- Bitcoin trades at $101K, marking a modest gain of 1.72% in the last 24 hours.

- BTC may reach its peak by October 2025 if past cycles repeat.

As the new week of anticipation unfolds, the crypto market displays mixed signals. The major cryptocurrencies like Bitcoin and Ethereum have exhibited moderate spikes over the last 24 hours. BTC needs to test a series of resistance levels on the upside for further gains.

Over the past few days, Bitcoin experienced a pullback and surged past the $100K mark again. BTC’s crucial resistance levels are likely tested to confirm a bullish trend. The asset has shown resilience, with the bulls eyeing higher targets.

Over the day, BTC has recorded a modest 1.72% gain. BTC opened the day trading at $100.15K, eventually, it climbed to a high of $102.618. At press time, BTC trades at $101,355. Consequently, BTC stays in the extreme greed zone in the market as the Fear and Greed Index stays at 83.

Moreover, the market observed a liquidation of $38.24 million worth of Bitcoin during this timespan. In the meantime, BTC’s daily trading volume has reached $55.68 billion.

On the other hand, Ali’s chart suggests that Bitcoin’s price performance in the previous cycles shows different patterns. If Bitcoin follows the 2015 and 2018 cycles, the market peak might occur around October 2025. However, if it mirrors the 2011 pattern, BTC could have already hit its market peak.

Will Bitcoin Break Its Price Record?

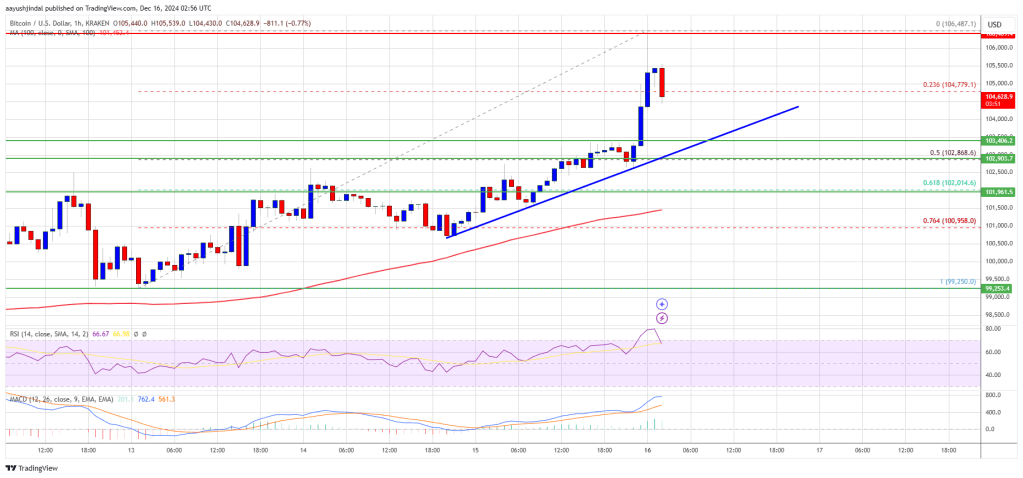

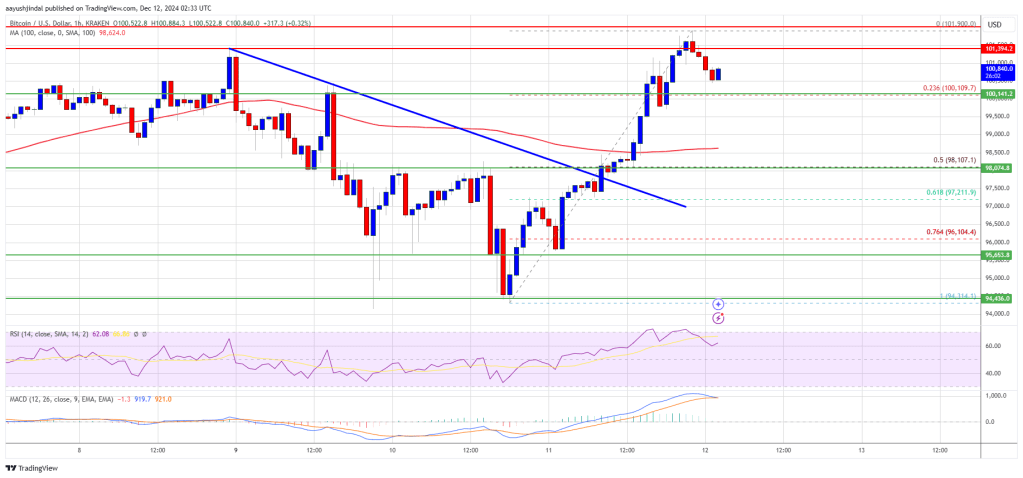

The four-hour trading window of Bitcoin has revealed its current bullish momentum. If the buying pressure increases, the asset’s price could retest the $103,000 level soon. Eventually, Bitcoin price might rally toward the new high of $105,000, if the uptrend strengthens.

On the downside, if the trend reverses and BTC fails to hold above the current trading level at $101,000, a steady decline might take the asset down to the 99,000 mark. If the BTC market gets extremely bearish and the selling pressure is reinforced, the price could drop to its previous lows.

The Moving Average Convergence Divergence line of BTC demonstrates that the MACD has crossed over the signal line. This crossover indicates the asset’s positive momentum and a potential buy signal within the market.

BTC chart (Source: TradingView)

In addition, the technical indicator that determines the capital flow, Chaikin Money Flow (CMF), is found at 0.13. It highlights the positive money flow and moderate accumulation in the market. Meanwhile, the daily trading volume of BTC has plunged by over 17.97%.

The asset’s trading frame has revealed the short-term 50-day moving average above the long-term 200-day moving average. Besides, the daily relative strength index (RSI) is settled at 58.88, inferring that BTC’s current market sentiment is in the neutral range.

Highlighted Crypto News

MicroStrategy Enters Nasdaq-100 as the First Bitcoin-Focused Firm