Uniswap’s UNI started a decent increase above $5.35 against the US Dollar. The price is likely to continue higher above $6.00 and $6.20 in the near term.

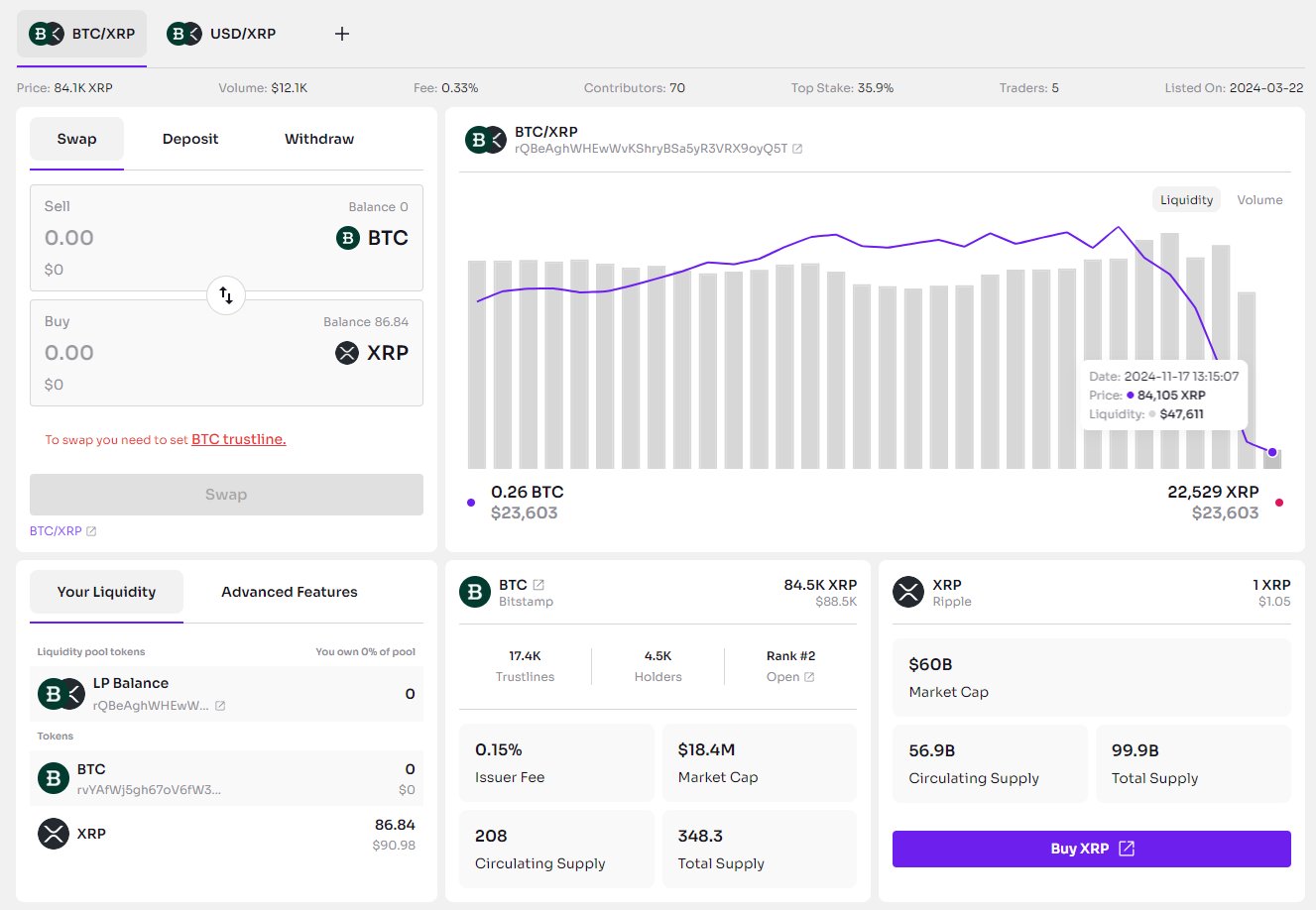

After forming a support base above $5.00, UNI started a fresh increase. The bulls were able to push Uniswap’s price above the $5.25 and $5.30 resistance levels, similar to Bitcoin and Ethereum.

There was also a break above a major contracting triangle with resistance near $5.35 on the 4-hour chart of the UNI/USD pair. The pair gained pace and tested the $6.30 zone. A high is formed near $6.291 and the price started a downside correction.

There was a break below the $6.00 level. UNI price tested the 50% Fib retracement level of the upward move from the $5.09 low to the $6.291 high.

Source: UNIUSD on TradingView.com

The price is now trading above $5.50 and the 100 simple moving average (4 hours). On the upside, the price is facing hurdles near $6.00 and $6.10. A close above the $6.10 level could open the doors for more gains in the near term. The next key resistance could be near $6.30, above which the bulls are likely to aim a test of the $6.80 level. Any more gains might send UNI toward $7.00.

If UNI price fails to climb above $6.00 or $6.20, it could correct further lower. The first major support is near the $5.70 level. The next major support is near the $5.50 level.

It is close to the 61.8% Fib retracement level of the upward move from the $5.09 low to the $6.291 high. A downside break below the $5.50 support might open the doors for a push toward the key $5.10.

Technical Indicators

4-Hours MACD – The MACD for UNI/USD is gaining momentum in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for UNI/USD is well above the 50 level.

Major Support Levels – $5.65, $5.50 and $5.10.

Major Resistance Levels – $6.00, $6.30 and $6.80.

- UNI started a fresh increase after forming a base above the $4.75 level against the US dollar.

- The price is trading above $5.65 and the 100 simple moving average (4 hours).

- There was a break above a major contracting triangle with resistance near $5.35 on the 4-hour chart of the UNI/USD pair (data source from Kraken).

- The pair is likely to continue higher if it clears the $6.00 and $6.20 resistance levels in the near term.

Uniswap’s UNI Regains Traction

After forming a support base above $5.00, UNI started a fresh increase. The bulls were able to push Uniswap’s price above the $5.25 and $5.30 resistance levels, similar to Bitcoin and Ethereum.

There was also a break above a major contracting triangle with resistance near $5.35 on the 4-hour chart of the UNI/USD pair. The pair gained pace and tested the $6.30 zone. A high is formed near $6.291 and the price started a downside correction.

There was a break below the $6.00 level. UNI price tested the 50% Fib retracement level of the upward move from the $5.09 low to the $6.291 high.

Source: UNIUSD on TradingView.com

The price is now trading above $5.50 and the 100 simple moving average (4 hours). On the upside, the price is facing hurdles near $6.00 and $6.10. A close above the $6.10 level could open the doors for more gains in the near term. The next key resistance could be near $6.30, above which the bulls are likely to aim a test of the $6.80 level. Any more gains might send UNI toward $7.00.

Dips Supported?

If UNI price fails to climb above $6.00 or $6.20, it could correct further lower. The first major support is near the $5.70 level. The next major support is near the $5.50 level.

It is close to the 61.8% Fib retracement level of the upward move from the $5.09 low to the $6.291 high. A downside break below the $5.50 support might open the doors for a push toward the key $5.10.

Technical Indicators

4-Hours MACD – The MACD for UNI/USD is gaining momentum in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for UNI/USD is well above the 50 level.

Major Support Levels – $5.65, $5.50 and $5.10.

Major Resistance Levels – $6.00, $6.30 and $6.80.