- SOL price up 5% in a week, trading at $164.

- Key resistance levels: $171, $186.32, and $200.

- Open Interest at $2.31 billion, highest since August 1.

Solana (SOL) has emerged as a standout performer in the cryptocurrency market, registering a decent 5% price increase over the past week. Currently trading at $164, SOL finds itself on the cusp of a crucial resistance level at $171.

A successful breach of this threshold could potentially catalyze further upward movement, with subsequent targets at $186.32 and the psychologically important $200 mark.

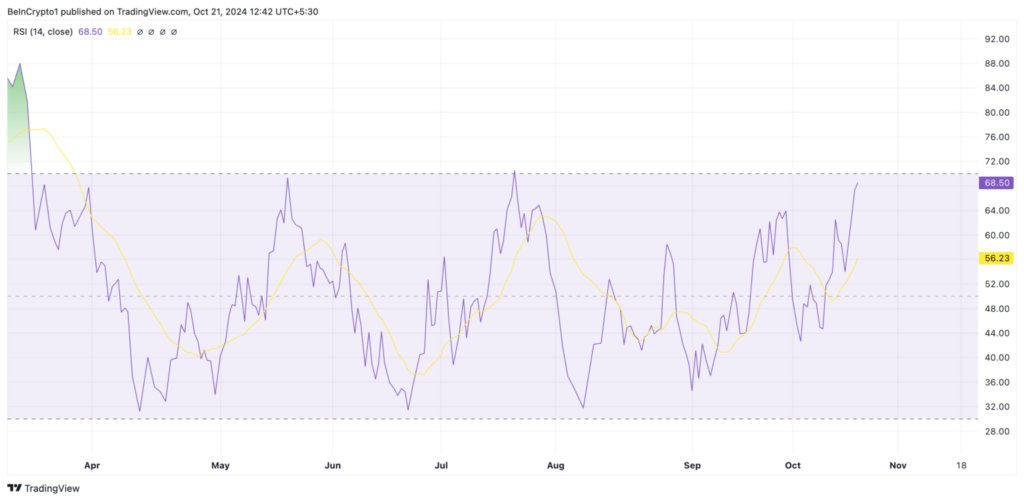

Technical analysis of SOL’s one-day chart reveals compelling evidence of surging demand for the altcoin. The Relative Strength Index (RSI), a key momentum indicator, currently stands at 68.50 and is trending upward.

Source: TradingView

While this reading approaches overbought territory (typically considered above 70), it signifies sustained buying pressure that has been driving SOL’s price appreciation.

Solana’s open interest surges

Complementing the RSI’s bullish signal, Solana’s Open Interest has experienced a dramatic surge, reaching $2.31 billion – its highest level since August 1. This metric, which has risen 29% since October 18, measures the number of outstanding derivative contracts.

The simultaneous increase in open interest and price typically indicates a robust uptrend supported by significant market participation.

Notably, the composition of this rising open interest appears to favor long positions, as evidenced by Solana’s positive funding rate of 0.012%.

This metric suggests that traders are predominantly betting on further price appreciation rather than a decline, potentially setting the stage for continued upward momentum.

Looking ahead, if SOL maintains its current trajectory, a breach of the $171.74 resistance level could pave the way for further gains. The next significant hurdle lies at $186.32, with a potential push towards $209.90 – a price point not seen since March – should bullish sentiment persist.