- A whale sold 9.23 million $GOAT tokens, realizing over $9 million in profits.

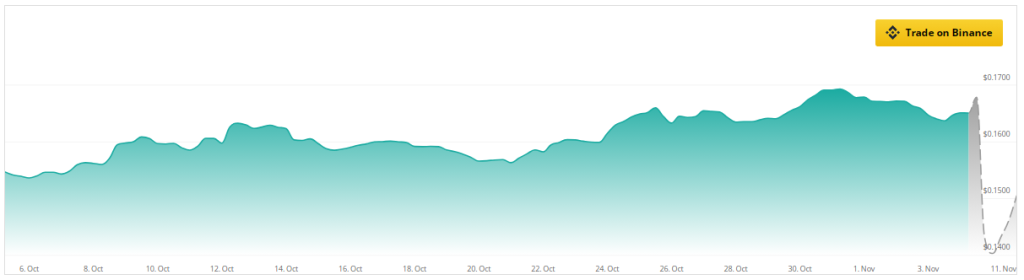

- $GOAT’s price is currently $0.6703, with a 24-hour trading volume of $546.40M.

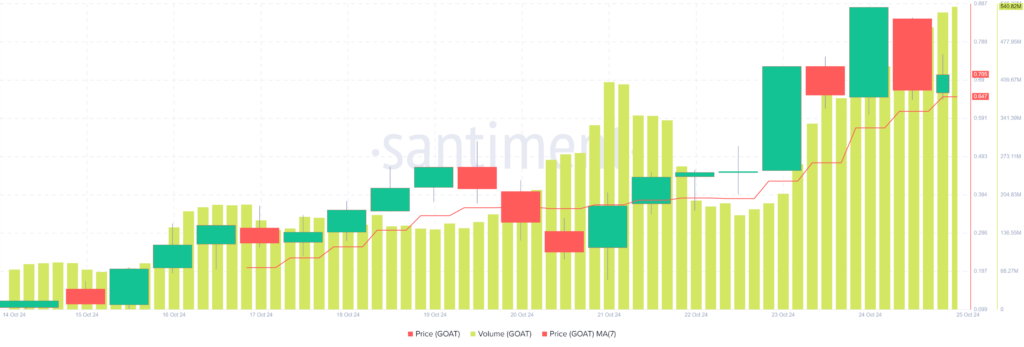

Memecoins are once again making waves in the cryptocurrency space. With a surge in popularity, these tokens are being actively traded by both retail investors and whales alike. One such memecoin grabbing attention is Goatseus Maximus ($GOAT). Like others in the space, $GOAT is riding the current memecoin trend, with massive price and trading volume fluctuations.

A notable transaction involving a giant whale has brought the spotlight to $GOAT. Yesterday, a whale who had accumulated more than $9 million in profit sold 9.23 million $GOAT tokens for $7.13 million. The whale initially purchased 22.48 million $GOAT at an average price of $0.334, spending $7.5 million.

Approximately 17 hours ago, the whale began unloading its holdings. They sold 6.7 million $GOAT tokens for $5.18 million for $0.773 on-chain, followed by depositing 2.53 million $GOAT into the Gate.io exchange (valued at $1.95 million). After these transactions, the whale still holds 13.25 million $GOAT, valued at $9.7 million, with total profits exceeding $9 million.

Current Market Performance of GOAT

At the time of writing, $GOAT is priced at $0.6703, representing a 19.92% decrease over the past 24 hours. Despite this decline, the trading volume has surged by 40.78%, reaching $546.40 million. The market cap stands at $682.54 million, showing a strong presence in the memecoin space. The volume/market cap ratio is currently at 75.45%, indicating high trading activity relative to its market value.

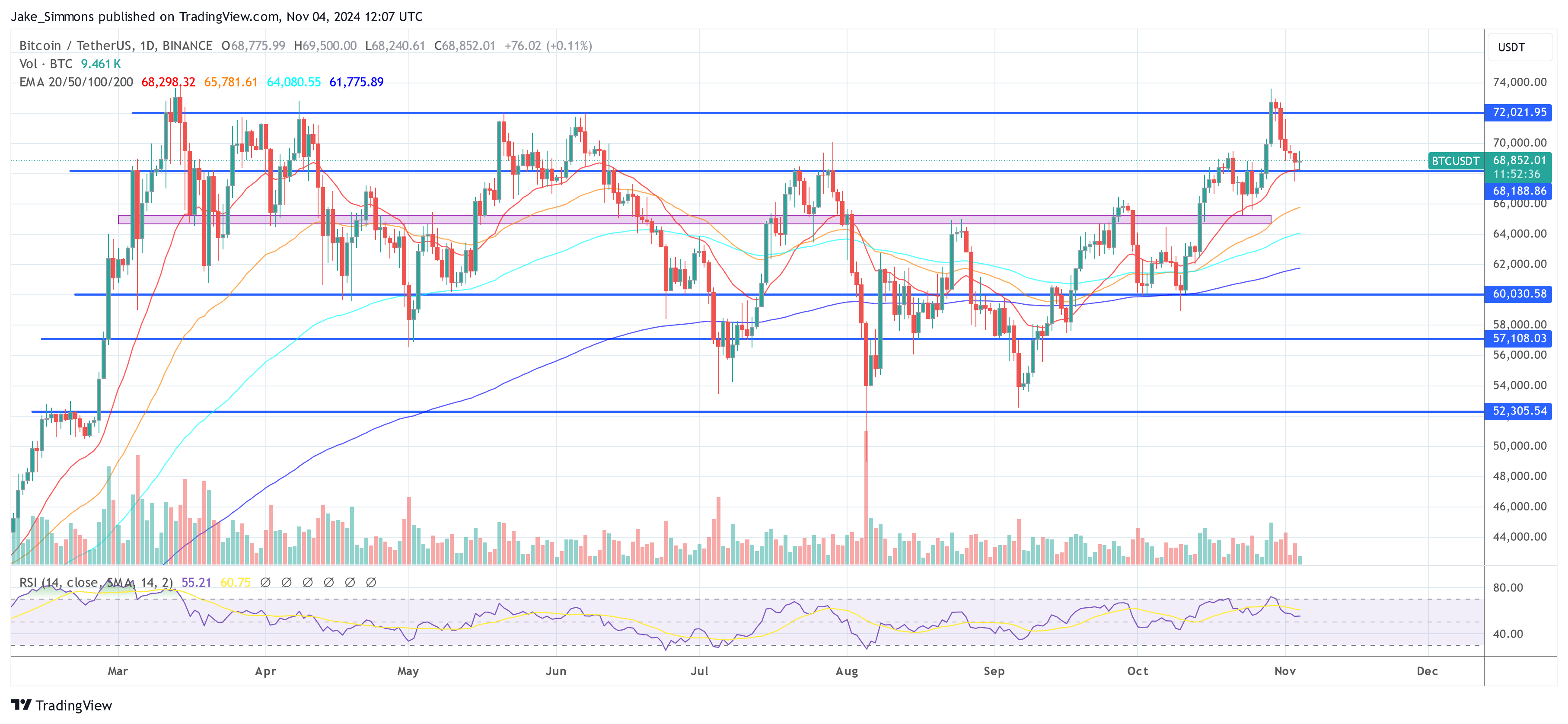

On the technical front, $GOAT is trading between key support and resistance levels. The support level is around $0.475, indicating where buying interest is likely to emerge if prices dip. On the upside, resistance is seen at $0.76, where selling pressure may increase as the price approaches this level.

Meanwhile, the 9-day moving average shows bullish momentum, with the price sitting above the short-term trendline, indicating a possible continuation of the upward trajectory if market sentiment remains favorable.

Highlighted Crypto News Today

Microsoft Shareholders to Vote on Potential Bitcoin Investment