- The recent announcement by the SEC has caused a sharp drop in emerging ecosystems’ prices.

- Solana and Polygon’s market capitalization plummeted by nearly 25%.

Binance and Coinbase, the leading cryptocurrency exchanges, are facing increased regulatory pressure as the US Securities and Exchange Commission (SEC) cracks down on them. Just recently, the SEC filed a lawsuit against these global cryptocurrency giants. SEC’s filings against Binance and Coinbase shake emerging ecosystem tokens SOL and MATIC. Market capitalization of SOL and MATIC plummets by approximately 25% as a consequence.

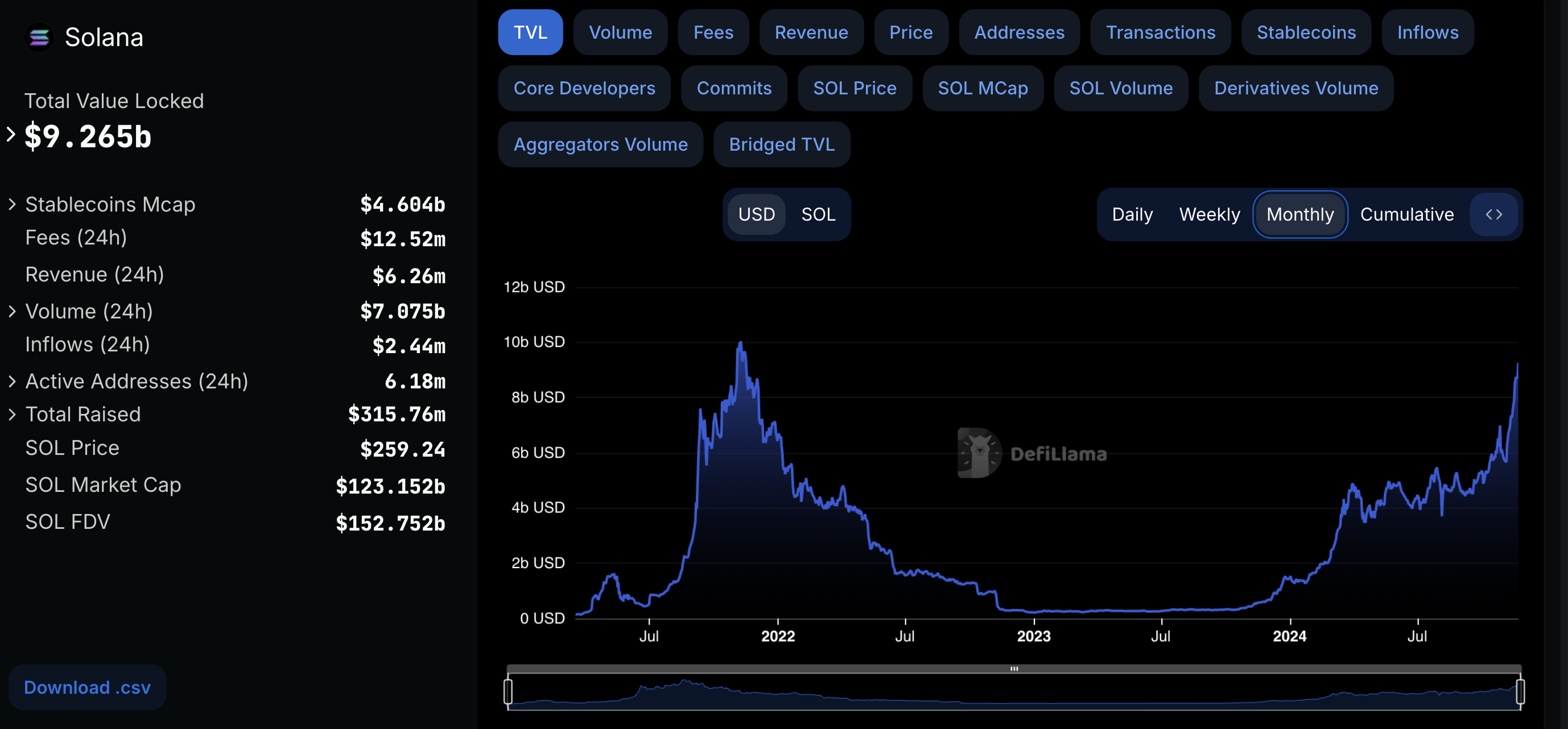

As reported by DeFiLlama, Solana’s total value locked (TVL) stood at $253.26 million on June 26th, while Polygon‘s TVL is $944.15 million. Accusations have been made against Binance and Coinbase, claiming that they operated as securities exchanges without proper registration with the SEC, thus violating legal requirements. Binance has faced additional charges, including the diversion of customer funds to an unrelated business.

The SEC has filed a lawsuit claiming that Solana, Polygon, and several other cryptocurrencies should be classified as securities. Notably, these coins, which include both established players and emerging gaming-centric projects, have significant market capitalizations in the multi-billion dollar range.

CoinMarketCap reports that, as of now, SOL is at $16.94, with a trading volume of $249,339,490 in the past hour. During the last 24 hours, SOL has seen a decline of 1.90% in its trading value. And also, MATIC is priced at $0.6623, with a 24-hour trading volume of $249,452,661. Over the past 24 hours, MATIC has shown a decrease of 1.56% in its trading value.

Highlighted Crypto News Today

Binance.US Strikes Back Against SEC: Allegations of Dishonesty