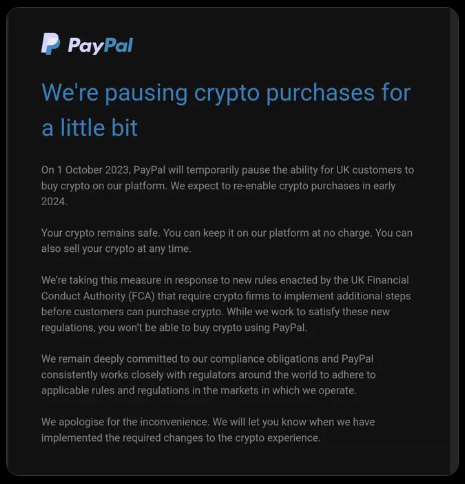

PayPal has announced a temporary suspension of cryptocurrency sales within the United Kingdom for a minimum of three months, commencing on October 1. This decision is in direct response to the recent regulatory reforms introduced by the Financial Conduct Authority, Britain’s financial regulator.

The FCA is set to implement more stringent guidelines aimed at curbing the advertising of cryptocurrencies to British consumers, which includes the mandatory inclusion of risk warnings and the discontinuation of “refer a friend” incentives.

In an email to customers, PayPal UK explained that customers who currently hold cryptocurrency in their PayPal accounts will be able to retain their holdings on the platform without incurring any fees. Furthermore, the option to sell their cryptocurrency at any time will remain available.

However, the ability to purchase cryptocurrencies using PayPal will be temporarily suspended during the company’s efforts to ensure compliance with the new regulations set forth by the FCA.

This move comes against the backdrop of the impending enforcement of the “Travel Rule” in the UK. As of September 1, 2023, all cryptocurrency firms registered under the FCA will be obligated to adhere to the Travel Rule guidelines, a series of crucial Anti-Money Laundering and Know-Your-Customer regulations established by the Financial Action Task Force (FATF).

This mandate was introduced following governmental amendments to relevant legislation in July 2022.

PayPal, which has rapidly solidified its reputation as a crypto-friendly platform, introduced a notable addition to its offerings with the launch of its PayPal USD (PYUSD) stablecoin early this month.

The company originally unveiled its foray into the cryptocurrency realm within the United States in late 2020, positioning itself as a key player in the ever-evolving landscape of financial technology.

As the financial industry grapples with the ongoing integration of cryptocurrencies, PayPal’s response to regulatory changes highlights the evolving nature of the relationship between traditional financial platforms and the burgeoning world of digital currencies.

While the company navigates these challenges, users and industry stakeholders alike are keenly observing how this temporary pause in cryptocurrency sales will shape the future of PayPal’s engagement with the crypto market within the UK.

PayPal’s decision to temporarily suspend cryptocurrency sales in response to new FCA regulations underscores the complex interplay between regulatory developments and the cryptocurrency industry.

As the company strives to align with evolving standards, the trajectory of its cryptocurrency ventures will continue to influence the broader financial landscape.

Featured image from Francois Poirier/Shutterstock.com.

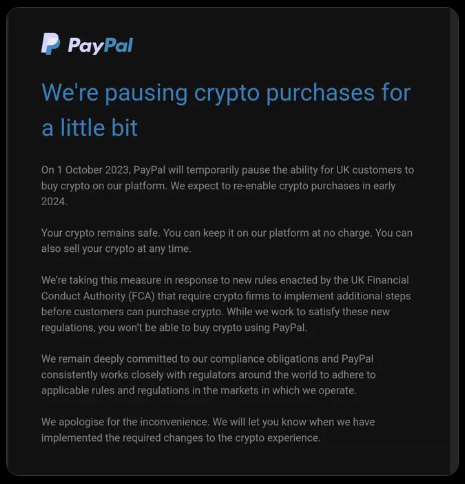

The FCA is set to implement more stringent guidelines aimed at curbing the advertising of cryptocurrencies to British consumers, which includes the mandatory inclusion of risk warnings and the discontinuation of “refer a friend” incentives.

Adapting To Regulatory Landscape

In an email to customers, PayPal UK explained that customers who currently hold cryptocurrency in their PayPal accounts will be able to retain their holdings on the platform without incurring any fees. Furthermore, the option to sell their cryptocurrency at any time will remain available.

PayPal will ‘pause’ crypto purchases in UKpic.twitter.com/NPkj7F61cC

— Crypto Crib (@Crypto_Crib_) August 16, 2023

However, the ability to purchase cryptocurrencies using PayPal will be temporarily suspended during the company’s efforts to ensure compliance with the new regulations set forth by the FCA.

This move comes against the backdrop of the impending enforcement of the “Travel Rule” in the UK. As of September 1, 2023, all cryptocurrency firms registered under the FCA will be obligated to adhere to the Travel Rule guidelines, a series of crucial Anti-Money Laundering and Know-Your-Customer regulations established by the Financial Action Task Force (FATF).

This mandate was introduced following governmental amendments to relevant legislation in July 2022.

PayPal: Foray In The Crypto Landscape

PayPal, which has rapidly solidified its reputation as a crypto-friendly platform, introduced a notable addition to its offerings with the launch of its PayPal USD (PYUSD) stablecoin early this month.

The company originally unveiled its foray into the cryptocurrency realm within the United States in late 2020, positioning itself as a key player in the ever-evolving landscape of financial technology.

As the financial industry grapples with the ongoing integration of cryptocurrencies, PayPal’s response to regulatory changes highlights the evolving nature of the relationship between traditional financial platforms and the burgeoning world of digital currencies.

While the company navigates these challenges, users and industry stakeholders alike are keenly observing how this temporary pause in cryptocurrency sales will shape the future of PayPal’s engagement with the crypto market within the UK.

PayPal’s decision to temporarily suspend cryptocurrency sales in response to new FCA regulations underscores the complex interplay between regulatory developments and the cryptocurrency industry.

As the company strives to align with evolving standards, the trajectory of its cryptocurrency ventures will continue to influence the broader financial landscape.

Featured image from Francois Poirier/Shutterstock.com.