Solana (SOL) recently experienced a significant milestone by crossing the $20 price mark. This achievement has sparked considerable enthusiasm among investors and crypto enthusiasts alike, as Solana’s bullish momentum continues to gain traction.

With its growing popularity and impressive performance, what can investors expect from Solana after this milestone?

Let’s delve into the factors behind Solana’s recent success, explore its potential for further growth, and assess the risks and opportunities that lie ahead for this emerging cryptocurrency.

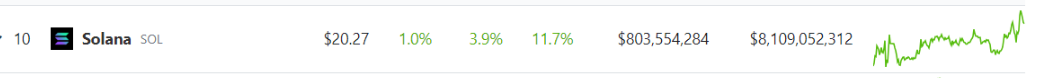

Solana (SOL) has experienced an impressive ascent to new heights, as its price broke through the $20 threshold, reaching $20.27, according to the latest data from CoinGecko.

This notable surge indicates a 3.9% rally within the past 24 hours, accompanied by a substantial overall increase of 11.7% over the course of the past seven days.

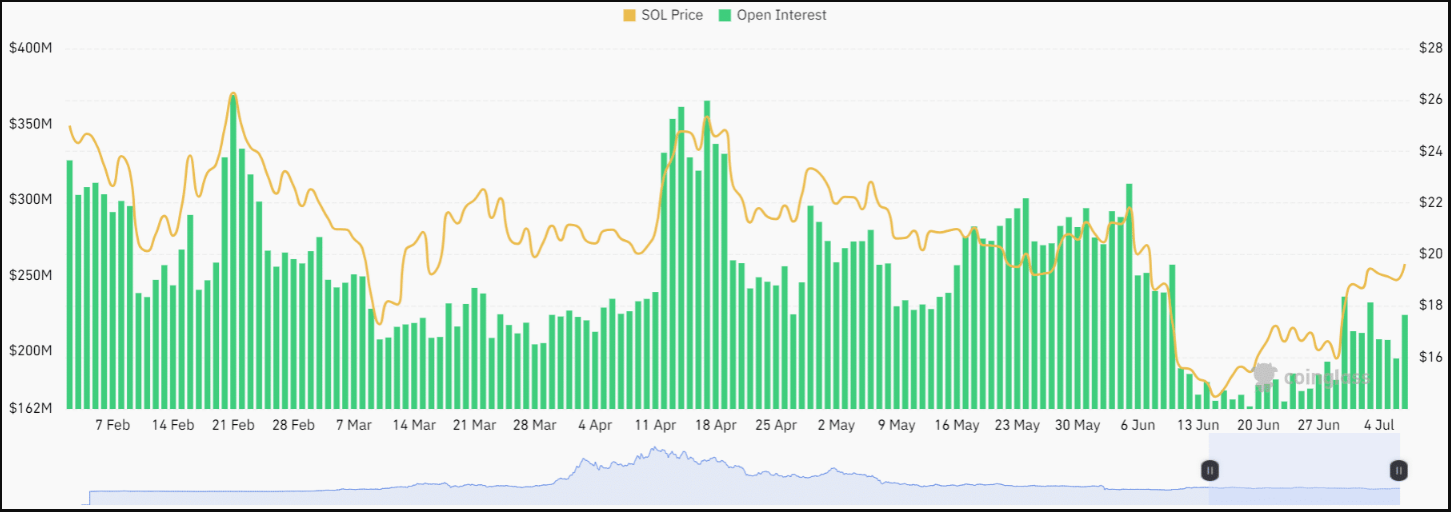

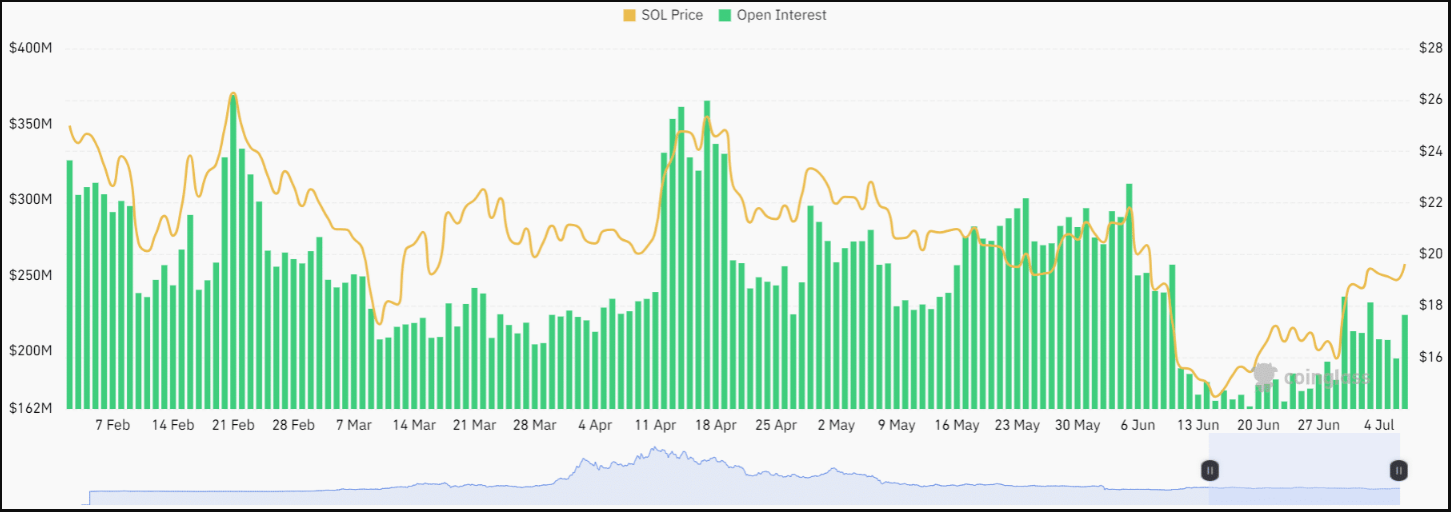

Analyzing SOL’s Open Interest (OI) chart provides further evidence of the prevailing bullish sentiment in recent weeks.

A SOL price report reveals a consistent upward trajectory of the OI, closely following the surge in prices since June 20. These findings indicate that speculators hold strong bullish convictions regarding SOL’s future prospects.

Although there was a slight setback on July 3, which led to a pullback from $19.8 to $18.5, the price action and OI chart continue to signal an enduring bullish sentiment over the past two weeks.

While the buying pressure may not be as robust, the upward trajectory of SOL’s performance could persist if Bitcoin (BTC), the leading cryptocurrency, were to experience further upward momentum.

Bitcoin has an indirect influence on the overall cryptocurrency market, and Solana is no exception. As the Bitcoin price has safely maintained its position around the $30,000 level, it provides stability to the broader market and allows altcoins like Solana to flourish.

Bitcoin’s stability helps maintain investor confidence and encourages risk-taking in other cryptocurrencies, including SOL. As a result, Solana has been able to experience its remarkable surge and sustain its bullish momentum.

While SOL’s surge is driven primarily by its own merits and growing popularity as a blockchain platform, the overall market conditions shaped by Bitcoin’s stability have certainly played a part in facilitating Solana’s ascent.

As investors seek alternative opportunities and diversification beyond Bitcoin, Solana’s impressive performance and potential for further growth have garnered significant attention and contributed to its recent surge.

The interplay between SOL’s impressive surge and Bitcoin’s stable position raises intriguing questions about the potential impact of broader market factors on the future growth of Solana.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from 99 Walks

With its growing popularity and impressive performance, what can investors expect from Solana after this milestone?

Let’s delve into the factors behind Solana’s recent success, explore its potential for further growth, and assess the risks and opportunities that lie ahead for this emerging cryptocurrency.

Solana: Remarkable Surge And Bullish Sentiment

Solana (SOL) has experienced an impressive ascent to new heights, as its price broke through the $20 threshold, reaching $20.27, according to the latest data from CoinGecko.

This notable surge indicates a 3.9% rally within the past 24 hours, accompanied by a substantial overall increase of 11.7% over the course of the past seven days.

Analyzing SOL’s Open Interest (OI) chart provides further evidence of the prevailing bullish sentiment in recent weeks.

A SOL price report reveals a consistent upward trajectory of the OI, closely following the surge in prices since June 20. These findings indicate that speculators hold strong bullish convictions regarding SOL’s future prospects.

Although there was a slight setback on July 3, which led to a pullback from $19.8 to $18.5, the price action and OI chart continue to signal an enduring bullish sentiment over the past two weeks.

While the buying pressure may not be as robust, the upward trajectory of SOL’s performance could persist if Bitcoin (BTC), the leading cryptocurrency, were to experience further upward momentum.

Bitcoin’s Role in Solana’s Momentum

Bitcoin has an indirect influence on the overall cryptocurrency market, and Solana is no exception. As the Bitcoin price has safely maintained its position around the $30,000 level, it provides stability to the broader market and allows altcoins like Solana to flourish.

Bitcoin’s stability helps maintain investor confidence and encourages risk-taking in other cryptocurrencies, including SOL. As a result, Solana has been able to experience its remarkable surge and sustain its bullish momentum.

While SOL’s surge is driven primarily by its own merits and growing popularity as a blockchain platform, the overall market conditions shaped by Bitcoin’s stability have certainly played a part in facilitating Solana’s ascent.

As investors seek alternative opportunities and diversification beyond Bitcoin, Solana’s impressive performance and potential for further growth have garnered significant attention and contributed to its recent surge.

The interplay between SOL’s impressive surge and Bitcoin’s stable position raises intriguing questions about the potential impact of broader market factors on the future growth of Solana.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from 99 Walks