- Solana breaks above $200 with 8.7% daily gain

- Net Unrealized Profit/Loss indicates sustained investor confidence

- RSI moves above 50.0, confirming renewed bullish momentum

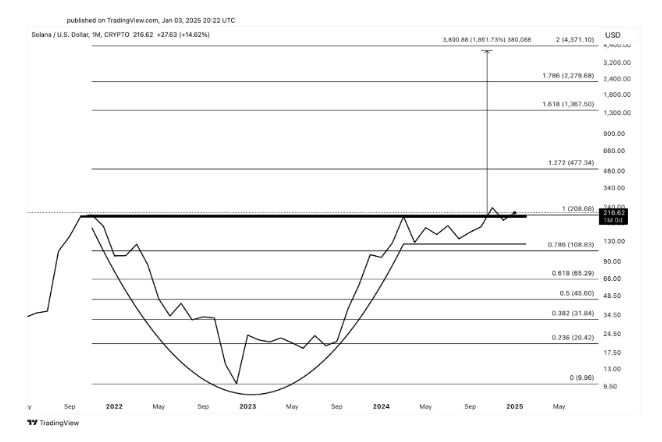

Solana’s recent price action represents a shift in market dynamics, with the cryptocurrency breaking free from December’s consolidation phase to reclaim the psychologically important $200 level. This movement suggests increasing market confidence in SOL’s fundamental value proposition.

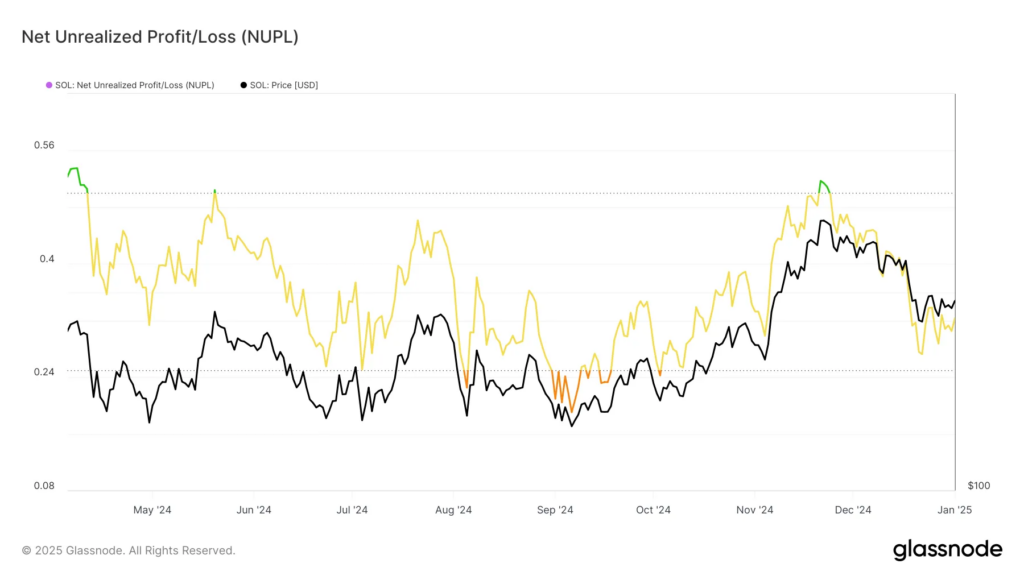

Source: Glassnode

The Power of Solana Holder Behavior

The Net Unrealized Profit/Loss (NUPL) indicator provides fascinating insight into investor psychology during this recovery phase. This metric, which measures the aggregate profit and loss positions of all holders, reveals that investors are maintaining their positions despite recent volatility.

Think of NUPL as a thermometer for market confidence – when holders resist selling even during price fluctuations, it often indicates strong conviction in the asset’s long-term potential.

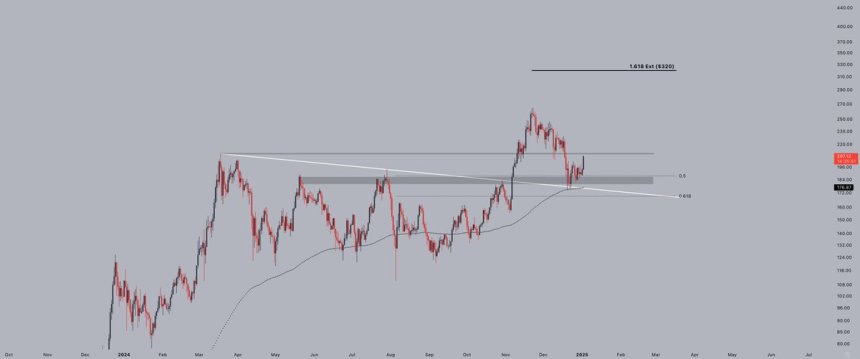

The technical picture reinforces this bullish narrative, with the Relative Strength Index (RSI) crossing above the crucial 50.0 threshold. This technical development typically signals a shift from neutral to positive momentum, providing validation for the recent price appreciation.

Currently trading at $205, SOL faces its next significant challenge at the $221 resistance level, with potential for extension toward $245 if current momentum persists.

However, traders should remain mindful of the $201 support level, as its maintenance is crucial for preserving bullish market structure. A failure to hold this level could trigger a retreat toward $186, potentially invalidating the current recovery thesis. The interplay between strong holder conviction and technical levels will likely determine SOL’s next major move.