Data from Glassnode reveals that the structure of the current Bitcoin rally is looking similar to the genesis points of historical uptrends.

In its latest weekly report, the on-chain analytics firm Glassnode has looked into how the current Bitcoin rally lines up against similar rallies that the cryptocurrency observed during the previous cycles.

To make this comparison, the analytics firm has taken the data for the performance of the coin starting from the all-time high in each cycle.

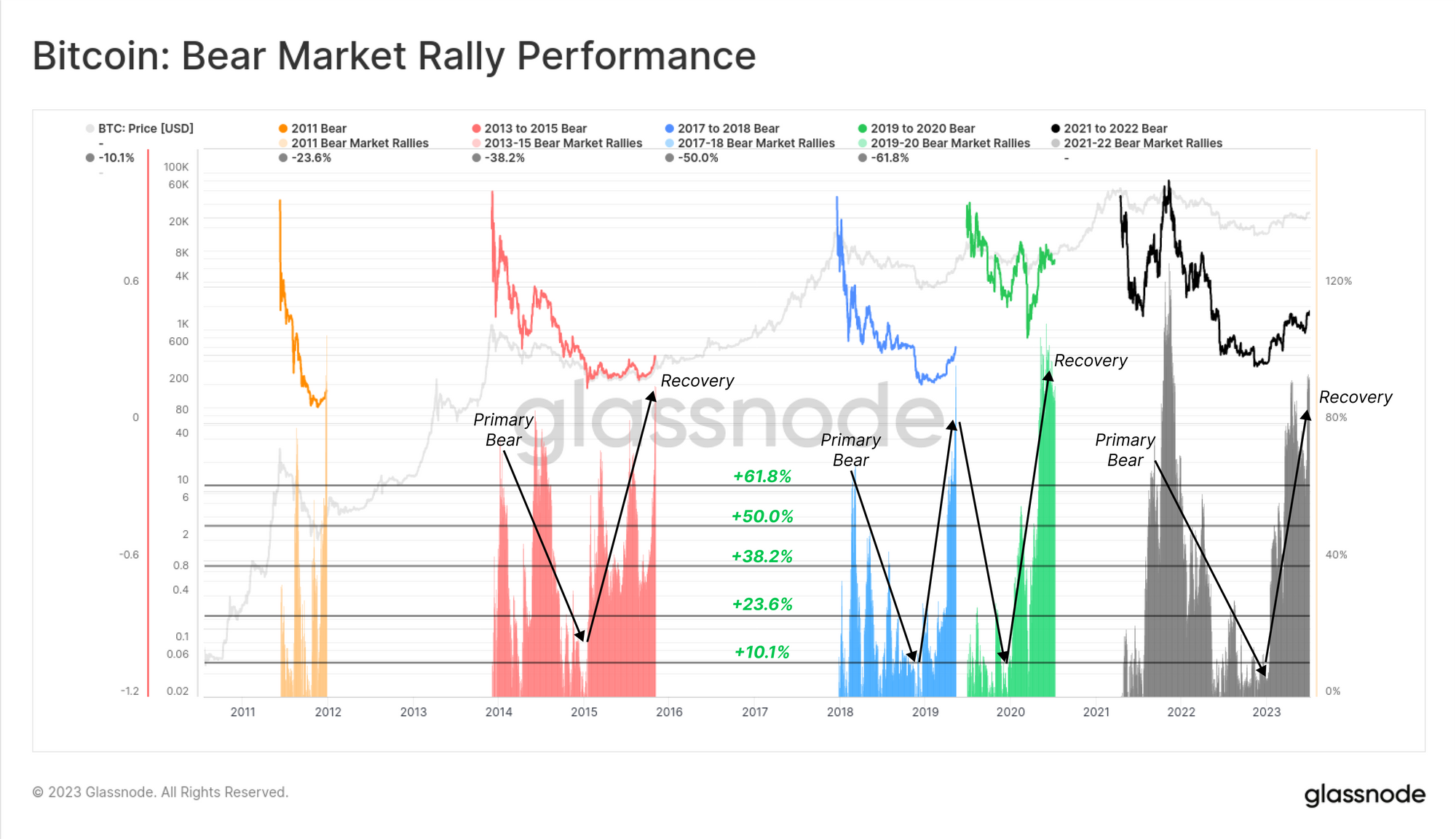

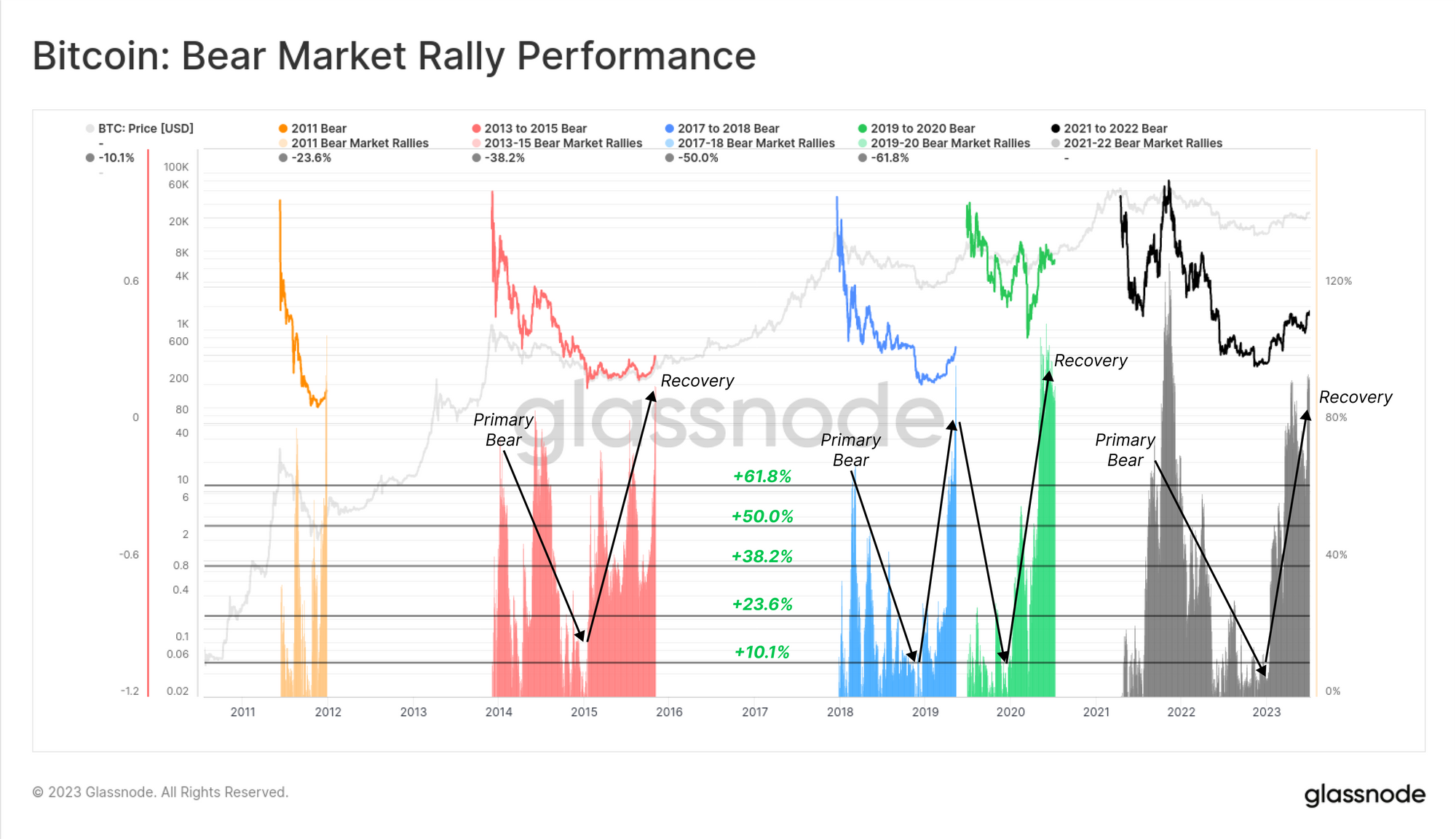

Here is a chart that shows how the past bear market rallies have looked like in terms of this metric:

Note that only the upwards performance of Bitcoin is being considered here, and the drawdown has been excluded. From the chart, it’s visible that during all the cycles, gains after the ATH was set disappeared in time as the bear market went into full gear.

Soon after the bear bottom formation took place, these cycles saw the asset experiencing a recovery rally. In the current cycle so far, it’s not completely certain yet if the November 2022 low seen after the FTX crash was indeed the cyclical bottom.

However, if it’s assumed that this low was indeed the bottom, then the rally that has been going on in the past few months would take the role of the recovery rally in the current cycle.

Interestingly, so far, the cryptocurrency has seen an uplift of 91% since the aforementioned bottom, which is very similar in scale to the recovery rallies of the past cycles.

“With the exception of 2019, all prior cycles which experienced a similar magnitude move off the bottom, were in fact the genesis point of a new cyclical uptrend,” explains Glassnode.

The reason 2019 was different is that the April 2019 rally (which may have normally acted as the recovery rally from the bear market bottom) ran out of steam before long and the price subsequently declined.

The drawdown was then extended in March 2020 as the crash due to the emergence of COVID-19 took place. It’s the recovery rally from this crash that ended up leading to the 2021 bull market.

Naturally, if the pattern of the first two Bitcoin cycles is anything to go by, the current recovery rally structure may mean that the asset is now on its way toward a cyclical uptrend.

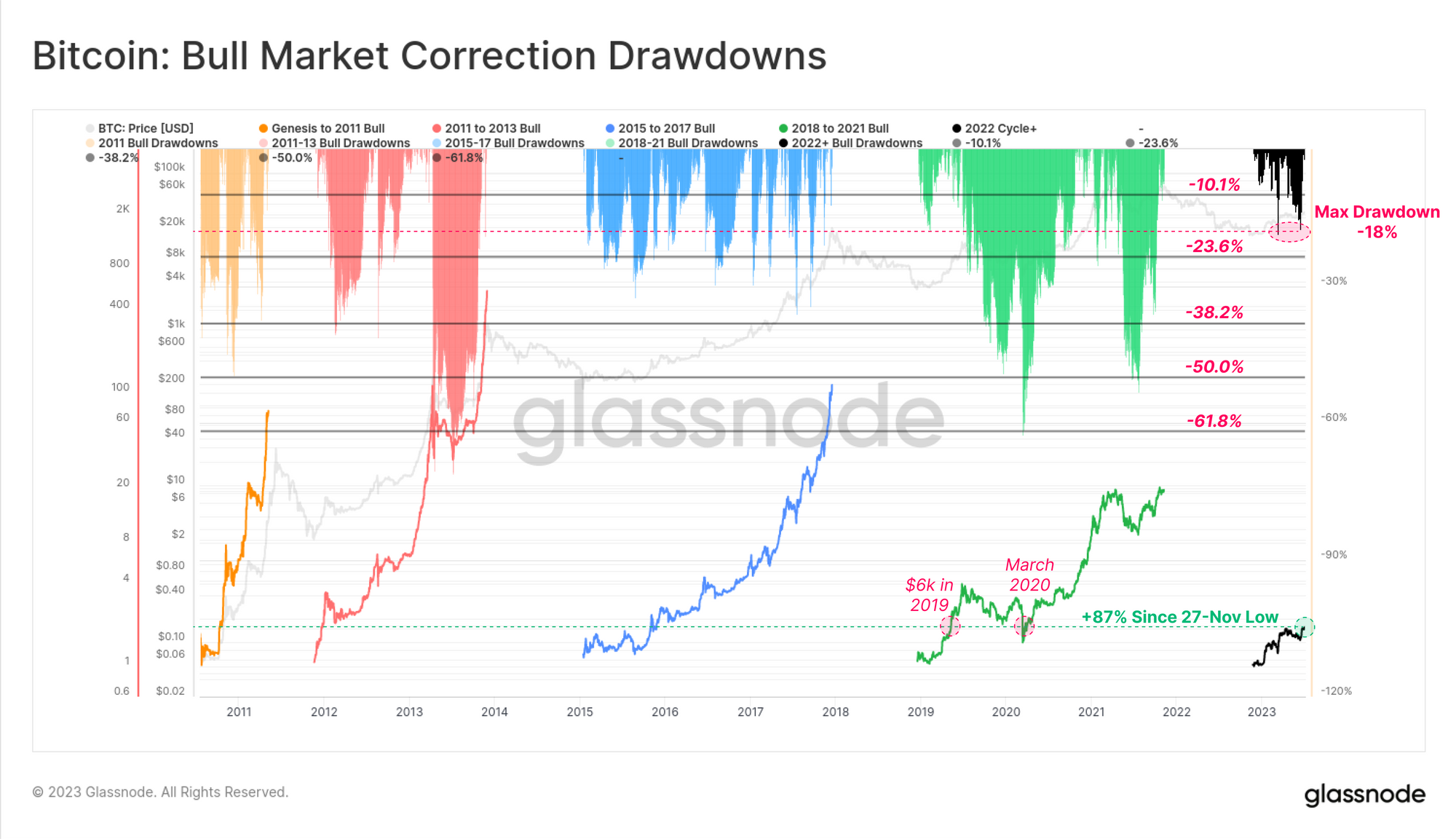

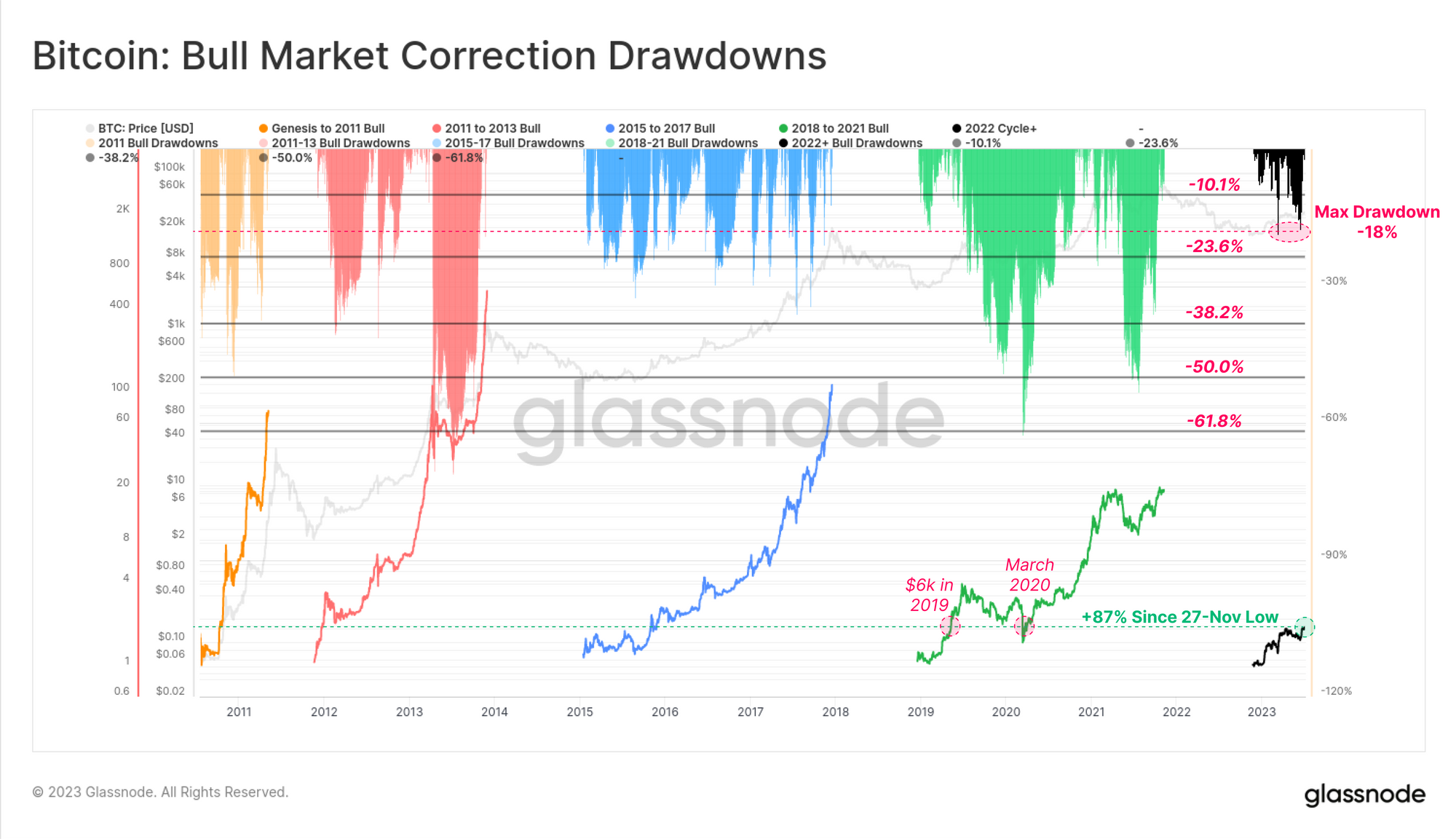

The analytics firm has also looked at the rally from another angle: this time in terms of the drawdown (that is, the negative performance).

As displayed in the graph, the Bitcoin rally has seen a peak drawdown of just 18% so far, which is clearly much less than what the previous bull markets saw. “This perhaps suggests a relatively strong degree of demand underlies the asset,” suggests Glassnode.

At the time of writing, Bitcoin is trading around $30,400, down 2% in the last week.

Bitcoin Recovery Since November Lows Is Reminiscent Of Past Rallies

In its latest weekly report, the on-chain analytics firm Glassnode has looked into how the current Bitcoin rally lines up against similar rallies that the cryptocurrency observed during the previous cycles.

To make this comparison, the analytics firm has taken the data for the performance of the coin starting from the all-time high in each cycle.

Here is a chart that shows how the past bear market rallies have looked like in terms of this metric:

Note that only the upwards performance of Bitcoin is being considered here, and the drawdown has been excluded. From the chart, it’s visible that during all the cycles, gains after the ATH was set disappeared in time as the bear market went into full gear.

Soon after the bear bottom formation took place, these cycles saw the asset experiencing a recovery rally. In the current cycle so far, it’s not completely certain yet if the November 2022 low seen after the FTX crash was indeed the cyclical bottom.

However, if it’s assumed that this low was indeed the bottom, then the rally that has been going on in the past few months would take the role of the recovery rally in the current cycle.

Interestingly, so far, the cryptocurrency has seen an uplift of 91% since the aforementioned bottom, which is very similar in scale to the recovery rallies of the past cycles.

“With the exception of 2019, all prior cycles which experienced a similar magnitude move off the bottom, were in fact the genesis point of a new cyclical uptrend,” explains Glassnode.

The reason 2019 was different is that the April 2019 rally (which may have normally acted as the recovery rally from the bear market bottom) ran out of steam before long and the price subsequently declined.

The drawdown was then extended in March 2020 as the crash due to the emergence of COVID-19 took place. It’s the recovery rally from this crash that ended up leading to the 2021 bull market.

Naturally, if the pattern of the first two Bitcoin cycles is anything to go by, the current recovery rally structure may mean that the asset is now on its way toward a cyclical uptrend.

The analytics firm has also looked at the rally from another angle: this time in terms of the drawdown (that is, the negative performance).

As displayed in the graph, the Bitcoin rally has seen a peak drawdown of just 18% so far, which is clearly much less than what the previous bull markets saw. “This perhaps suggests a relatively strong degree of demand underlies the asset,” suggests Glassnode.

BTC Price

At the time of writing, Bitcoin is trading around $30,400, down 2% in the last week.