- The CLO asked the soon-to-be Trump administration to fix the problems caused by William “Bill” Hinman.

- The new crypto-friendly chair of the SEC, Paul Atkins, must first focus on rebuilding confidence.

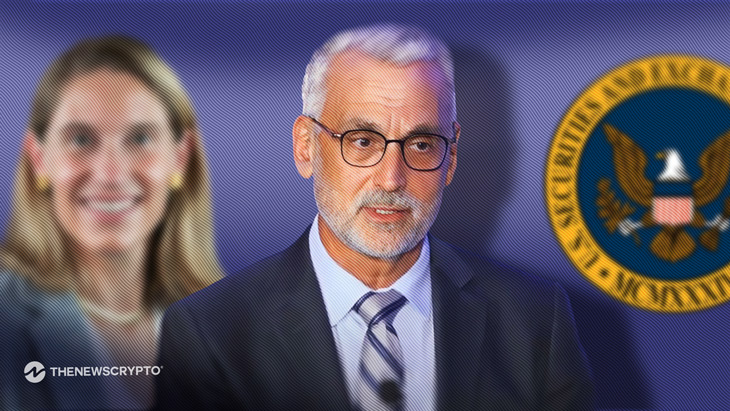

Stuart Alderoty, chief legal officer of Ripple, has openly demanded the termination of SEC v. Ripple on the fourth anniversary of the case. In addition, he asked the soon-to-be Trump administration to fix the problems caused by William “Bill” Hinman, a former SEC official who made misleading regulatory claims that benefited some while confusing the sector as a whole.

As the Ripple vs. SEC litigation entered its fourth anniversary, Stuart Alderoty made a post on X. On behalf of Ripple, its CEO Brad Garlinghouse, and co-founder Chris Larsen, he demanded that the US SEC’s “lawless lawsuit” against them be dropped.

Lot of Work to Fix the Harm

Alderoty pleaded with the incoming Trump administration to “cleanse the lingering stain of Hinman from the agency” on behalf of Ripple and its management. Note that the crypto sector was greatly affected by William “Bill” Hinman’s regulatory pronouncements. Along with confusing and clarifying the industry and authorities, Hinman’s emails and speeches have had mixed results. Since then, there have been conflicts of interest, most notably in the case of Ripple vs. SEC.

Stuart Alderoty, CLO of Ripple, said that the Trump government has a lot of work to do to fix the harm. The new crypto-friendly chair of the SEC, Paul Atkins, must first focus on rebuilding confidence. Justices in the United States found the SEC to have behaved “arbitrarily and capriciously” after it abandoned its commitment to upholding the law. Crypto industry participants felt the agency was too regulatory and too aggressive in its enforcement.

On or before January 15, the agency is required to submit its opening brief in the Ripple vs. SEC case. This is happening exactly five days before Gary Gensler’s scheduled resignation as chair of the SEC.

Highlighted Crypto News Today:

Pavel Durov’s Telegram Achieves Profitability with $1B Revenue in 2024