- US government officials’ skepticism towards crypto contrasts with personal investments.

- Regulatory scrutiny challenges the crypto industry, but resilience and interest resist.

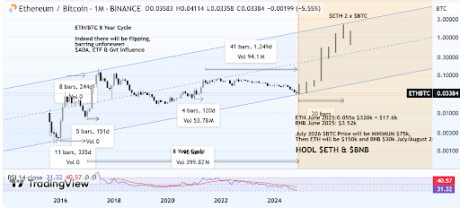

In 2023, the cryptocurrency industry witnessed a notable chapter in its history, particularly within the United States. While the SEC’s rigorous actions against major exchanges and coins have created a challenging environment, the impact has been far-reaching. Amidst the market’s roller coaster ride, the struggle to reach a bullish trajectory remains evident.

Meanwhile, within the realm of US cryptocurrency, two contrasting forces emerge: government officials who exhibit animosity towards cryptocurrencies and those who paradoxically hold digital assets, including influential senators who support the rise of these blockchain-based currencies. As the dominant economic power globally, every move by the United States government carries significant weight. While authorities emphasize the importance of safety and employ strict measures, cryptocurrency users display resilience and unwavering support, ensuring the US remains a top contender in terms of crypto adoption.

US Government’s Regulatory Scrutiny

The US Securities and Exchange Commission (SEC) has been at the forefront of regulatory actions against major exchanges and coins. Lawsuits were filed against prominent crypto titans such as Binance and Coinbase, accusing them of securities violations, unregistered offers, and sales of tokens. These legal battles have intensified regulatory scrutiny globally, raising concerns and uncertainties within the cryptocurrency industry.

Looking back , Ripple Labs, along with its co-founder and CEO, faced a lawsuit from the SEC, alleging an unregistered securities offering through the sale of XRP tokens. And The SEC filed charges against Binance, accusing the exchange of allowing high-value US customers to trade on the platform and exerting control over customer assets.

Impact

The lawsuits against major exchanges and the ongoing legal battles contribute to increased uncertainty and decreased confidence in the cryptocurrency sector. Trust issues arise between the crypto community and regulatory authorities, further complicating the regulatory landscape. The outcome of these legal proceedings will have far-reaching implications.

FOMC’s Impact on Crypto Market Sentiment

The Federal Open Market Committee’s decisions regarding interest rates and economic growth indirectly influence cryptocurrency values. Rate hikes can prompt investors to retreat from risky assets, including cryptocurrencies, seeking stability. Conversely, positive economic projections and inflation concerns may reignite confidence in venturesome investments like cryptocurrencies. The FOMC’s battle against rising inflation and its efforts to anchor inflation back to its 2% objective could impact the appeal of cryptocurrencies as inflation hedges.

What’s Behind The US Curtain ?

Despite the expressed skepticism, several US government officials have been found to hold cryptocurrencies themselves. This paradoxical situation raises questions about their personal beliefs and motivations. It suggests that while they may publicly criticize cryptocurrencies, they recognize their potential value and investment opportunities.

Just recently, there have been notable instances of government officials holding cryptocurrencies, revealing a contrasting picture. One such example involves presidential candidate Robert F. Kennedy Jr., who had previously denied being a bitcoin investor but was found to have holdings exceeding $250,000 in a recent financial disclosure. Additionally, SEC chairman Gary’s past application to Binance highlights his personal interest in cryptocurrencies, despite public criticism.

Furthermore, members of Congress have also disclosed their investments in cryptocurrencies, with some going a step further to advocate for more transparent regulations. These disclosures suggest that these officials recognize the long-term potential of digital currencies.

In summary, these instances reflect a complex and nuanced relationship between government officials and cryptocurrencies

Conclusion

The US government’s stance on cryptocurrencies remains complex, with regulatory actions and personal investments revealing a dual nature. While regulatory scrutiny continues to pose challenges for the crypto industry, the resilience of crypto users and the ongoing investments in digital assets suggest a broader acceptance and interest in the digital revolution.