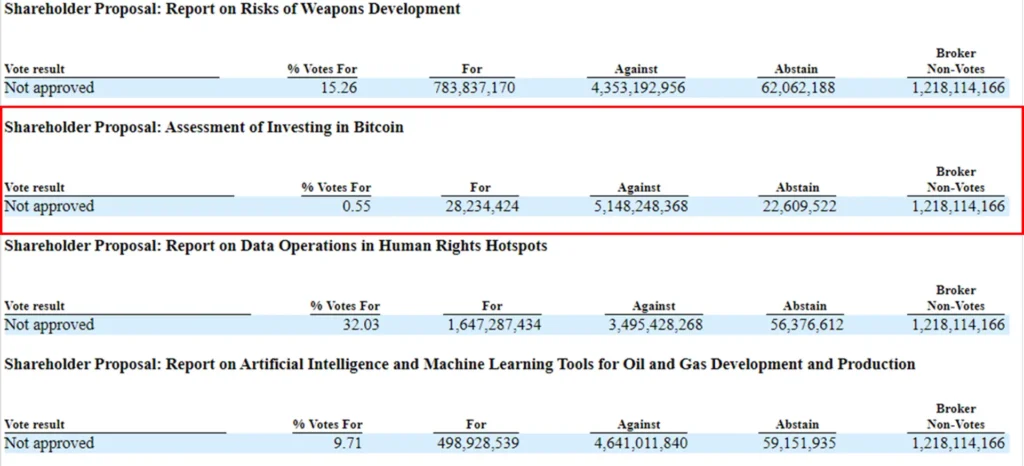

- Only 0.55% of Microsoft shareholders supported investing 1% of assets in Bitcoin, showing strong skepticism.

- Microsoft’s board opposed Bitcoin investments, citing its volatility and prioritizing stable financial strategies.

- The rejection shows that many companies are still hesitant to adopt cryptocurrencies, despite efforts to promote them.

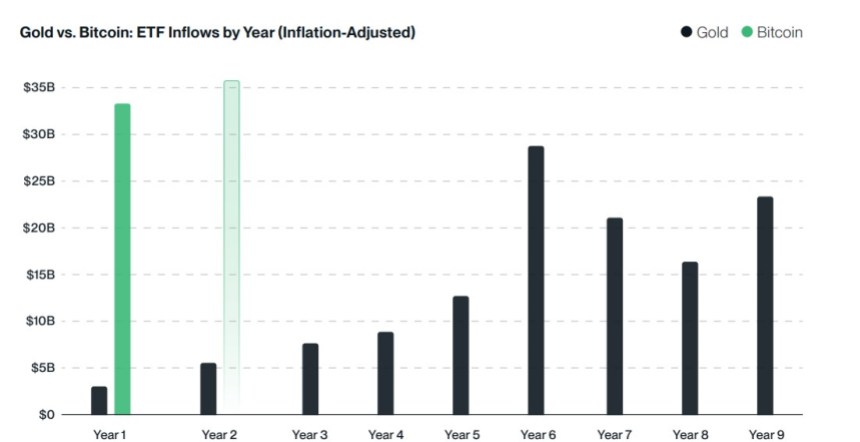

Microsoft’s recent shareholder meeting about cryptocurrency adoption in corporate finance. A request to allocate 1% of Microsoft’s total assets to Bitcoin (BTC) as a hedge against inflation received a 0.55% approval.

Which shows shareholders skepticism about digital assets though they have their own.

The Bitcoin Proposal

The National Center for Public Policy Research proposed that Microsoft allocate a small fraction of its massive $2.5 trillion market cap to Bitcoin. MicroStrategy’s CEO, Michael Saylor, positioning Bitcoin as a safeguard against inflation, made his case during the shareholders’ meeting, highlighting MicroStrategy’s success in BTC accumulation.

Despite his efforts, the proposal saw minimal traction, with just 28.2 million votes in favour, compared to over 5.14 billion votes against and 22.6 million abstentions. This difference underscores that Shareholders are hesitant to invest in cryptocurrency.

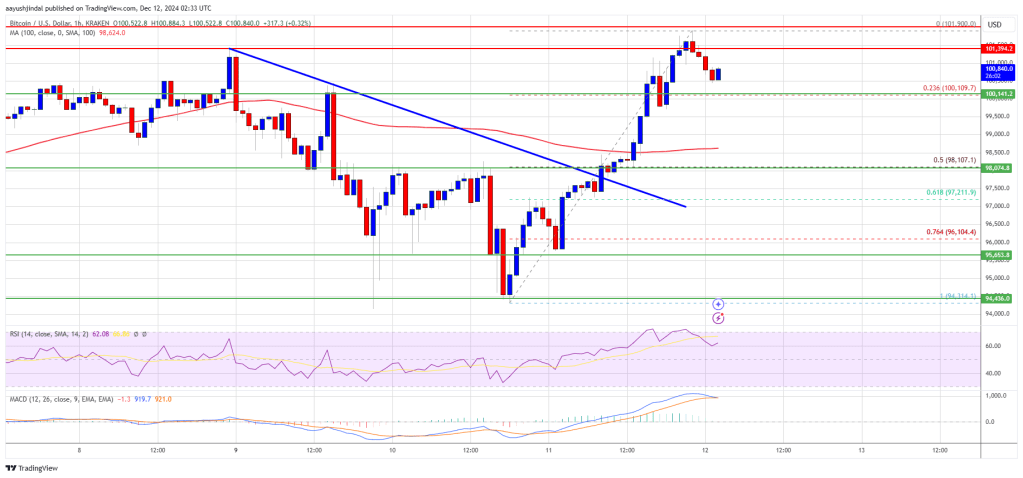

Although the proposal was rejected, Microsoft’s stock price stayed the same at $448 after the announcement. However, Bitcoin’s price dropped by 4%, falling to about $94,000 at that time. While some Bitcoin supporters may feel this was a missed opportunity, the decision shows that Microsoft is more interested in safe investments and growing its AI technology.

Microsoft’s Stance

Microsoft’s board opposed the motion, citing Bitcoin’s inherent volatility as a major risk to shareholder value. In an investor letter released after the meeting, the board reiterated that Bitcoin is far more volatile than traditional investment assets like corporate bonds. “Companies should not hold too much Bitcoin, risking shareholder value,” the statement read.

The tech giant’s leadership further noted that its current financial strategy, including stable investments, dividends, and share buybacks, had successfully returned $200 billion in capital to shareholders. However, it argued that Bitcoin investments could introduce unnecessary risk to this approach.

The Bitcoin at Microsoft reflects a broader hesitation in traditional corporate circles to adopt the cryptocurrency. Prediction markets, such as Polymarket, had this outcome, with bettors assigning only a 12-16% probability of the motion passing.

Other motions at the meeting, including those addressing AI misinformation and risks of weapons development, also needed to gain significant traction.

Michael Saylor’s Take

Saylor framed the vote for Microsoft on whether to embrace the future with Bitcoin or cling to traditional finance. Despite his compelling argument, the overwhelming rejection suggests that Microsoft shareholders, at least for now, prefer the stability of conventional investments over the volatility of digital assets.

The 0.55% approval is a critical indicator of Bitcoin’s challenges in gaining mainstream corporate adoption. For now, Microsoft remains firmly on the sidelines of the cryptocurrency debate.

Highlighted Crypto News

Australia Slaps Kraken Operator with $5 Million Fine