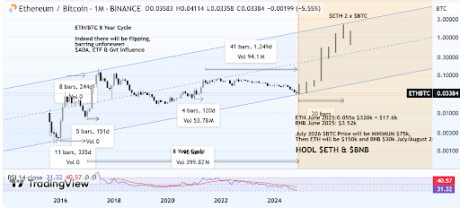

Altcoin sentiment is at extreme lows, but that’s not the only thing reaching extremes. Bitcoin dominance, a measure of the top cryptocurrency by market cap’s weight compared to the rest of the space, also reached the most extreme reading ever on a technical indicator known for its precise timing and ability to pin-point reversals.

If accurate, it’s only a matter of time until altcoins once again outperform BTC.

In recent weeks, BTC dominance reached above 50% — an important psychological level in the relationship between Bitcoin and altcoins. While the metric has been much higher — and lower — in the past, the idea that one coin is the size of all others combined is a massive accomplishment.

But after reaching only 2% above the 50% zone, Bitcoin dominance has struggled to push any higher and found resistance. The first signs of a possible reversal began as XRP was deemed not a security by a US judge. Since then, the relationship between Bitcoin and alts has since switch course.

The change in course coincides with the Fisher Transform flipping downward from the most extreme reading in the history of 2W BTC.D charts.

The Fisher Transform, created by John Elhers, converts price action into a Gaussian normal distribution in order to better highlight precise turning points in markets.

The tool’s readings are based on a standard deviation, where readings on the most extreme side of the bell curve are rare, and thus have a higher probability of reversal once the signal turns down. Such moves to extremes require enormous strength behind the underlying trend. But even the most powerful trends must eventually come to an end.

Reversing down from the highest point in 2W BTC.D history could suggest the trend favoring Bitcoin has ended, and the altcoins will perform better for the foreseeable future. Whether or not that leads to a sustainable altcoin season remains to be seen.

If accurate, it’s only a matter of time until altcoins once again outperform BTC.

Why The 50% Level In Bitcoin Dominance Is Critical

In recent weeks, BTC dominance reached above 50% — an important psychological level in the relationship between Bitcoin and altcoins. While the metric has been much higher — and lower — in the past, the idea that one coin is the size of all others combined is a massive accomplishment.

But after reaching only 2% above the 50% zone, Bitcoin dominance has struggled to push any higher and found resistance. The first signs of a possible reversal began as XRP was deemed not a security by a US judge. Since then, the relationship between Bitcoin and alts has since switch course.

The change in course coincides with the Fisher Transform flipping downward from the most extreme reading in the history of 2W BTC.D charts.

The Fisher Transform Forecasts A Potential Altcoin Season

The Fisher Transform, created by John Elhers, converts price action into a Gaussian normal distribution in order to better highlight precise turning points in markets.

The tool’s readings are based on a standard deviation, where readings on the most extreme side of the bell curve are rare, and thus have a higher probability of reversal once the signal turns down. Such moves to extremes require enormous strength behind the underlying trend. But even the most powerful trends must eventually come to an end.

Reversing down from the highest point in 2W BTC.D history could suggest the trend favoring Bitcoin has ended, and the altcoins will perform better for the foreseeable future. Whether or not that leads to a sustainable altcoin season remains to be seen.