- The SEC approved Hashdex and Franklin Templeton’s Bitcoin-Ethereum ETFs.

- Hashdex’s ETF will trade on Nasdaq, and Franklin’s on Cboe BZX.

The United States Securities and Exchange Commission (SEC) has approved two groundbreaking crypto exchange-traded funds (ETFs). These include the Hashdex Nasdaq Crypto Index US ETF and the Franklin Crypto Index ETF. The decision marks the first time ETFs combining spot Bitcoin and Ethereum have received regulatory clearance.

SEC has *approved* both the Hashdex Nasdaq Crypto Index US ETF & Franklin Crypto Index ETF…

Will initially hold both btc & eth. pic.twitter.com/5GUhhhXL7y

— Nate Geraci (@NateGeraci) December 19, 2024

Hashdex’s ETF will trade on the Nasdaq, while Franklin Templeton’s product will launch on the Cboe BZX Exchange. Both ETFs will allocate holdings based on the free-float market capitalizations of Bitcoin and Ethereum. This innovative approach diversifies investment exposure, reducing risk compared to single-asset funds.

The SEC’s decision reflects growing regulatory comfort with hybrid crypto products. The agency emphasized compliance with commodity-based trust standards and surveillance-sharing agreements. These measures aim to detect and prevent fraud while ensuring investor protection. The ETFs align closely with previously approved single-asset crypto ETPs, meeting criteria under the Exchange Act.

ETFs Tackle Volatility with Secure Investment

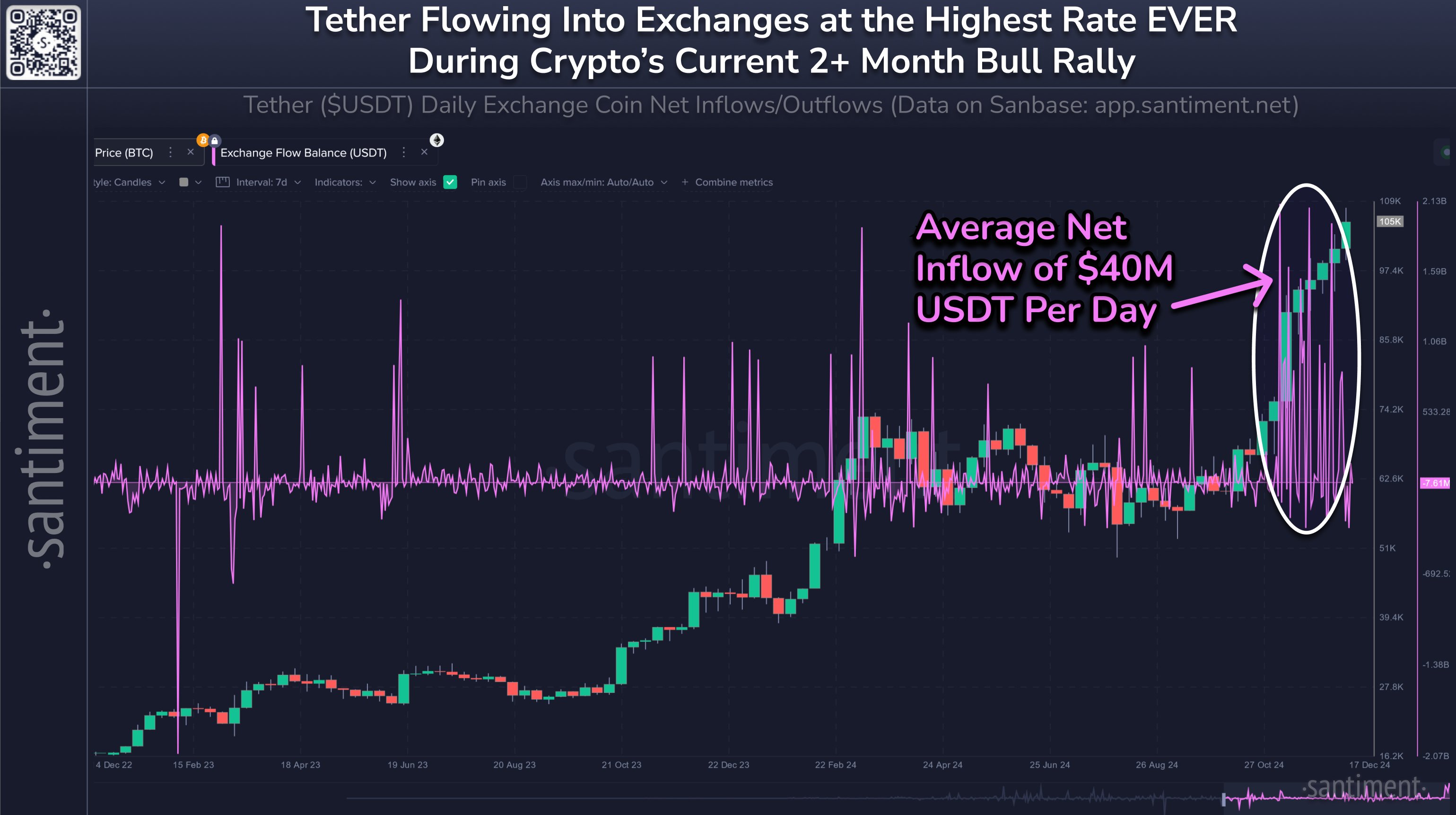

Recent market volatility adds significance to this approval. Bitcoin’s price dropped below $96,000, and Ethereum fell to $3,440, highlighting the importance of regulated investment options. The funds provide institutional and retail investors with a secure pathway to participate in cryptocurrency.

The ETFs must adhere to strict operational guidelines. They will maintain transparency in portfolio holdings and pricing, updating intraday indicative values every 15 seconds. Both exchanges will monitor compliance and can delist the funds if they breach regulations. These safeguards enhance trust and stability in the crypto market.

Industry analysts predict high demand for these ETFs. Nate Geraci, president of The ETF Store, noted their potential to attract advisors seeking diversified crypto exposure. Bloomberg analysts expect the funds to launch in January, featuring an 80% Bitcoin and 20% Ethereum split. This ratio mirrors current market trends, ensuring balanced exposure.

The approval could pave the way for similar products in the future. Other cryptocurrencies like Litecoin might become candidates for ETFs. However, regulatory uncertainty still surrounds assets like Solana and XRP. A leadership change at the SEC in 2025 could further shape the crypto ETF landscape.

Highlighted Crypto News Today

Ordeez is Reshaping the NFT Landscape with Ordinal Derivatives