PEPE, the once-promising meme coin that garnered attention in the past quarter, suffered an unforeseen blow on Thursday as it succumbed to the grip of FUD (fear, uncertainty, and doubt). Despite making waves in recent months, PEPE’s momentum fizzled out by August, exacerbated by a wave of negative sentiment that battered the altcoin.

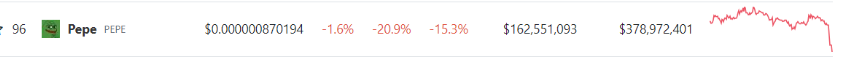

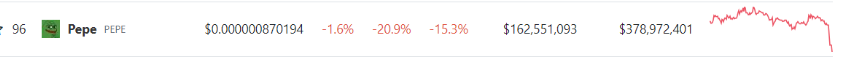

The current price of PEPE stands at a mere $0.000000870194 according to CoinGecko, sustaining a 21% slump in the last 24 hours alone. Over the span of seven days, the meme coin incurred losses of 15.3%, signaling a distressing trend for its holders.

The root of this downturn traces back to recent alterations in PEPE’s multisig wallet, coupled with newfound token transfers that ignited a prevailing fear of a potential “rug pull” orchestrated by the project’s developers.

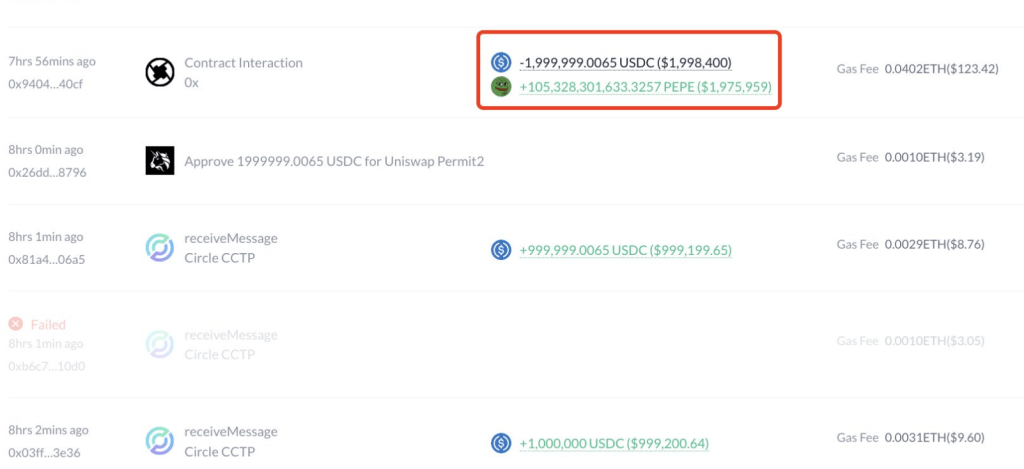

On August 24, nearly $16 million worth of Pepe tokens were transferred from the developers’ multisig wallet to various crypto exchanges, sending shockwaves throughout the community.

The tokens flowed out of the PEPE multisig wallet, directed towards addresses affiliated with notable platforms such as Binance, OXK, and Bybit.

What further exacerbated concerns was the transformation in the transaction approval process within the vault-like wallet. Previously requiring consensus from five out of eight wallets, it had inexplicably shifted to a meager two out of eight.

This unprecedented maneuver marked the first instance in which the project’s crucial multisig, responsible for safeguarding a significant portion of the token’s supply, executed such an outward transfer.

While the authenticity of the allegations remains unverified, investors swiftly leaped to conclusions, suspecting the development team of orchestrating a scam for personal gain. Contrary to this sentiment, closer analysis suggests that had foul play been intended, the transfer’s magnitude would have been substantially larger.

Nevertheless, the panic-induced sell-off rapidly gained traction, precipitating an abrupt nosedive in PEPE’s price and fostering an environment dominated by fear.

On a broader scale, the network experienced a surge in Realized Losses, reaching a three-month peak and registering the third-highest single-day losses since the token’s inception. Ultimately, investor losses tallied a staggering $14 million.

The rollercoaster journey of the PEPE meme coin, from soaring highs to a precipitous fall, underscores the impact of FUD within the volatile cryptocurrency landscape.

While the true intentions behind the wallet changes and token transfers remain shrouded in uncertainty, the incident serves as a stark reminder of the fragility inherent in meme-based tokens.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Blockcast

The current price of PEPE stands at a mere $0.000000870194 according to CoinGecko, sustaining a 21% slump in the last 24 hours alone. Over the span of seven days, the meme coin incurred losses of 15.3%, signaling a distressing trend for its holders.

Multisig Wallet Changes Fuel PEPE Rug Pull Allegations

The root of this downturn traces back to recent alterations in PEPE’s multisig wallet, coupled with newfound token transfers that ignited a prevailing fear of a potential “rug pull” orchestrated by the project’s developers.

On August 24, nearly $16 million worth of Pepe tokens were transferred from the developers’ multisig wallet to various crypto exchanges, sending shockwaves throughout the community.

1/4

1 hour ago, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of $PEPE to exchanges.

A breakdown of what we know: pic.twitter.com/bxBxp6Nzqz

— ASXN (@asxn_r) August 24, 2023

The tokens flowed out of the PEPE multisig wallet, directed towards addresses affiliated with notable platforms such as Binance, OXK, and Bybit.

What further exacerbated concerns was the transformation in the transaction approval process within the vault-like wallet. Previously requiring consensus from five out of eight wallets, it had inexplicably shifted to a meager two out of eight.

Any reason why the PEPE multisig wallet changed the threshold to just 2/8 signatures? Seems weird, this isn’t standard right?

Also, seems that some has been sent to exchanges pic.twitter.com/1DVZIOvef8

— CryptoNoddy (@Crypto_Noddy) August 24, 2023

This unprecedented maneuver marked the first instance in which the project’s crucial multisig, responsible for safeguarding a significant portion of the token’s supply, executed such an outward transfer.

Investor Reactions And Realized Losses

While the authenticity of the allegations remains unverified, investors swiftly leaped to conclusions, suspecting the development team of orchestrating a scam for personal gain. Contrary to this sentiment, closer analysis suggests that had foul play been intended, the transfer’s magnitude would have been substantially larger.

Nevertheless, the panic-induced sell-off rapidly gained traction, precipitating an abrupt nosedive in PEPE’s price and fostering an environment dominated by fear.

On a broader scale, the network experienced a surge in Realized Losses, reaching a three-month peak and registering the third-highest single-day losses since the token’s inception. Ultimately, investor losses tallied a staggering $14 million.

The rollercoaster journey of the PEPE meme coin, from soaring highs to a precipitous fall, underscores the impact of FUD within the volatile cryptocurrency landscape.

While the true intentions behind the wallet changes and token transfers remain shrouded in uncertainty, the incident serves as a stark reminder of the fragility inherent in meme-based tokens.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Blockcast