Ethereum adoption is soaring, with the network just passing a critical milestone that has analysts forecasting a price recovery.

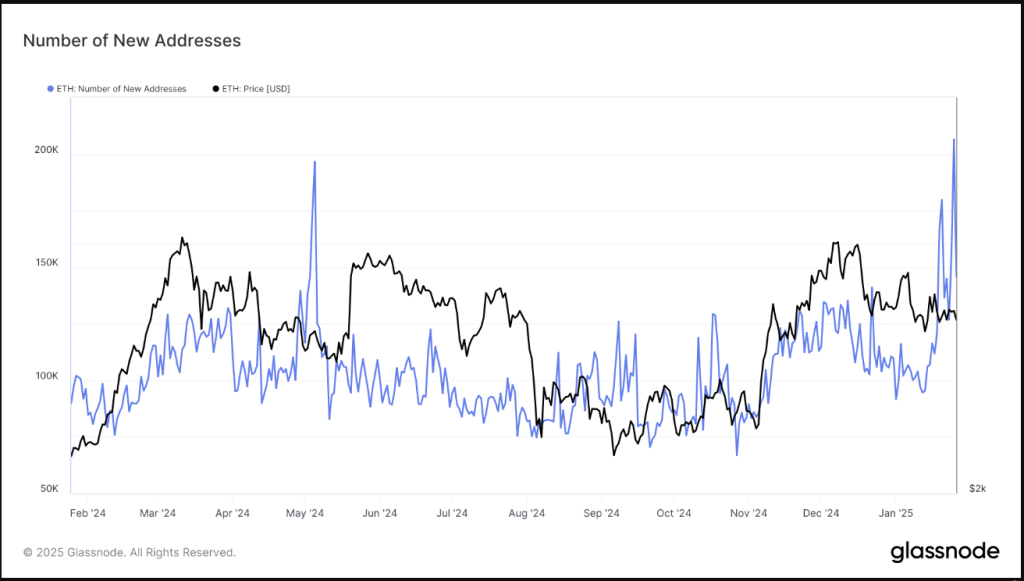

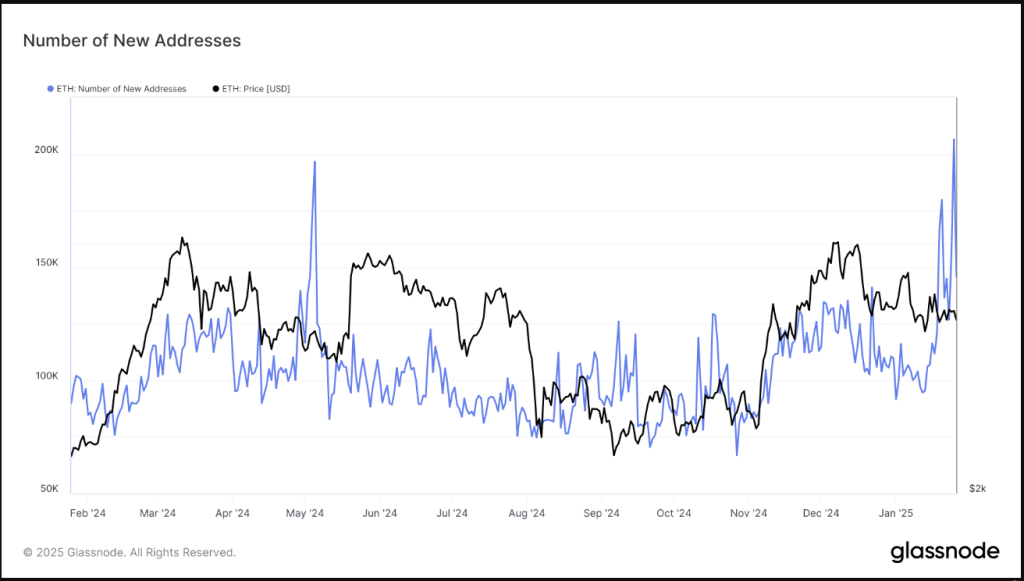

On January 24th and 25th, Ethereum experienced a rise in daily active addresses, exceeding 200,000—a number not seen since October 2022. This huge increase reflects the network’s increased engagement and importance in decentralized finance (DeFi) and non-fungible tokens (NFT), Glassnode data shows.

The increase in daily active addresses is one of the most important measures of Ethereum adoption since it demonstrates that more users are interacting with decentralized apps (dApps) and conducting DeFi transactions.

The recent increase in new Ethereum addresses shows that more people are entering the market. This may be because price changes are drawing in newcomers, even though prices have fallen recently. The increase in addresses shows past patterns seen during times of market instability and price changes, when fluctuations usually lead to more activity on the network.

Ethereum addresses with a non-zero balance have likewise steadily grown; in January 2025 they will have topped 136 million. This consistent rise—even in the face of declining prices—showcases Ethereum’s resilience and suggests that network acceptance is transcending simple speculative trading, therefore showing substantial, long-term demand in the platform.

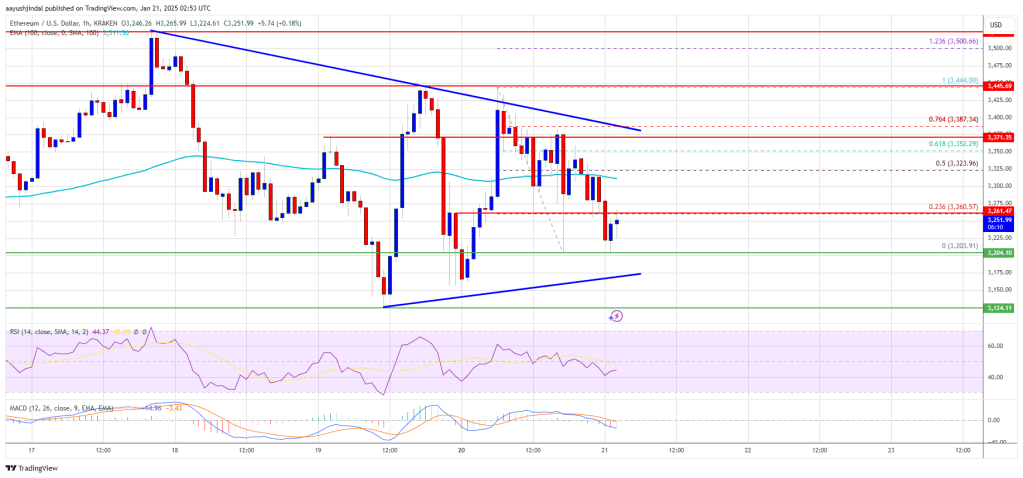

Now, the question is whether this pattern will lead to a price recovery for Ethereum, even as its use is growing. Ethereum’s price has had difficulty breaking past significant resistance levels, even if the network’s user base is expanding.

The price of ETH is still below its peak in January 2025, even with strong adoption signs. ETH was down 4.0% and 1.0% on the daily and weekly charts at $3,203 at the time of writing.

Analysts are keeping a close eye on the price movement, and some predict that as more institutional investors and individual traders look to profit from the rising demand for ETH-powered services, Ethereum’s price will rise.

On Macroeconomic Conditions & Bitcoin Price Performance

Meanwhile, macroeconomic conditions, especially Bitcoin performance and broader market mood, continue to have a significant impact on Ethereum’s price swings. The cryptocurrency market’s volatility continues to be an issue, with unexpected drops and spikes forcing traders to be hesitant.

However, if Ethereum can sustain its present acceptance trend and continue to grow its network of active users, its price may finally gain the upward impetus it has been lacking.

What Triggered The Spike?

The increase in new Ethereum addresses on January 24 and 25 is a result of rising market volatility, which attracts more users. This increase shows the growing engagement with DeFi and NFTs and suggests a future usage beyond speculative trading. The network’s operations show that consumer interest is expanding, regardless of price reduction.

Featured image from DALL-E, chart from TradingView

On January 24th and 25th, Ethereum experienced a rise in daily active addresses, exceeding 200,000—a number not seen since October 2022. This huge increase reflects the network’s increased engagement and importance in decentralized finance (DeFi) and non-fungible tokens (NFT), Glassnode data shows.

Ethereum Network Activity And User Engagement

The increase in daily active addresses is one of the most important measures of Ethereum adoption since it demonstrates that more users are interacting with decentralized apps (dApps) and conducting DeFi transactions.

The recent increase in new Ethereum addresses shows that more people are entering the market. This may be because price changes are drawing in newcomers, even though prices have fallen recently. The increase in addresses shows past patterns seen during times of market instability and price changes, when fluctuations usually lead to more activity on the network.

Ethereum addresses with a non-zero balance have likewise steadily grown; in January 2025 they will have topped 136 million. This consistent rise—even in the face of declining prices—showcases Ethereum’s resilience and suggests that network acceptance is transcending simple speculative trading, therefore showing substantial, long-term demand in the platform.

Price Recovery And Market Volatility

Now, the question is whether this pattern will lead to a price recovery for Ethereum, even as its use is growing. Ethereum’s price has had difficulty breaking past significant resistance levels, even if the network’s user base is expanding.

The price of ETH is still below its peak in January 2025, even with strong adoption signs. ETH was down 4.0% and 1.0% on the daily and weekly charts at $3,203 at the time of writing.

Analysts are keeping a close eye on the price movement, and some predict that as more institutional investors and individual traders look to profit from the rising demand for ETH-powered services, Ethereum’s price will rise.

On Macroeconomic Conditions & Bitcoin Price Performance

Meanwhile, macroeconomic conditions, especially Bitcoin performance and broader market mood, continue to have a significant impact on Ethereum’s price swings. The cryptocurrency market’s volatility continues to be an issue, with unexpected drops and spikes forcing traders to be hesitant.

However, if Ethereum can sustain its present acceptance trend and continue to grow its network of active users, its price may finally gain the upward impetus it has been lacking.

What Triggered The Spike?

The increase in new Ethereum addresses on January 24 and 25 is a result of rising market volatility, which attracts more users. This increase shows the growing engagement with DeFi and NFTs and suggests a future usage beyond speculative trading. The network’s operations show that consumer interest is expanding, regardless of price reduction.

Featured image from DALL-E, chart from TradingView