According to Bloomberg, in a key development for the cryptocurrency industry, the US Securities and Exchange Commission (SEC) is reportedly set to allow the launch of exchange-traded funds (ETFs) based on Ethereum (ETH) futures.

This move marks a significant win for numerous firms that have long sought to introduce such products. While the SEC has previously hesitated to approve ETFs directly tied to cryptocurrencies, the decision to greenlight an Ethereum futures ETF could have profound implications for Ethereum’s classification as a non-security.

This development also holds potential ramifications for other cryptocurrencies, as the SEC’s stance on where the line between security and non-security lies becomes a subject of litigation.

According to Bloomberg’s report, sources familiar with the matter claim the SEC is unlikely to block the ETFs based on futures contracts for Ethereum, which is currently the second-largest cryptocurrency by market capitalization.

Nearly a dozen companies, including prominent names like Volatility Shares, Bitwise, Roundhill, and ProShares, have filed applications to launch these ETFs. While it remains unclear which funds will receive approval, insiders suggest that several may be granted the green light as early as October.

This anticipated approval of an Ethereum futures ETF by the SEC could have far-reaching implications for the regulatory treatment of cryptocurrencies.

The SEC’s reluctance to approve ETFs directly tied to cryptocurrencies has spurred speculation that derivative-based products would offer a potential pathway to market access.

On this matter, crypto analyst Adam Cochran has highlighted that the SEC potentially approving an ETF based on Ethereum futures contracts implicitly acknowledges that Ethereum itself is not considered a security.

This decision challenges the notion that Ethereum should be regulated as a traditional financial security, considering its proof-of-stake mechanism, purpose, and usage.

Cochran further believes that the SEC’s approval of an Ethereum futures ETF bolsters Ethereum’s non-security status and sets a precedent that could impact other cryptocurrencies facing regulatory scrutiny.

The ongoing legal battle between the SEC and Grayscale Investments over rejecting their Bitcoin trust’s conversion into an ETF highlights the agency’s concerns regarding investor protection, manipulation risks, and price volatility.

However, this approval could provide a compelling argument in favor of distinguishing between the underlying asset and how it is sold, bolstering the Torres Doctrine and potentially influencing the outcome of similar cases, such as the XRP appeal.

The SEC’s approval of an Ethereum futures ETF holds tremendous significance for the cryptocurrency industry. If confirmed, it would mark a pivotal moment for Ethereum’s classification as a non-security, further solidifying its position as a commodity or currency.

The decision also highlights the regulatory challenge of defining clear boundaries between securities and non-securities in crypto.

As the industry evolves, approving an Ethereum futures ETF could shape the regulatory landscape, paving the way for increased adoption and investment opportunities in the cryptocurrency market.

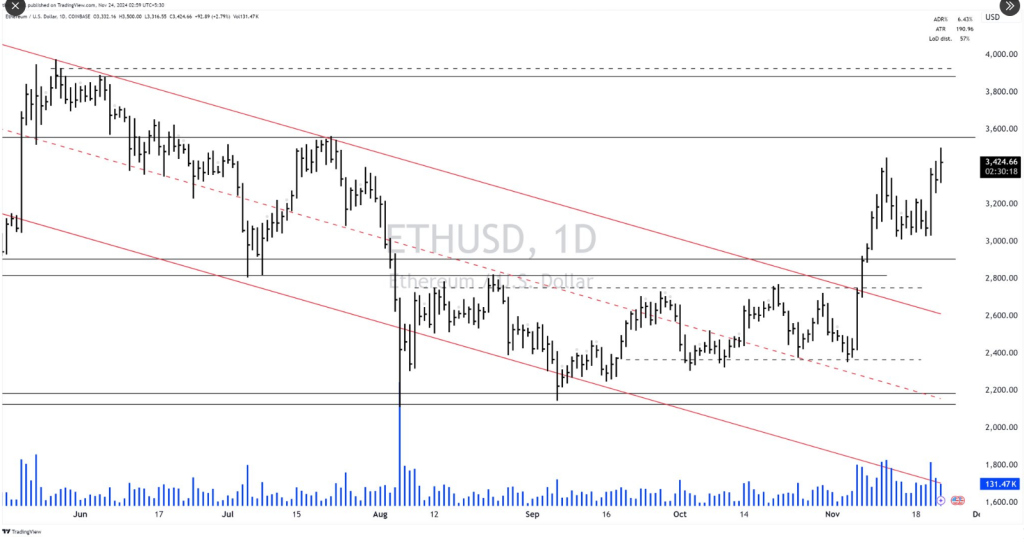

However, the news is not entirely favorable for ETH as it trades at $1,660, following a downward trend similar to Bitcoin and the overall cryptocurrency market. The market has experienced a substantial outflow of liquidity, leading to a significant decline in most digital currencies.

Over the past 24 hours, ETH has declined more than 4% after breaking its previously established range between $1,895 and $1,830. Additionally, it has suffered a notable loss of 10% within the seven-day timeframe.

Featured image from iStock, chart from TradingView.com

This move marks a significant win for numerous firms that have long sought to introduce such products. While the SEC has previously hesitated to approve ETFs directly tied to cryptocurrencies, the decision to greenlight an Ethereum futures ETF could have profound implications for Ethereum’s classification as a non-security.

This development also holds potential ramifications for other cryptocurrencies, as the SEC’s stance on where the line between security and non-security lies becomes a subject of litigation.

Ethereum Paradigm Shift

According to Bloomberg’s report, sources familiar with the matter claim the SEC is unlikely to block the ETFs based on futures contracts for Ethereum, which is currently the second-largest cryptocurrency by market capitalization.

Nearly a dozen companies, including prominent names like Volatility Shares, Bitwise, Roundhill, and ProShares, have filed applications to launch these ETFs. While it remains unclear which funds will receive approval, insiders suggest that several may be granted the green light as early as October.

This anticipated approval of an Ethereum futures ETF by the SEC could have far-reaching implications for the regulatory treatment of cryptocurrencies.

The SEC’s reluctance to approve ETFs directly tied to cryptocurrencies has spurred speculation that derivative-based products would offer a potential pathway to market access.

On this matter, crypto analyst Adam Cochran has highlighted that the SEC potentially approving an ETF based on Ethereum futures contracts implicitly acknowledges that Ethereum itself is not considered a security.

This decision challenges the notion that Ethereum should be regulated as a traditional financial security, considering its proof-of-stake mechanism, purpose, and usage.

Cochran further believes that the SEC’s approval of an Ethereum futures ETF bolsters Ethereum’s non-security status and sets a precedent that could impact other cryptocurrencies facing regulatory scrutiny.

The ongoing legal battle between the SEC and Grayscale Investments over rejecting their Bitcoin trust’s conversion into an ETF highlights the agency’s concerns regarding investor protection, manipulation risks, and price volatility.

However, this approval could provide a compelling argument in favor of distinguishing between the underlying asset and how it is sold, bolstering the Torres Doctrine and potentially influencing the outcome of similar cases, such as the XRP appeal.

The SEC’s approval of an Ethereum futures ETF holds tremendous significance for the cryptocurrency industry. If confirmed, it would mark a pivotal moment for Ethereum’s classification as a non-security, further solidifying its position as a commodity or currency.

The decision also highlights the regulatory challenge of defining clear boundaries between securities and non-securities in crypto.

As the industry evolves, approving an Ethereum futures ETF could shape the regulatory landscape, paving the way for increased adoption and investment opportunities in the cryptocurrency market.

However, the news is not entirely favorable for ETH as it trades at $1,660, following a downward trend similar to Bitcoin and the overall cryptocurrency market. The market has experienced a substantial outflow of liquidity, leading to a significant decline in most digital currencies.

Over the past 24 hours, ETH has declined more than 4% after breaking its previously established range between $1,895 and $1,830. Additionally, it has suffered a notable loss of 10% within the seven-day timeframe.

Featured image from iStock, chart from TradingView.com