies.

Another significant advantage was the incorporation of two-factor authentication in SCWs. This feature allows users to authenticate and sign transactions using biometric data such as fingerprints or facial scans, enhancing security and mitigating the risk of unauthorized access.

Recommended for you

Ethereum (ETH) Price Prediction 2023