- Chainlink is considered as the industry’s gold standard when it comes to bringing off-chain data onto the blockchain.

- This trustworthy on-chain data is beneficial to projects that are currently using ORDER.

In order to support the ORDER token, Orderly Network, a leading provider of cloud liquidity infrastructure, has announced that it has integrated with Chainlink Price Feeds on the Arbitrum mainnet. This connection will offer high-quality and secure market data straight to its ecosystem. Chainlink was chosen by Orderly Network, a leading supplier of cloud liquidity and perpetual DEX infrastructure, because of its unrivaled dependability and industry-standard infrastructure. Orderly Network processes daily trading volumes that surpass $84 million.

Creating a strong basis for the usability of ORDER and contributing to the larger DeFi ecosystem on Arbitrum is the result of the integration with Chainlink Price Feeds, which gives access to premium market data in a way that is both easy and safe. This trustworthy on-chain data is beneficial to projects that are currently using ORDER, such as Beefy Finance, Jones DAO, and Silo Finance. Additionally, it enables sustainable growth and encourages the creation of new decentralized applications.

Chainlink is generally considered to be the industry’s gold standard when it comes to the process of bringing off-chain data onto the blockchain. Because it has secured some of the most prominent names in the decentralized finance industry, its decentralized oracle network has garnered an outstanding reputation. The Chainlink Price Feeds are built to withstand challenging conditions, guaranteeing that the data they provide is accurate and reliable even during times of heavy demand.

- Data of the Highest Quality: The oracles of Chainlink collect information from the most reliable sources, so guaranteeing that we are provided with the most precise market pricing.

- Reliable Nodes: Chainlink’s network is made up of security-tested, independent nodes that are managed by top-tier teams. This ensures that the network remains reliable even when it is experiencing congestion.

- Decentralized Infrastructure: Chainlink helps us build a more secure trading environment by removing the possibility of a single point of failure.

- Transparent Performance: This means that we, along with our users, are able to quickly verify the data that is feeding our ecosystem thanks to real-time monitoring tools.

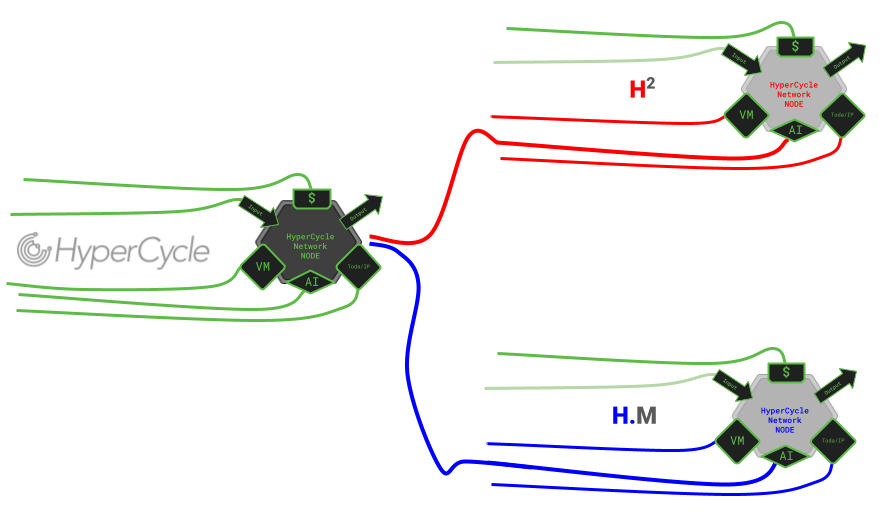

An ecosystem for unified trading that is geared for scalability is something that Orderly Network is dedicated to developing. Through the use of its orderbook-based infrastructure, it is possible to engage in frictionless perpetual futures trading. This is accomplished by combining liquidity from both EVM and non-EVM chains into a unified orderbook. By using its white-label decentralized exchange (DEX) infrastructure, Orderly Network is providing developers with the ability to build on top of its liquidity while simultaneously concentrating on providing unique trading experiences for users.

This ambition is directly supported by the integration with Chainlink Price Feeds, which ensures that all projects that use ORDER have access to data that can be relied upon. In order to supply high-quality market data with little risk, a strong oracle network was required. This is due to the fact that blockchains are fundamentally isolated from data that is collected in the real world. This need is satisfied by Chainlink, which enables Orderly Network to reliably increase its footprint inside the Arbitrum DeFi ecosystem.