- Invesco submitted a proposal for a Bitcoin Futures ETF in 2021.

- Citing regulatory concerns the investment firm backed out at the last minute.

A new application for a spot Bitcoin (BTC) exchange-traded fund (ETF) has been made by Invesco, a major investment management firm that manages $1.49 trillion in assets. This comes after Invesco and Galaxy Digital first applied to launch a Bitcoin ETF in 2021.

A recent filing with the Securities and Exchange Commission (SEC) indicates that Invesco is once again interested in launching a Bitcoin exchange-traded fund (ETF).

Spot Bitcoin ETF New Favorite

Invesco submitted a proposal for a Bitcoin Futures ETF in 2021, however, they backed out at the last minute. They blamed government oversight even though the SEC had previously given its clearance to ProShares’ Bitcoin Futures ETF.

In its most recent filing, Invesco stressed the critical need for a spot Bitcoin ETF, arguing that investors are forced to choose riskier options in the absence of such a product.

Invesco’s decision to reapply for a Bitcoin spot ETF reflects the increasing popularity and fierce competition in the cryptocurrency ETF market. The recent application made by BlackRock, a major participant in the investment management business, is likely what prompted Invesco to reapply.

Since last Thursday, a number of well-known firms, including iShares, Bitwise, and WisdomTree, have filed paperwork for spot Bitcoin ETFs.

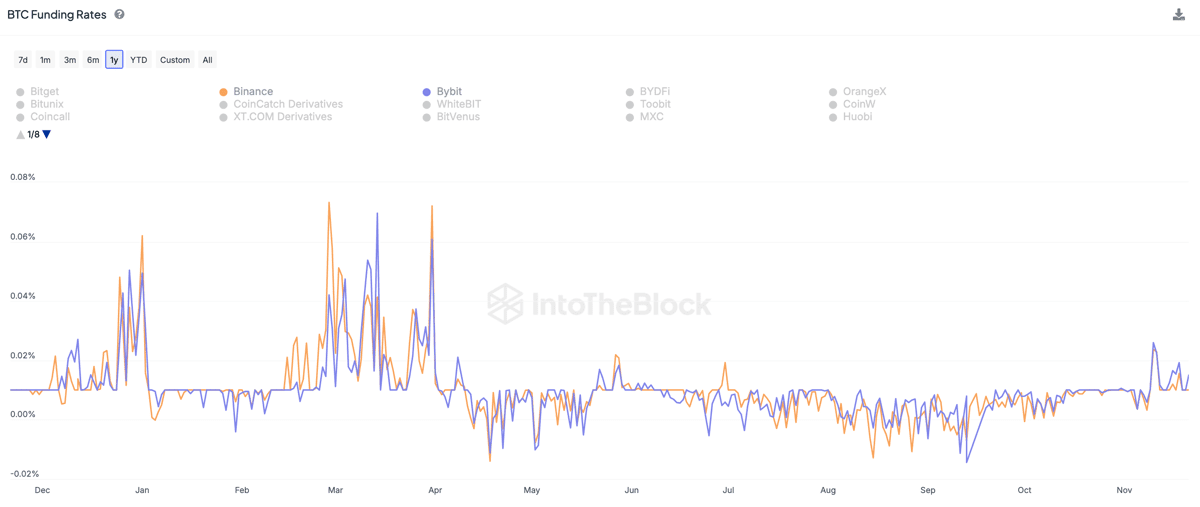

Over the previous 24 hours, the price of Bitcoin has skyrocketed, rising by 8 percent. It has risen sharply, up 10.6 percent in only the previous week. As per statistics, Bitcoin’s market value has surpassed 51% dominance. Thus, solidifying Bitcoin’s position as the market leader among cryptocurrencies. According to CMC, the price of BTC is $28,924.