Layer 3 Orbs announced that QuickSwap, the top multi-chain DEX, has integrated its Liquidity Hub. In order to improve pricing on QuickSwap, the integration will use Orbs technology to aggregate Ethereum liquidity.

QuickSwap will obtain all of the liquidity for its DEX from Orbs Liquidity Hub in order to enable its expansion to Ethereum. This will allow QuickSwap to provide competitive pricing by using Orbs-sourced on-chain and off-chain liquidity.

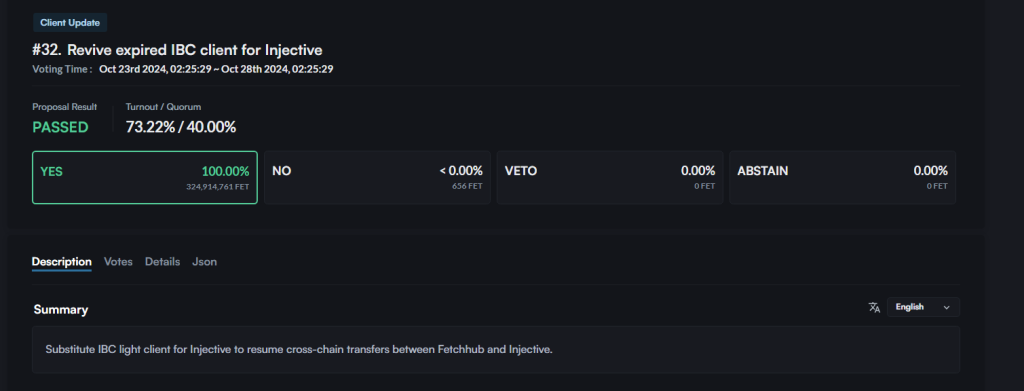

After a governance vote that largely supported the proposal, QuickSwap’s plan to use Orbs technology and extend to Ethereum was authorized. After being included by several DEXs running on different chains, Orbs Liquidity Hub has emerged as the industry standard for liquidity aggregation.

Third-party solvers compete to complete a DEX order that is routed via Liquidity Hub by using onchain liquidity, such as AMM pools or their own private inventory. Professional traders like market makers may place bids and compete to fill swaps since orders are also available via API.

This is accomplished via the Liquidity Hub through the use of an off-chain and on-chain network of solvers that compete to identify the most effective liquidity for traders. This covers integrations with various platforms, such as Odos and ParaSwap.

Two flagship Orbs protocols for advanced trading orders, dTWAP and dLIMIT on Polygon, have already been integrated by QuickSwap. To lessen the impact on prices, they enable DEX traders to issue DCA orders and divide big transactions into smaller orders. The choice of QuickSwap to include Liquidity Hub for managing all Ethereum swaps was bolstered by the success of these products.

Orbs Liquidity Hub’s integration will help QuickSwap achieve its objective of being a multi-chain DEX that offers top-notch trading experiences across a variety of L1 and L2 networks. In addition to expanding its user base and improving the liquidity accessible to users across the multi-chain ecosystem, this will enable QuickSwap to further solidify its position as the most capital-efficient DEX.