Polkadot is among the top blockchains, securing a spot in the top 20. Even though the platform promotes blockchain interoperability, a feature needed in the age of increasing fragmentation, DOT prices have failed to inspire bulls.

This state of affairs on price charts reflects the general trend across the board, especially in leading smart contract platforms like Ethereum and Solana.

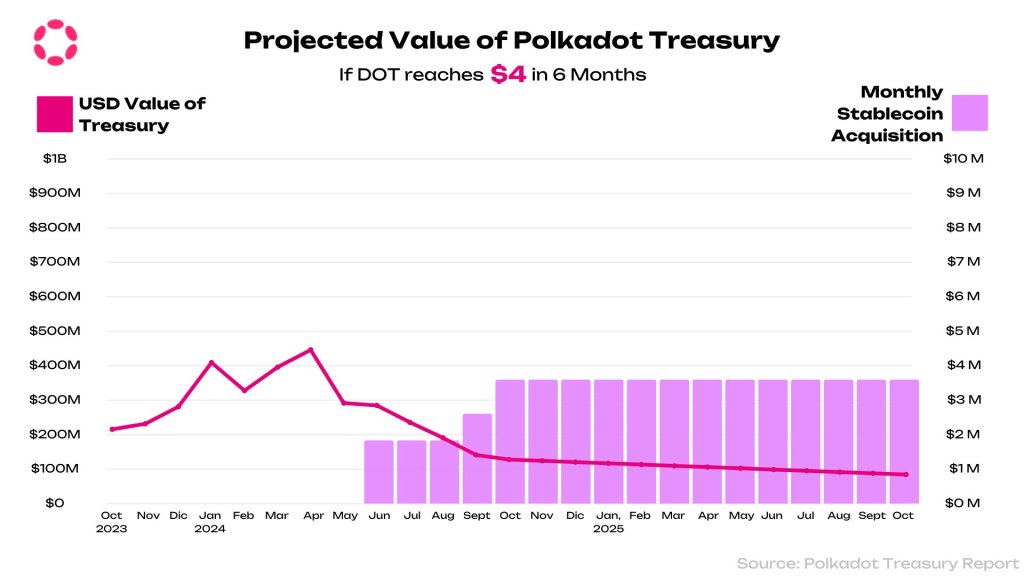

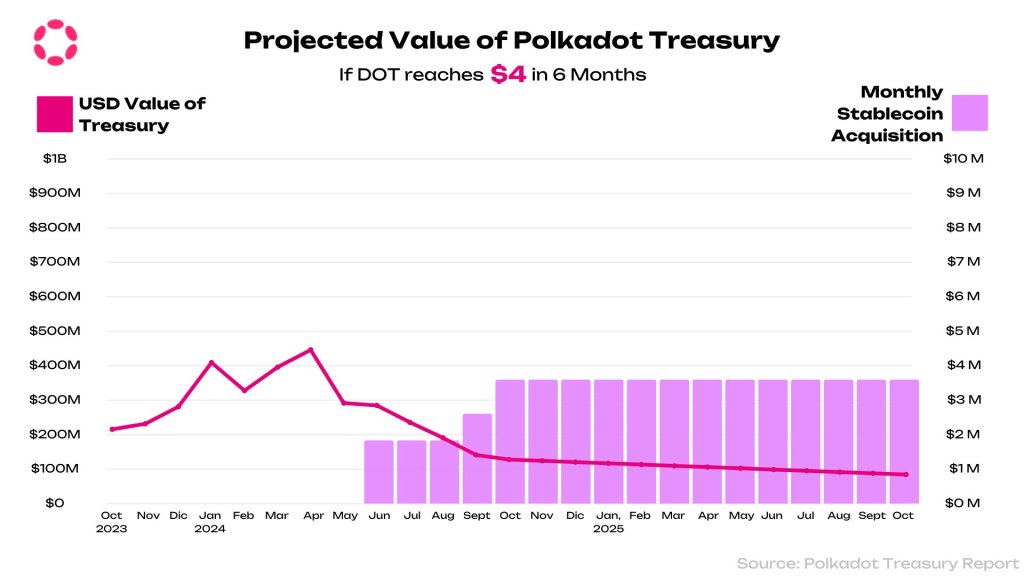

Unyielding bears have been forcing prices lower over the months since DOT rose to around $10 in Q1 2024, depleting the Polkadot Treasury Reserves.

In early November, one observer on X said they stood at all-time lows. However, it could get worse for Polkadot should the bears of Q3 2024 flow back, forcing prices below local support levels.

The daily chart shows that DOT has critical support at around $3.8. This level marks September and October lows. On the other hand, the coin is facing strong liquidation pressure at $4.6 and $5.

As the coin ranges, the direction of the breakout could shape the short—to medium-term trend but also impact the Polkadot Treasury.

A lot depends on whether DOT prices will recover, which will, in turn, help the Polkadot Treasury reserves recover. Technically, prices play a big role. When bulls take over, the reserve, denominated in DOT, increases in USD terms, easing pressure on the team.

To further increase inflows into the Treasury Reserves, the Polkadot community passed a policy to reduce inflation. Specifically, the community voted to drop DOT annual inflation from 10% to 8%.

With low inflation and sustained on-chain demand, DOT prices may find support. Additionally, 15% of staking rewards distributed from stakers will be moved to the Treasury.

The analyst predicts these changes could boost the Treasury by adding 1.5 million DOT. This will be the much-needed infusion of funds that may increase the Treasury Reserves after months of low income.

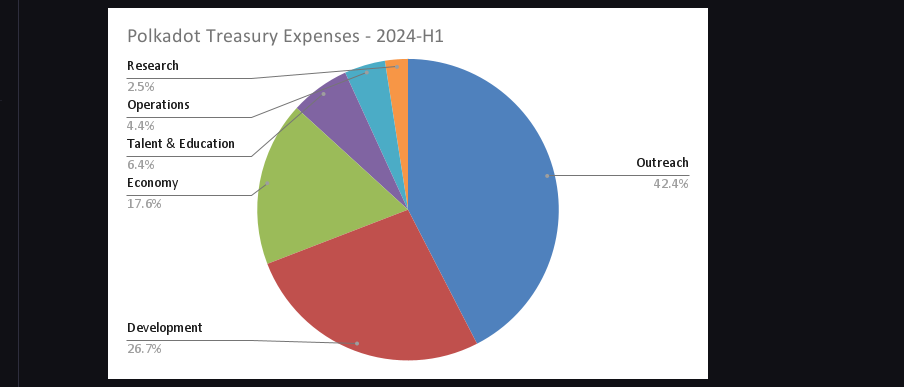

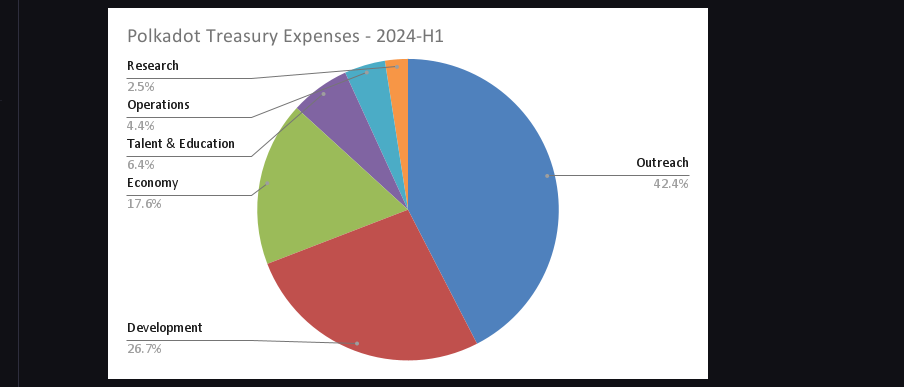

The team could build better and even strike quality partnerships, improving the blockchain’s ecosystem. Based on H1 2024 data, the team spent most on outreach, while nearly 27% went to development.

The rest was split between funding research, operations, talent, and the economy. Given the valuation in the year’s first half, they spent $87 million, or around 11 million DOT, in total.

This state of affairs on price charts reflects the general trend across the board, especially in leading smart contract platforms like Ethereum and Solana.

Polkadot Treasury Reserves Down To All-Time Lows

Unyielding bears have been forcing prices lower over the months since DOT rose to around $10 in Q1 2024, depleting the Polkadot Treasury Reserves.

In early November, one observer on X said they stood at all-time lows. However, it could get worse for Polkadot should the bears of Q3 2024 flow back, forcing prices below local support levels.

The daily chart shows that DOT has critical support at around $3.8. This level marks September and October lows. On the other hand, the coin is facing strong liquidation pressure at $4.6 and $5.

As the coin ranges, the direction of the breakout could shape the short—to medium-term trend but also impact the Polkadot Treasury.

A lot depends on whether DOT prices will recover, which will, in turn, help the Polkadot Treasury reserves recover. Technically, prices play a big role. When bulls take over, the reserve, denominated in DOT, increases in USD terms, easing pressure on the team.

Policy Intervention To Boost Funds

To further increase inflows into the Treasury Reserves, the Polkadot community passed a policy to reduce inflation. Specifically, the community voted to drop DOT annual inflation from 10% to 8%.

With low inflation and sustained on-chain demand, DOT prices may find support. Additionally, 15% of staking rewards distributed from stakers will be moved to the Treasury.

The analyst predicts these changes could boost the Treasury by adding 1.5 million DOT. This will be the much-needed infusion of funds that may increase the Treasury Reserves after months of low income.

The team could build better and even strike quality partnerships, improving the blockchain’s ecosystem. Based on H1 2024 data, the team spent most on outreach, while nearly 27% went to development.

The rest was split between funding research, operations, talent, and the economy. Given the valuation in the year’s first half, they spent $87 million, or around 11 million DOT, in total.