In a stunning divergence from the recent altcoin carnage, Stacks (STX) has emerged as a beacon of green. The token has not only weathered the storm but thrived, soaring for seven consecutive weeks and etching its highest price point since March 2023.

At the time of writing, STX was trading at $1.80, down 10% in the last 24 hours, but managed to sustain a solid 16% rally in the last seven days, data from Coingecko shows.

This bullish defiance is no fluke. Stacks broke through a key resistance level, showcasing investor confidence. The lack of pullbacks underscores the sustained buying pressure, while the flash crash’s long wick transformed the once-intimidating barrier into a sturdy support floor.

Even amid the broader market correction, STX’s resilience speaks volumes about its relative strength. While this remarkable ascent undoubtedly excites, prudent skepticism remains.

The rapid climb without pullbacks might trigger a sudden correction, and concerns about potential overheating linger. Ultimately, STX’s fate remains intertwined with the overall cryptocurrency market sentiment.

Stacks has surged 694% in the past year, benefiting from the Bitcoin boom and standing out amid a recent decline in altcoins. This growth is driven by a mix of optimism around Bitcoin and Stacks serving as a prominent layer 2 solution for the cryptocurrency.

Meanwhile, the potential approval of a Bitcoin ETF has generated excitement in the crypto community, benefiting projects like Stacks.

Stacks’s ability to incorporate smart contracts and decentralized applications onto the secure Bitcoin blockchain positions it well for potential developments in DeFi and NFTs within the Bitcoin ecosystem.

As a leader in the Bitcoin layer 2 space, Stacks is well-positioned to meet the rising demand for scaling solutions. This advantage allows it to attract developers and users interested in building on the security of Bitcoin.

However, the crypto market is volatile, and Stacks’s success depends on ongoing innovation and adoption, given intense competition in the layer 2 sector.

While acknowledging these challenges, Stacks’s impressive performance should be monitored by investors.

The cryptocurrency is navigating the evolving landscape of the Bitcoin resurgence, and its ability to sustain momentum and establish a lasting presence remains uncertain. Nonetheless, the current chapter of Stacks’s story is filled with exciting possibilities.

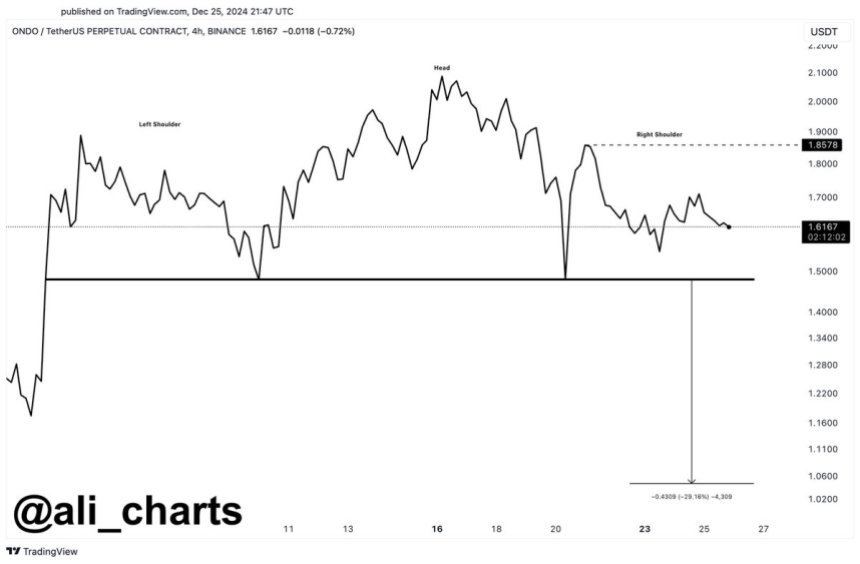

STX Technical Overview

Stacks (STX) is feeling the heat from the bulls, who are aiming to break through the $1.80 psychological barrier and potentially climb to $1.95, the upper channel limit.

This bullish sentiment finds fuel in a rising Relative Strength Index (RSI) at 66, suggesting buyer dominance, and upward-trending moving averages, hinting at favorable market conditions. If the bulls conquer $1.95, $2.0, a 14% climb from current levels, could be the next stop.

However, caution lurks beneath the optimism. Buyer exhaustion or profit-taking could trigger a correction, sending STX dipping towards $1.6 and even $1.48, the lower channel boundary. The moving averages currently act as strong support zones, potentially buffering this potential dip.

While the bulls lead the charge, keep an eye on the RSI and price action around $1.80 and $1.95. A clean break could propel STX higher, but consolidation or a dip is also a possibility.

Featured image from Shutterstock

At the time of writing, STX was trading at $1.80, down 10% in the last 24 hours, but managed to sustain a solid 16% rally in the last seven days, data from Coingecko shows.

This bullish defiance is no fluke. Stacks broke through a key resistance level, showcasing investor confidence. The lack of pullbacks underscores the sustained buying pressure, while the flash crash’s long wick transformed the once-intimidating barrier into a sturdy support floor.

STX Resilience Amid Market Volatility

Even amid the broader market correction, STX’s resilience speaks volumes about its relative strength. While this remarkable ascent undoubtedly excites, prudent skepticism remains.

The rapid climb without pullbacks might trigger a sudden correction, and concerns about potential overheating linger. Ultimately, STX’s fate remains intertwined with the overall cryptocurrency market sentiment.

Stacks has surged 694% in the past year, benefiting from the Bitcoin boom and standing out amid a recent decline in altcoins. This growth is driven by a mix of optimism around Bitcoin and Stacks serving as a prominent layer 2 solution for the cryptocurrency.

STX Price Movement Amid Anticipation Of BTC ETF Nod

Meanwhile, the potential approval of a Bitcoin ETF has generated excitement in the crypto community, benefiting projects like Stacks.

Stacks’s ability to incorporate smart contracts and decentralized applications onto the secure Bitcoin blockchain positions it well for potential developments in DeFi and NFTs within the Bitcoin ecosystem.

As a leader in the Bitcoin layer 2 space, Stacks is well-positioned to meet the rising demand for scaling solutions. This advantage allows it to attract developers and users interested in building on the security of Bitcoin.

However, the crypto market is volatile, and Stacks’s success depends on ongoing innovation and adoption, given intense competition in the layer 2 sector.

While acknowledging these challenges, Stacks’s impressive performance should be monitored by investors.

The cryptocurrency is navigating the evolving landscape of the Bitcoin resurgence, and its ability to sustain momentum and establish a lasting presence remains uncertain. Nonetheless, the current chapter of Stacks’s story is filled with exciting possibilities.

STX Technical Overview

Stacks (STX) is feeling the heat from the bulls, who are aiming to break through the $1.80 psychological barrier and potentially climb to $1.95, the upper channel limit.

This bullish sentiment finds fuel in a rising Relative Strength Index (RSI) at 66, suggesting buyer dominance, and upward-trending moving averages, hinting at favorable market conditions. If the bulls conquer $1.95, $2.0, a 14% climb from current levels, could be the next stop.

However, caution lurks beneath the optimism. Buyer exhaustion or profit-taking could trigger a correction, sending STX dipping towards $1.6 and even $1.48, the lower channel boundary. The moving averages currently act as strong support zones, potentially buffering this potential dip.

While the bulls lead the charge, keep an eye on the RSI and price action around $1.80 and $1.95. A clean break could propel STX higher, but consolidation or a dip is also a possibility.

Featured image from Shutterstock