Tron (TRX) has orchestrated an impressive recovery, bouncing back from last week’s dip of $0.07000 and regaining losses it incurred this month.

As of the latest data from CoinGecko, the TRX price currently stands at $0.076, despite a minor 1.2% decline over the past 24 hours. This resurgence follows a decent seven-day rally that has seen TRX gain 5.4%.

Delving into the technical analysis on a weekly timeframe, it becomes evident that TRON has been tracing an ascending support line since November 2022. This trajectory has been consistently validated through multiple instances, underscoring its significance.

Market analysts and enthusiasts are now setting their sights on potential price trajectories for TRX. Based on a comprehensive price analysis, bullish sentiment is prevailing as TRX bulls seem poised to take on the next resistance level at $0.080.

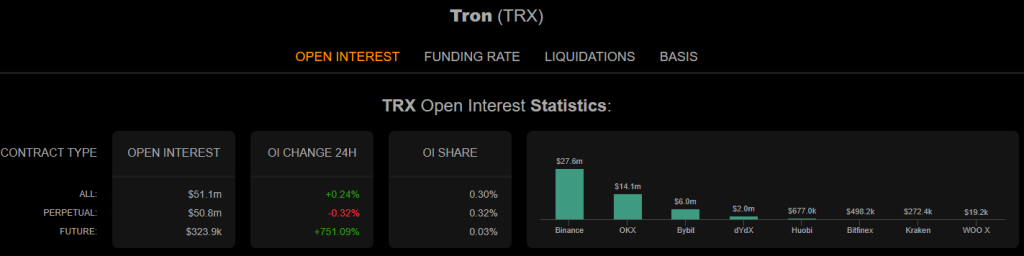

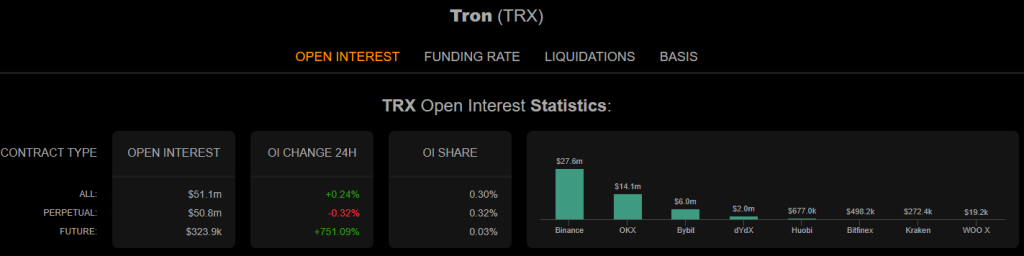

Meanwhile, a noteworthy development has emerged within the derivatives market, adding a new dimension to TRX’s ongoing journey. This development revolves around the concept of Open Interest rates, a critical metric that measures the cumulative value of outstanding derivative contracts.

Over a recent period, from August 18 to the present moment, Open Interest rates have experienced a remarkable surge, escalating from approximately $45 million to a robust figure exceeding $51 million.

This surge in Open Interest rates carries profound implications, casting a spotlight on the prevailing sentiment among traders. The notable increase is indicative of a prevailing bullish outlook held by a substantial portion of traders and market participants. This surge essentially signifies that there is a widespread belief in the potential for further upward movement in TRX’s price.

The significance of this rise in Open Interest rates transcends mere optimism. It’s also a concrete indicator of the broader market’s growing interest in TRX derivatives. This trend underscores a heightened willingness among traders to engage in derivative contracts linked to TRX, thereby enriching the trading landscape around the token.

Balancing Act: Consideration Of Fluctuating Funding Rates

Despite these encouraging signs, market participants are cognizant of potential headwinds. Fluctuating funding rates, which denote the cost of holding positions in futures contracts, could introduce volatility and potentially impede a solid and sustained upward momentum in the short term.

As TRX ventures toward key resistance levels, it faces the challenge of maintaining its upward trajectory while navigating potential dips. The derivatives market provides a favorable backdrop, but market players remain watchful of funding rate fluctuations. The coming days will shed light on whether TRX can maintain its ascent and solidify its position.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Zipmex

As of the latest data from CoinGecko, the TRX price currently stands at $0.076, despite a minor 1.2% decline over the past 24 hours. This resurgence follows a decent seven-day rally that has seen TRX gain 5.4%.

Delving into the technical analysis on a weekly timeframe, it becomes evident that TRON has been tracing an ascending support line since November 2022. This trajectory has been consistently validated through multiple instances, underscoring its significance.

Resistance Targets On Tron Radar

Market analysts and enthusiasts are now setting their sights on potential price trajectories for TRX. Based on a comprehensive price analysis, bullish sentiment is prevailing as TRX bulls seem poised to take on the next resistance level at $0.080.

Meanwhile, a noteworthy development has emerged within the derivatives market, adding a new dimension to TRX’s ongoing journey. This development revolves around the concept of Open Interest rates, a critical metric that measures the cumulative value of outstanding derivative contracts.

Over a recent period, from August 18 to the present moment, Open Interest rates have experienced a remarkable surge, escalating from approximately $45 million to a robust figure exceeding $51 million.

This surge in Open Interest rates carries profound implications, casting a spotlight on the prevailing sentiment among traders. The notable increase is indicative of a prevailing bullish outlook held by a substantial portion of traders and market participants. This surge essentially signifies that there is a widespread belief in the potential for further upward movement in TRX’s price.

The significance of this rise in Open Interest rates transcends mere optimism. It’s also a concrete indicator of the broader market’s growing interest in TRX derivatives. This trend underscores a heightened willingness among traders to engage in derivative contracts linked to TRX, thereby enriching the trading landscape around the token.

Balancing Act: Consideration Of Fluctuating Funding Rates

Despite these encouraging signs, market participants are cognizant of potential headwinds. Fluctuating funding rates, which denote the cost of holding positions in futures contracts, could introduce volatility and potentially impede a solid and sustained upward momentum in the short term.

As TRX ventures toward key resistance levels, it faces the challenge of maintaining its upward trajectory while navigating potential dips. The derivatives market provides a favorable backdrop, but market players remain watchful of funding rate fluctuations. The coming days will shed light on whether TRX can maintain its ascent and solidify its position.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Zipmex