- Microsoft shareholders to vote on Bitcoin investment proposal in December.

- Board opposes proposal, cites ongoing asset evaluations including Bitcoin.

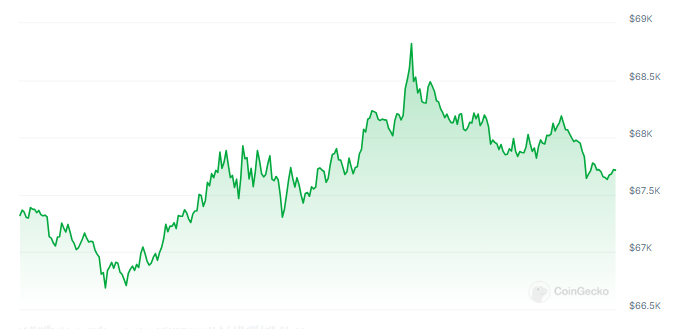

Microsoft shareholders will soon decide whether the company should publicly assess the potential of adding Bitcoin to its balance sheet. An October 24 filing with the U.S. Securities and Exchange Commission (SEC) reveals the proposal, named “Assessment of Investing in Bitcoin,” will be presented for a vote on December 10.

The proposal was put forward by the National Center for Public Policy Research (NCPPR), a conservative think tank, which cited the example of MicroStrategy—a company that has integrated Bitcoin as a key part of its business strategy. According to NCPPR, MicroStrategy’s Bitcoin-driven approach has reportedly outperformed Microsoft by over 300% this year. The NCPPR argues that Bitcoin could offer benefits as a hedge against inflation and declining bond yields, suggesting that even a modest allocation, such as 1% of Microsoft’s assets, might offer potential advantages.

However, Microsoft’s board of directors recommends that shareholders vote against the proposal, citing ongoing internal evaluations of various investable assets, including Bitcoin.

AI Takes Priority as Microsoft Reassesses Blockchain Focus

In its opposition statement, the board noted, “Past evaluations have included Bitcoin and other cryptocurrencies among the options considered, and Microsoft continues to monitor trends and developments related to cryptocurrencies to inform future decision-making.” The company emphasized that it already assesses a wide array of assets and sees no need to publicly announce Bitcoin investment considerations.

Microsoft has previously interacted with Bitcoin, notably accepting it for online Xbox store payments between 2014 and 2018. However, the tech giant has since focused more on artificial intelligence technologies than on blockchain and cryptocurrency developments.

The December 10 meeting will feature votes on other corporate matters, including governance policies, executive compensation, and board member elections. The proposal reflects a broader trend of increasing interest in cryptocurrency among corporations, amid rising institutional adoption of digital assets.

Highlighted News Of The Day

Is XRP Ready to Break Free from These Price Barriers?