- Solana shifts its focus from DeFi to consumer applications.

- Differentiation and user retention are crucial for Solana’s growth.

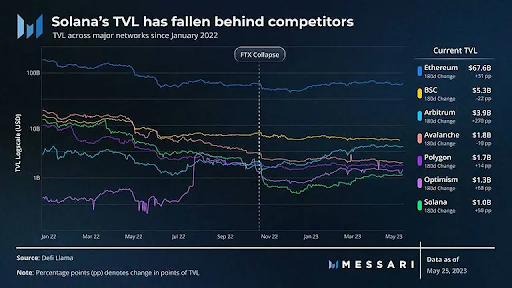

Solana’s journey presents a striking contrast in an era where decentralization dominates. Besides its initial success in Decentralized Finance (DeFi), Solana’s total value locked (TVL) saw a depreciation since the dawn of 2022.

While @Solana's TVL has depreciated since the beginning of 2022, it's important to note that TVL is primarily a measure for #DeFi protocols.

Solana's focus on consumer applications has led to a shift in user activity away from DeFi and toward consumer protocols. pic.twitter.com/eyzK44b2G5

— Messari (@MessariCrypto) June 14, 2023

Consequently, this downturn does not equate to a demise. Instead, it reflects a significant shift in Solana’s strategic focus, veering from DeFi toward consumer applications.

Solana’s TVL vs Competitors’ TVL (Source: Messari)

Significantly, this transition reflects changing user preferences. As per Messari’s report, the platform’s user activity observed a decline in DeFi applications, with a corresponding surge in consumer protocols. The key players driving this shift offer insights into Solana’s current state and illuminate its potential future.

Championing New Spaces: NFTs and Consumer Apps

Take tensor_hq, for instance. This leading NFT trading platform on Solana has made waves in the NFT community. Its innovative features, feeless trading, and unique airdrop mechanism have caught significant attention. Moreover, the rise of NFT lending platforms like SharkyFi has altered the financial dynamics surrounding NFTs on Solana, demonstrating impressive retention rates.

Additionally, Solana houses Saydialect, a messaging platform that capitalizes on the network’s NFT compression capabilities. With its high retention rates and new partnerships, Saydialect epitomizes the potential for consumer applications within Solana’s ecosystem.

Navigating the Future: Differentiation and User Retention

Solana’s journey from DeFi protocols to consumer-centric applications indicates a transformative shift in its application ecosystem. The platform’s infrastructure advantages and low unit costs position it favorably for consumer apps. However, for Solana to sustain growth and retain its competitive edge, differentiation, and user retention emerge as pivotal factors.

To sum it up, Solana’s strategy to embrace unique user experiences instead of solely focusing on DeFi protocols marks a significant evolution in the crypto landscape. With an eye on emerging consumer applications, Solana is carving a new niche in the crypto world. Time will tell how this transition shapes Solana’s future and the broader blockchain industry.