Data shows that Litecoin long-term holders exited the asset before the halving, while short-term holders were left to panic on the halving day. The “halving” here refers to an event where the block rewards of Litecoin are permanently cut in half.

According to data from the market intelligence platform IntoTheBlock, the long-term holders had been well-prepared for the “sell the news” halving event. The “long-term holders” (LTHs) generally include all investors who have been holding onto their coins since at least six months ago.

Related Reading: These Bitcoin Metrics Are At Important Retests, Will Bullish Trend Prevail?

This group includes some of the most resolute investors in the Litecoin market, who don’t easily react to whatever is going in on in the wider sector, as they usually hold through FUD or profit-taking opportunities without participating in any significant selling.

Because of how rare movements from these investors can be, the few times that they do sell can be the ones to watch out for, as they may spell trouble for the market.

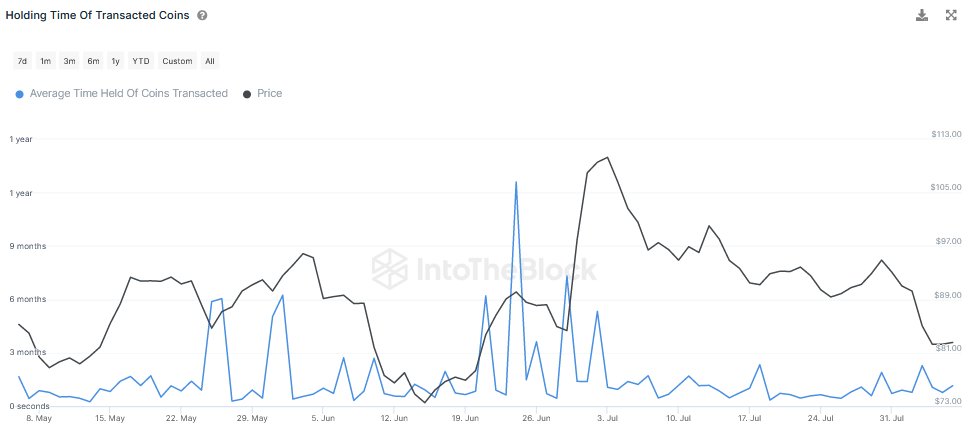

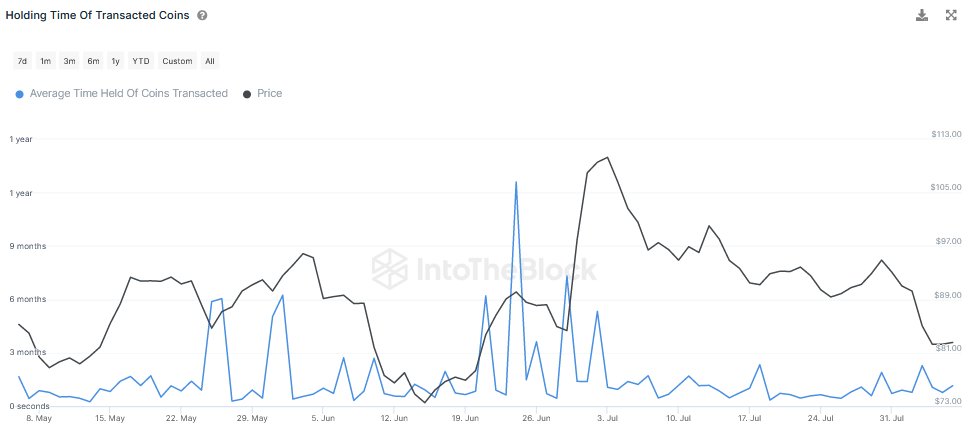

A way to gauge whether the LTHs are participating in selling or not is through the “holding time of transacted coins” metric, which tells us about the average amount of time that coins being transferred on the blockchain had been dormant prior to this movement.

When the value of this metric is high, it means that the age of coins being sold on the network is high, which can naturally be a sign that the LTHs are active right now. On the other hand, low values usually indicate that the short-term holders (STHs) are the ones selling currently.

Now, here is a chart that shows the trend in the Litecoin holding time of transacted coins over the past few months:

As you can see in the above graph, the Litecoin holding time of transacted coins spiked back in June, when the price of the cryptocurrency had been observing a sharp rally.

During the largest of these spikes, the indicator’s value had exceeded 1 year, implying that some of the most experienced investors in the market had broken their silence.

This rally had occurred as the market had started getting hyped about the halving, which was only a month and a half away at that point.

This event takes place every four years, with the latest one having occurred just earlier this month. Unlike what some may have hoped for, the event didn’t prove to be bullish for LTC, as the aforementioned rally didn’t last for too long and the cryptocurrency only declined in the remaining leadup to the halving, until finally it actually sharply plunged on the day of the event itself.

It would appear that the experienced LTHs had already predicted something like this may happen, so they had taken the wise decision of selling while the opportunity was there.

In the post-halving selloff, the indicator’s value has remained low, implying that it’s only the short-term holders who have been panic selling after they saw that a bullish trend couldn’t return to Litecoin with the event.

At the time of writing, Litecoin is trading around $84, down 8% in the last week.

Litecoin Long-Term Holders Sold During Price Surge Before The Halving

According to data from the market intelligence platform IntoTheBlock, the long-term holders had been well-prepared for the “sell the news” halving event. The “long-term holders” (LTHs) generally include all investors who have been holding onto their coins since at least six months ago.

Related Reading: These Bitcoin Metrics Are At Important Retests, Will Bullish Trend Prevail?

This group includes some of the most resolute investors in the Litecoin market, who don’t easily react to whatever is going in on in the wider sector, as they usually hold through FUD or profit-taking opportunities without participating in any significant selling.

Because of how rare movements from these investors can be, the few times that they do sell can be the ones to watch out for, as they may spell trouble for the market.

A way to gauge whether the LTHs are participating in selling or not is through the “holding time of transacted coins” metric, which tells us about the average amount of time that coins being transferred on the blockchain had been dormant prior to this movement.

When the value of this metric is high, it means that the age of coins being sold on the network is high, which can naturally be a sign that the LTHs are active right now. On the other hand, low values usually indicate that the short-term holders (STHs) are the ones selling currently.

Now, here is a chart that shows the trend in the Litecoin holding time of transacted coins over the past few months:

As you can see in the above graph, the Litecoin holding time of transacted coins spiked back in June, when the price of the cryptocurrency had been observing a sharp rally.

During the largest of these spikes, the indicator’s value had exceeded 1 year, implying that some of the most experienced investors in the market had broken their silence.

This rally had occurred as the market had started getting hyped about the halving, which was only a month and a half away at that point.

This event takes place every four years, with the latest one having occurred just earlier this month. Unlike what some may have hoped for, the event didn’t prove to be bullish for LTC, as the aforementioned rally didn’t last for too long and the cryptocurrency only declined in the remaining leadup to the halving, until finally it actually sharply plunged on the day of the event itself.

It would appear that the experienced LTHs had already predicted something like this may happen, so they had taken the wise decision of selling while the opportunity was there.

In the post-halving selloff, the indicator’s value has remained low, implying that it’s only the short-term holders who have been panic selling after they saw that a bullish trend couldn’t return to Litecoin with the event.

LTC Price

At the time of writing, Litecoin is trading around $84, down 8% in the last week.