Polygon (MATIC) has entered a phase of consolidation, hovering just above the crucial $0.50 mark. The coin’s recent retracement to June lows has garnered significant attention from bullish investors, even as the broader crypto market remains hounded by uncertainties and price plunges.

With the cryptocurrency market experiencing a notable downturn over the past week, Polygon’s native token, MATIC, has not escaped unscathed.

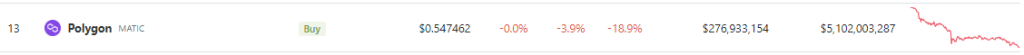

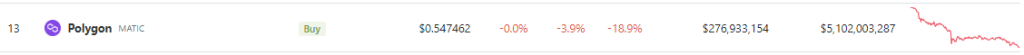

The token’s value has witnessed a decline of nearly 19% over the span of seven days, further amplified by a 4% drop in the last 24 hours alone. The current CoinGecko-listed price stands at $0.547.

The present state of MATIC at $0.54 marks its lowest valuation this year, with year-to-date lows just shy of the June benchmark of $0.59.

The recent downturn is closely linked to the broader market crash, during which Bitcoin suffered a plunge to $26,000, triggering nearly $2 billion in liquidations.

Technical indicators echo the prevailing bearish sentiment surrounding MATIC. The Relative Strength Index (RSI) notably retreated to the oversold territory on August 17th and continues to linger there. This persistent oversold condition underscores the ongoing selling pressure that has yet to abate.

Similarly, the Chaikin Money Flow (CMF) has maintained a position below zero, indicating a subdued influx of capital. This trend accentuates the bearish outlook for MATIC in the spot market.

Despite its recent dip, MATIC encountered a measure of stabilization at the bullish order block (OB) situated above the $0.50 level.

Notably, this level aligns with the June lows, which have historically facilitated successful rebounds upon retesting. This downturn has visibly impacted investors, leading to growing losses in their portfolios.

However, the overall strength of Bitcoin—whose performance has been lackluster—might potentially hinder MATIC’s ability to stage a robust recovery.

As the crypto market grapples with its recent setbacks, the fate of MATIC remains entwined with the broader industry trends.

Investors are keenly watching for signs of a substantial reversal in MATIC’s fortunes, gauging whether it can successfully break free from the gravitational pull of the current market downtrend.

In the midst of this challenging environment, MATIC enthusiasts and market analysts alike are closely monitoring the coin’s technical indicators and its ability to hold above the critical support level of $0.50. Only time will tell whether Polygon’s MATIC can weather the storm and reclaim its upward trajectory.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Cointribune

With the cryptocurrency market experiencing a notable downturn over the past week, Polygon’s native token, MATIC, has not escaped unscathed.

The token’s value has witnessed a decline of nearly 19% over the span of seven days, further amplified by a 4% drop in the last 24 hours alone. The current CoinGecko-listed price stands at $0.547.

The present state of MATIC at $0.54 marks its lowest valuation this year, with year-to-date lows just shy of the June benchmark of $0.59.

The recent downturn is closely linked to the broader market crash, during which Bitcoin suffered a plunge to $26,000, triggering nearly $2 billion in liquidations.

Technical Indicators Signal Caution For MATIC

Technical indicators echo the prevailing bearish sentiment surrounding MATIC. The Relative Strength Index (RSI) notably retreated to the oversold territory on August 17th and continues to linger there. This persistent oversold condition underscores the ongoing selling pressure that has yet to abate.

Similarly, the Chaikin Money Flow (CMF) has maintained a position below zero, indicating a subdued influx of capital. This trend accentuates the bearish outlook for MATIC in the spot market.

Navigating The Road Ahead For Polygon

Despite its recent dip, MATIC encountered a measure of stabilization at the bullish order block (OB) situated above the $0.50 level.

Notably, this level aligns with the June lows, which have historically facilitated successful rebounds upon retesting. This downturn has visibly impacted investors, leading to growing losses in their portfolios.

However, the overall strength of Bitcoin—whose performance has been lackluster—might potentially hinder MATIC’s ability to stage a robust recovery.

MATIC seven-day price action. Source: CoinMarketCap

As the crypto market grapples with its recent setbacks, the fate of MATIC remains entwined with the broader industry trends.

Investors are keenly watching for signs of a substantial reversal in MATIC’s fortunes, gauging whether it can successfully break free from the gravitational pull of the current market downtrend.

In the midst of this challenging environment, MATIC enthusiasts and market analysts alike are closely monitoring the coin’s technical indicators and its ability to hold above the critical support level of $0.50. Only time will tell whether Polygon’s MATIC can weather the storm and reclaim its upward trajectory.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Cointribune