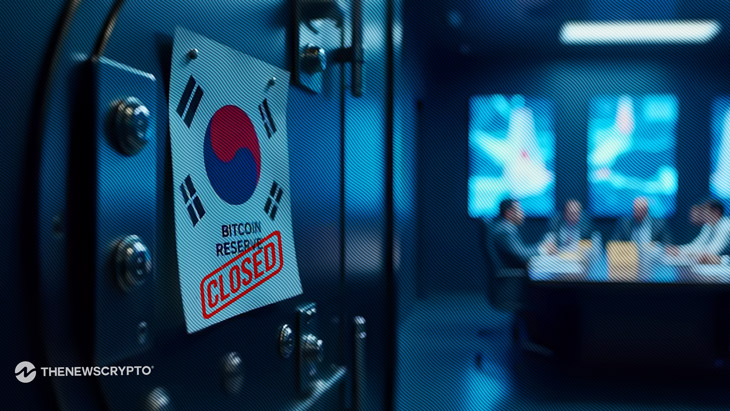

- South Korea’s FSC has rejected the creation of a national Bitcoin reserve.

- Chairman Kim Byung-hwan emphasized caution and investor protection.

South Korea’s Financial Services Commission (FSC) has rejected plans to create a national Bitcoin reserve. The decision comes as U.S. President-elect Donald Trump pushes pro-crypto policies. FSC Chairman Kim Byung-hwan expressed caution, prioritizing investor protection over rapid adoption.

JUST IN: SOUTH KOREA'S FINANCIAL SERVICES COMMISSION (FSC) DROPS PLANS TO ESTABLISH A BITCOIN RESERVE "FOR THE TIME BEING"

— BSCN Headlines (@BSCNheadlines) November 25, 2024

During a televised interview on November 24, Kim dismissed the idea of stockpiling Bitcoin, calling it “far-fetched at the moment.” He acknowledged the U.S.’s shift toward nurturing crypto but emphasized South Korea’s need for careful observation. He stated that the country must first connect digital assets to its financial system.

Economic Priorities Over Bitcoin

Kim highlighted the importance of traditional markets like KOSPI and KOSDAQ. He noted that stock investments create a positive cycle for the economy. In contrast, the FSC remains uncertain about Bitcoin’s economic benefits. Crypto trading volumes have recently surpassed stock trading, raising concerns about volatility.

“We need funds flowing into the stock market,”

Kim said, stressing the need to monitor the rapid rise in virtual asset prices. The FSC will focus on combating unfair trading practices in the crypto sector.

Kim explained that South Korea is not dismissing Bitcoin entirely. Instead, the country will wait to see how U.S. policies shape global crypto regulations. Trump’s administration plans to adopt a Bitcoin Strategic Reserve Act, which could influence South Korea’s stance.

The FSC chief admitted that the volatile nature of digital assets remains a concern. South Korea enacted the Virtual Asset Protection Act in July 2024. This legislation focuses on regulating and protecting crypto investors, laying the groundwork for future policies.

Highlighted Crypto News Today

Avalanche Hits 7-Month High Above $45 Amid November Bull Run