- Solana (SOL) has dropped 20% since closing at $252.42 on January 19, but spot inflows suggest a potential rebound.

- $16 million in spot inflows on Monday marked SOL’s first major inflow in 10 days, signaling renewed investor confidence.

- A positive Balance of Power (BoP) at 0.23 confirms increasing buying pressure.

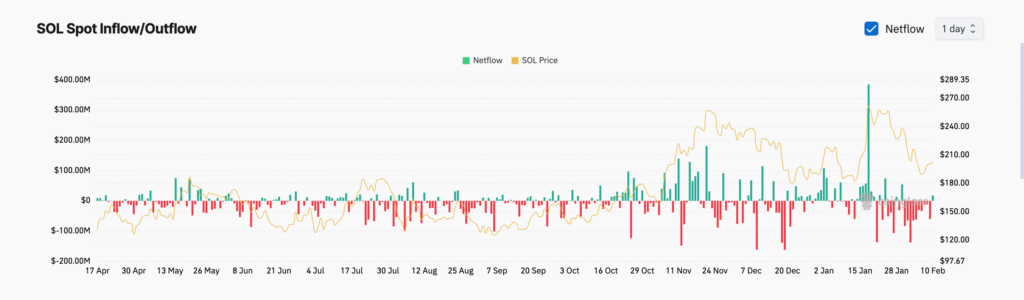

Solana (SOL) has been on a downward trend, shedding nearly 20% of its value since its January 19 close at $252.42. However, signs of a potential rebound are emerging as SOL records its first major spot inflow of the month, signaling renewed investor interest.

Solana Bulls Attempt a Comeback

According to Coinglass, SOL’s spot market inflows reached $16 million on Monday, marking its first significant inflow in 10 days. This surge in spot buying coincides with SOL’s effort to hold above the key $200 level.

SOL Spot Inflow/Outflow. Source: Coinglass

Spot inflows typically indicate increasing demand and positive market sentiment, as investors are willing to purchase the asset at current market prices. This renewed buying interest could be a sign of a potential bullish reversal.

Adding to the bullish case, SOL’s Balance of Power (BoP) has turned positive, reaching 0.23 at press time. The BoP measures the strength of buyers versus sellers, and a positive reading suggests that buyers are gaining control, potentially driving prices higher.

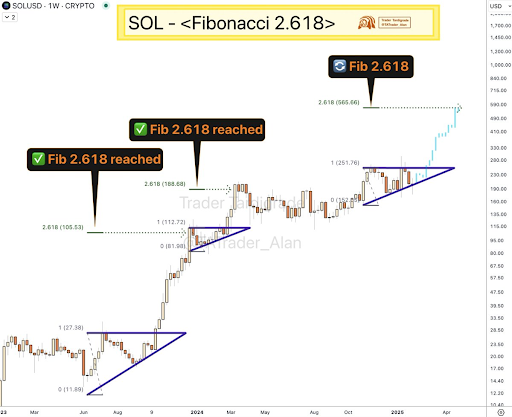

SOL Price Prediction: Key Support Holds the Key to a Rally

On the daily chart, Solana is testing a crucial support zone at the lower boundary of an ascending parallel channel that it has traded within for several months. Holding this support is essential for maintaining the current bullish momentum.

If SOL successfully defends this level, it could attract further buying interest, pushing the price toward $258.66. This would mark a full recovery from its recent losses and potentially signal the start of a new uptrend.

However, if SOL breaks below this support, it could trigger a deeper pullback, with prices potentially falling to $113.88. This would mark a significant downturn and suggest weakening investor confidence.