- The total inflows into U.S. spot Ether ETFs reached $2.5 billion on December 24th.

- Retail investors are paying more heed to round psychological figures like $3,500.

The fact that Ethereum ETFs have surpassed the $2.5 billion mark suggests that Ether could be about to make a significant move. Based on statistics from Farside Investors, the total inflows into U.S. spot Ether ETFs reached $2.5 billion on December 24th, with the ETFs receiving $53 million in cumulative net inflows. According to statistics from CMC, the price of Ether was $3,450, down almost 10% in the last 7 days despite good ETF inflows.

Crypto expert Satoshi Flipper said in a post on December 25 that once the price of Ether flips the $3,500 psychological level into resistance, additional positive momentum might be seen. Retail investors are paying more heed to round psychological figures like $3,500. But if Ether fails to reach the barrier, investor mood might take a knock.

Price Surge Anticipated

Many in the cryptocurrency industry are bullish about the future of Ether’s price as we go toward 2025. Analysts predict that the price of Ethereum may rise beyond $4,000. Before the inauguration of President-elect Donald Trump on January 20.

The price potential of Ether has been attracting increasing investor interest since November 21. When Gary Gensler, the chair of the SEC, announced his resignation, effective January 20, just before Trump takes office.

More ambitious price goals for Ethereum are being considered by a number of prominent institutional players in the cryptocurrency sector. According to VanEck, Bitcoin will reach $180,000 in 2025 while Ether will reach a $6,000 cycle peak.

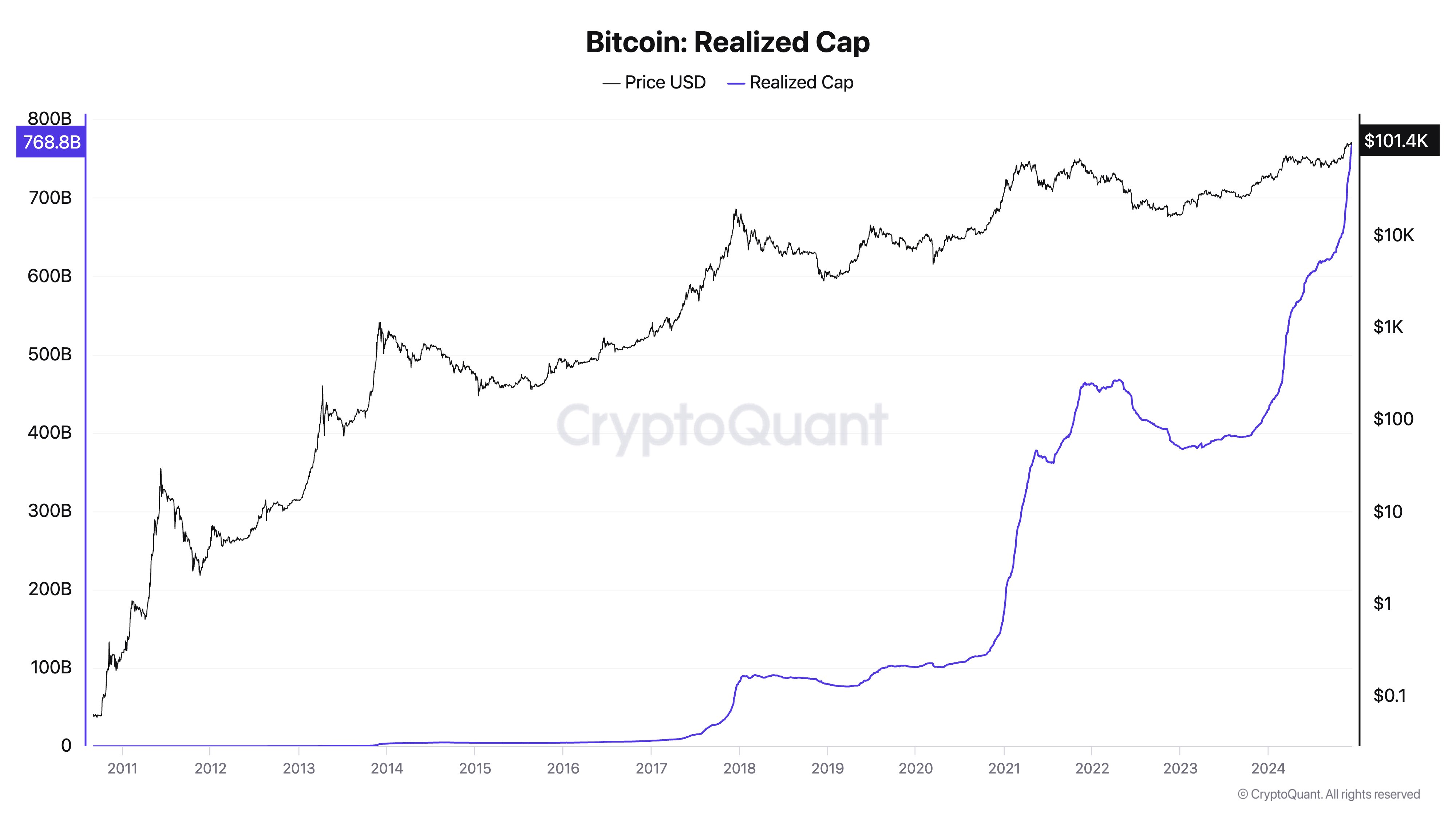

The flow patterns of the U.S. spot Bitcoin ETFs have lately undergone a dramatic shift. Outflows of $338.4 million were recorded on December 24th, the fourth day in a row, bringing the total outflows for the last four days to $1.52 billion. Following massive inflows—more than $6.7 billion—into spot Bitcoin ETFs up to December 18—this follows.

Highlighted Crypto News Today:

Singapore Tops Global Blockchain Rankings, Hong Kong and Estonia Follow