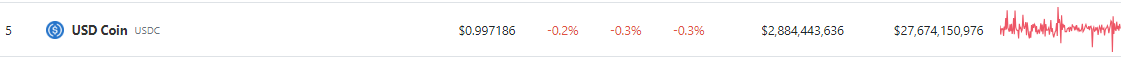

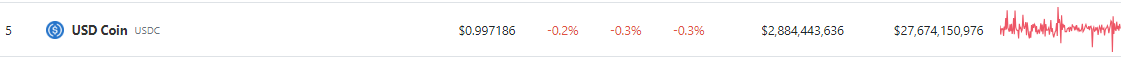

USDC experienced a notable decrease in its circulating supply during the weekend, causing ripples of concern within the cryptocurrency market. According to data from CoinGecko, the stablecoin’s circulating supply dwindled by over 2%, falling from $27.9 billion on June 30 to $27.3 billion in less than 48 hours.

This sudden drop has intensified existing worries regarding the stability and long-term viability of stablecoins in the volatile world of cryptocurrencies. Since the beginning of the year, the total supply of USDC has exhibited a downward trajectory, plunging by a staggering 38%.

This continuous decline raises questions about the underlying factors contributing to the diminishing supply of USDC and its potential impact on the broader cryptocurrency ecosystem.

The decrease in USDC’s circulating supply can have significant implications for its price and overall value. As the supply of a stablecoin decreases, its scarcity may result in increased demand from investors and traders. If the demand for USDC remains steady or rises, the reduced supply could potentially push its price higher, following the basic principles of supply and demand economics.

However, this effect may not be linear, as other factors such as market sentiment, regulatory developments, and the overall performance of the broader cryptocurrency market can also influence USDC’s price movements.

The declining circulating supply of USDC might also trigger questions regarding the underlying reasons behind the reduction. Investors and users may question the transparency and credibility of the stablecoin’s issuer or the overall health of its backing reserves.

Any perceived lack of clarity or uncertainty could lead to reduced trust in USDC, causing some participants to seek alternative stablecoin options or even exit the market altogether. Consequently, the trustworthiness and regulatory compliance of stablecoin issuers will come under increased scrutiny, underscoring the need for greater transparency and accountability within the industry.

Regulatory Scrutiny

The dwindling supply of USDC could also attract the attention of regulators and policymakers, who are increasingly keeping a close eye on the stablecoin space. Regulators have expressed concerns about the potential systemic risks associated with stablecoins, especially those with a significant market share.

A decline in the circulating supply might amplify these concerns and prompt regulatory bodies to take more aggressive actions to oversee and regulate stablecoin operations. Increased regulatory scrutiny could introduce new compliance requirements, which may impact stablecoin issuers and the broader cryptocurrency market.

Notably in March, the stablecoin experienced a temporary detachment from its peg to the dollar, which occurred in the aftermath of multiple cryptocurrency bank failures. In response to potential liquidity challenges related to US Treasury bonds, the company behind USDC, Circle, took proactive measures.

They made the strategic choice to shift their investment focus towards short-term maturity bonds. This decision was aimed at safeguarding the stablecoin’s value and addressing concerns about the stability of its backing reserves.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from WorldCoin

This sudden drop has intensified existing worries regarding the stability and long-term viability of stablecoins in the volatile world of cryptocurrencies. Since the beginning of the year, the total supply of USDC has exhibited a downward trajectory, plunging by a staggering 38%.

This continuous decline raises questions about the underlying factors contributing to the diminishing supply of USDC and its potential impact on the broader cryptocurrency ecosystem.

Declining Circulating Supply And Its Impact On USDC’s Price

The decrease in USDC’s circulating supply can have significant implications for its price and overall value. As the supply of a stablecoin decreases, its scarcity may result in increased demand from investors and traders. If the demand for USDC remains steady or rises, the reduced supply could potentially push its price higher, following the basic principles of supply and demand economics.

However, this effect may not be linear, as other factors such as market sentiment, regulatory developments, and the overall performance of the broader cryptocurrency market can also influence USDC’s price movements.

Market Perception And Trust Concerns

The declining circulating supply of USDC might also trigger questions regarding the underlying reasons behind the reduction. Investors and users may question the transparency and credibility of the stablecoin’s issuer or the overall health of its backing reserves.

Any perceived lack of clarity or uncertainty could lead to reduced trust in USDC, causing some participants to seek alternative stablecoin options or even exit the market altogether. Consequently, the trustworthiness and regulatory compliance of stablecoin issuers will come under increased scrutiny, underscoring the need for greater transparency and accountability within the industry.

Regulatory Scrutiny

The dwindling supply of USDC could also attract the attention of regulators and policymakers, who are increasingly keeping a close eye on the stablecoin space. Regulators have expressed concerns about the potential systemic risks associated with stablecoins, especially those with a significant market share.

A decline in the circulating supply might amplify these concerns and prompt regulatory bodies to take more aggressive actions to oversee and regulate stablecoin operations. Increased regulatory scrutiny could introduce new compliance requirements, which may impact stablecoin issuers and the broader cryptocurrency market.

Notably in March, the stablecoin experienced a temporary detachment from its peg to the dollar, which occurred in the aftermath of multiple cryptocurrency bank failures. In response to potential liquidity challenges related to US Treasury bonds, the company behind USDC, Circle, took proactive measures.

They made the strategic choice to shift their investment focus towards short-term maturity bonds. This decision was aimed at safeguarding the stablecoin’s value and addressing concerns about the stability of its backing reserves.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from WorldCoin