- Tether minted $2B USDT in the last four days, contributing to a total of $19B since November 6.

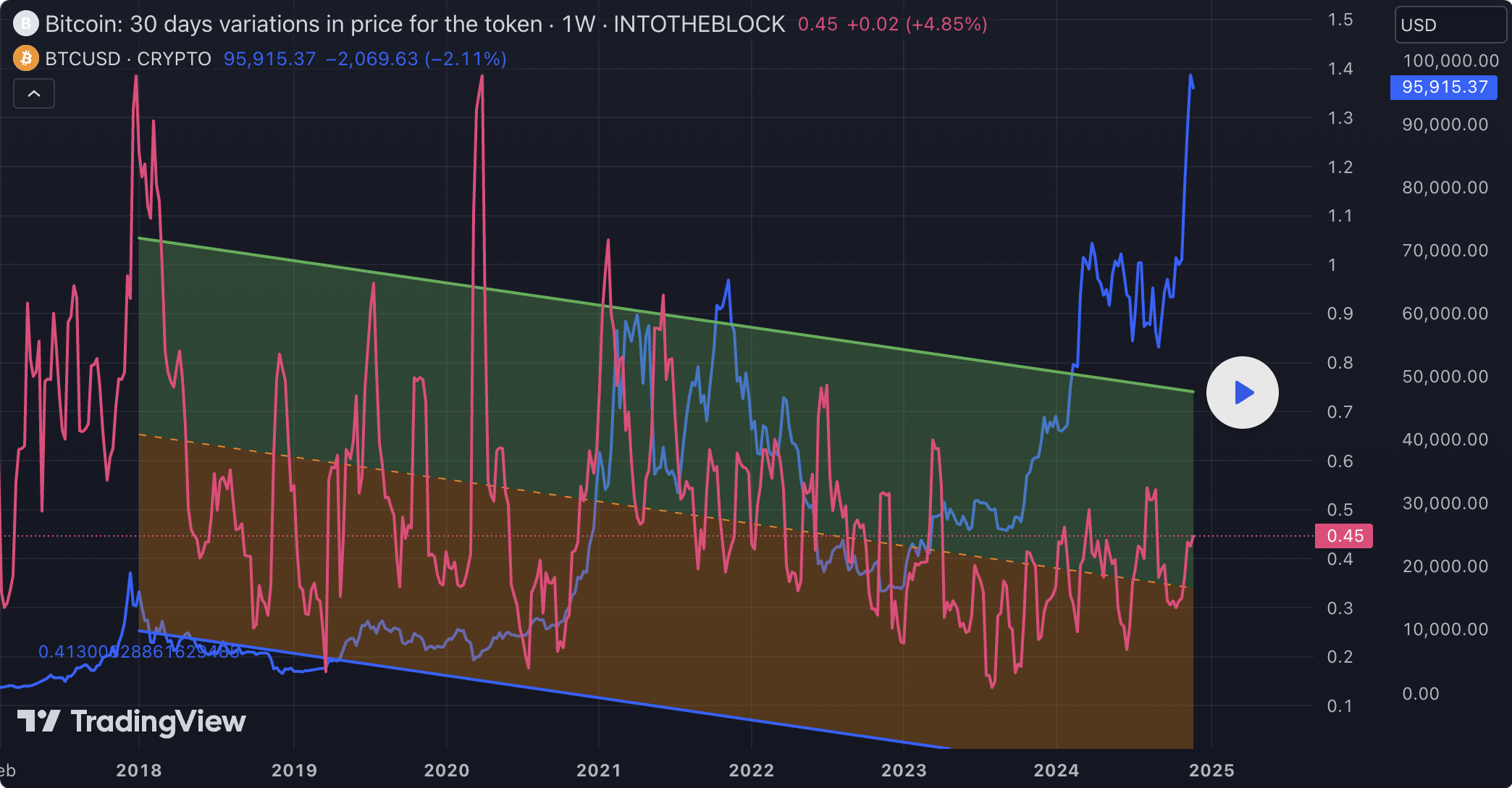

- Bitcoin surpassed $100K twice, signaling a strong crypto market rally.

Tether, the largest stablecoin issuer, has minted $2 billion USDT in the last four days. This contributes to a total of $19 billion USDT minted on Ethereum and Tron since November 6. These funds have consistently flowed into various cryptocurrency exchanges, fueling market activity.

During the same period, Bitcoin’s price crossed the $100,000 mark twice. This milestone highlights the rally’s impact on the broader crypto market. Notably, rival blockchains Ethereum and Tron hold nearly equal amounts of circulating USDT. However, Tron’s ecosystem remains smaller compared to Ethereum’s expansive network.

Tether minted 2B $USDT again 6 hours ago!#Tether has minted 19B $USDT on #Ethereum and #Tron since Nov 6!https://t.co/mRlyzWmCSj pic.twitter.com/D3OmnyXVxc

— Lookonchain (@lookonchain) December 7, 2024

In the third quarter of 2024, Tron generated $577 million in revenue. A large portion of this came from its stablecoin-related activities. Despite its smaller ecosystem, Tron has solidified its position in the stablecoin market.

As of August 2024, Ethereum held a dominant 55.7% share of all stablecoins. Meanwhile, Tron secured the second-largest market share at 37.9%. These figures reflect the networks’ influence on the stablecoin ecosystem and their competition for market dominance.

Tether CEO Paolo Ardoino stated that achieving hyper-productivity by 2025 is crucial for meeting the company’s goals. Increased USDT issuance signals strong demand for stablecoins, often seen as a barometer of interest in cryptocurrency markets.

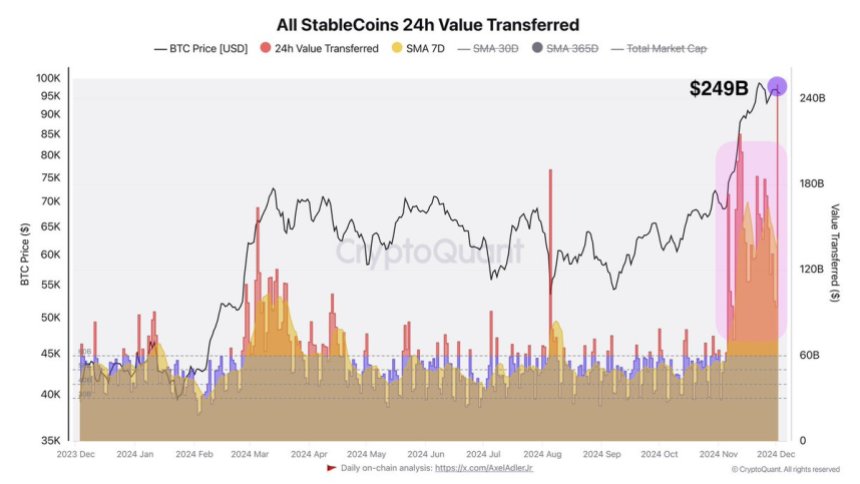

Stablecoins Drive Market Trends

Traders and investors rely on stablecoins like USDT as a fiat entry and exit point. They use stablecoins to buy cryptocurrencies and secure profits by selling holdings. Analysts view a rise in stablecoin issuance as a bullish sign for market sentiment, while a decline indicates bearish trends.

Stablecoins remain a vital component of the crypto ecosystem. Their growing demand reflects their importance for liquidity and price stability. As Tether mints billions more in USDT, market participants will closely monitor its effects on cryptocurrency prices.

This surge in stablecoin activity underscores Tether’s pivotal role in shaping market trends. Both Ethereum and Tron continue competing for dominance, driving innovation in the blockchain space. With rising demand, the stablecoin market’s trajectory points toward sustained growth.

Highlighted Crypto News Today

Truflation Launches Independent Inflation Tracker with Levitate Labs Partnership for India