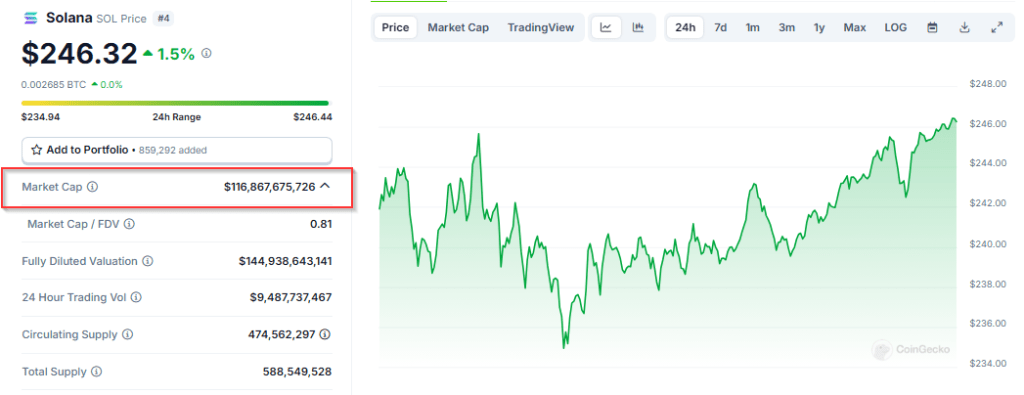

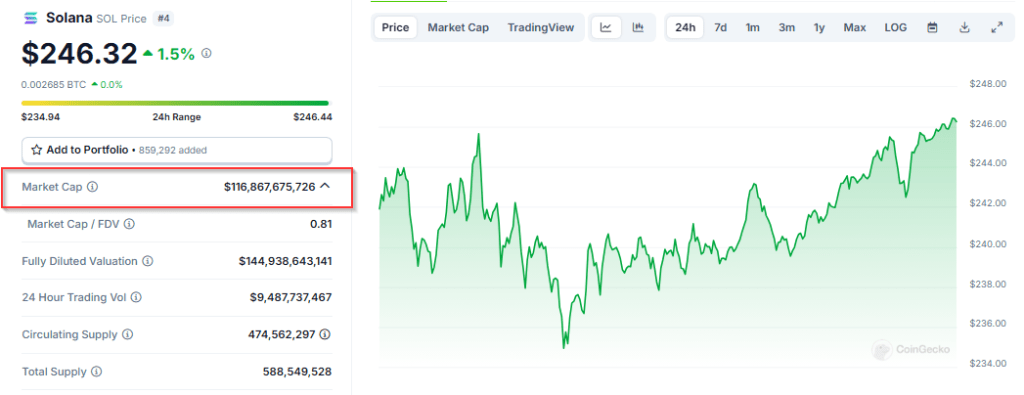

Following a price surge, Solana (SOL) reached a market valuation of nearly $117 billion for a new milestone. As the blockchain ecosystem gains traction, both analysts and investors are beginning to pay attention. This surge reflects the growing appeal of its blockchain, which offers fast, low-cost transactions, making it an attractive option for decentralized applications (DApps) and developers searching for a more efficient platform.

Solana’s value boost isn’t temporary. It signals a bigger trend in cryptocurrency investing toward alternative financial systems. As blockchain usage grows, Solana leads due to its technical skills and growing recognition of its possibilities.

It’s hard to overlook Solana’s rapid proliferation in decentralized finances (DeFi). On November 17, the network’s infrastructures were credited with among crypto’s highest processed fees to date. Five of the ten most significant fee-charging platforms were built on the Solana blockchain.

Raydium, a famous automated market maker, led the list with over $11 million in fees, followed closely by Jito, a liquid staking protocol, with close to $10 million.

The surge in activity is being fueled in part by the resurgence of memecoin craze, as investors return to the market with renewed enthusiasm. As the DeFi ecosystem on Solana grows, its capacity to execute massive transaction volumes without breaking the bank positions it as a leading contender in the fast developing blockchain race.

With the given upward momentum, analysts are becoming more positive about the Solana prospects. Titan of Crypto has also commented that SOL can possibly reach $400 as it seems to be creating a break out pattern. This pattern is known as Cup & Handle and is seen as a positive signal for further gains, especially when Solana hits its all-time high.

Another famous figure in the crypto field, Peter Brandt, has expressed similar comments, saying that Solana’s swing upward will drive its price further higher. Solana’s recent performance supports these predictions—only this week, SOL achieved a high of $248, representing an 11% increase in just seven days. SOL, at the time of writing, was trading at $246.

Solana’s surge has also enabled it to surpass Binance Coin (BNB) in market capitalization, cementing its position as the fourth-largest cryptocurrency. This confirms its position as one of the most powerful players in the industry, putting it on course to compete with other important assets, such as the stablecoin USDT.

The Road Ahead For Solana

However, Solana seems to be poised to continue upward momentum in the future. Solana is very well positioned for future growth thanks to great performance in the DeFi sector, favorable price expectations, and ever-increasing market capitalization. If it is able to maintain the level of performance at present and attract even more developers and users to its ecosystem, then it play an even more important role in the blockchain world in months and years to come.

Featured image from Forbes, chart from TradingView

Solana’s value boost isn’t temporary. It signals a bigger trend in cryptocurrency investing toward alternative financial systems. As blockchain usage grows, Solana leads due to its technical skills and growing recognition of its possibilities.

DeFi Hotspot: Solana’s Growing Influence

It’s hard to overlook Solana’s rapid proliferation in decentralized finances (DeFi). On November 17, the network’s infrastructures were credited with among crypto’s highest processed fees to date. Five of the ten most significant fee-charging platforms were built on the Solana blockchain.

Raydium, a famous automated market maker, led the list with over $11 million in fees, followed closely by Jito, a liquid staking protocol, with close to $10 million.

The surge in activity is being fueled in part by the resurgence of memecoin craze, as investors return to the market with renewed enthusiasm. As the DeFi ecosystem on Solana grows, its capacity to execute massive transaction volumes without breaking the bank positions it as a leading contender in the fast developing blockchain race.

Price Predictions: Will Solana Reach $400?

With the given upward momentum, analysts are becoming more positive about the Solana prospects. Titan of Crypto has also commented that SOL can possibly reach $400 as it seems to be creating a break out pattern. This pattern is known as Cup & Handle and is seen as a positive signal for further gains, especially when Solana hits its all-time high.

#Altcoins #SOL $400 is next!#Solana is breaking out from the Cup & Handle pattern on the monthly timeframe.

Once it clears its previous ATH, it could soar straight to $400! pic.twitter.com/CILozp95uN

— Titan of Crypto (@Washigorira) November 17, 2024

Another famous figure in the crypto field, Peter Brandt, has expressed similar comments, saying that Solana’s swing upward will drive its price further higher. Solana’s recent performance supports these predictions—only this week, SOL achieved a high of $248, representing an 11% increase in just seven days. SOL, at the time of writing, was trading at $246.

Often times price moves in swings whereby the swings are relatively equal in price. I am sure Elliott traders get quite precise (as they tend to do ) but I just use swing targets as a guide pic.twitter.com/QBGzOAZTHi

— Peter Brandt (@PeterLBrandt) November 18, 2024

Solana’s surge has also enabled it to surpass Binance Coin (BNB) in market capitalization, cementing its position as the fourth-largest cryptocurrency. This confirms its position as one of the most powerful players in the industry, putting it on course to compete with other important assets, such as the stablecoin USDT.

The Road Ahead For Solana

However, Solana seems to be poised to continue upward momentum in the future. Solana is very well positioned for future growth thanks to great performance in the DeFi sector, favorable price expectations, and ever-increasing market capitalization. If it is able to maintain the level of performance at present and attract even more developers and users to its ecosystem, then it play an even more important role in the blockchain world in months and years to come.

Featured image from Forbes, chart from TradingView