- Bitcoin’s increased liquidations has caused a bearish turn in the cryptocurrency’s price.

- The digital asset’s daily trading volume showed an increase of 7.28% as per CMC data.

In less than 48 hours, the crypto market, and particularly Bitcoin, has taken a downturn. The cryptocurrency dropped 7% on Tuesday, hitting the $91K level after days of trading above $95,000. This price movement has had minor effects on the altcoin sector, but tokens have bounced back to previous trading levels. Meanwhile, the industry also saw DeFi hit a new 3-year high in the past day.

Inferring Bitcoin’s daily chart, it shows an additional 1.89% dip. In the Asian morning hours of November 27, the digital asset was trading at $94,683. However, more bearish candles sparked, causing prices to drop to current levels. At the time of writing, Bitcoin was trading at $92,487, as per CMC data.

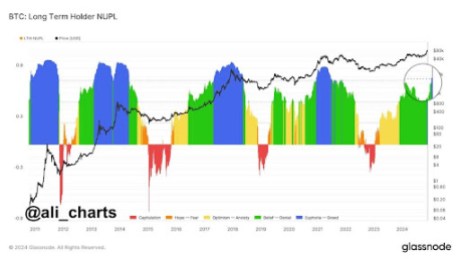

Secondly, when analyzing the causative factors, as widely discussed on X, the whales’ liquidations resulted in the price drop. Moreover, according to Glassnode reports, BTC long-term holders sold a total of 507,000 tokens in this cycle, which resulted in intense liquidation. Subsequently, the huge influx of Bitcoin tokens into the market caused the prices to drop.

The report also stated that this recent selling was lesser compared to the March selling. At the time, the holders sold a significant amount of 934K Bitcoins. However, the recent liquidation frenzy has led to reemerging speculation, if BTC whales are attempting to manipulate market prices.

Does Bitcoin Price Have an Opportunity to Bounce Back?

The largest cryptocurrency’s TradingView data shows intriguing inferences. On analyzing technical indicators, its long-term bull power indicator’s value stands at 9.91. However, its bear power indicator value stands at -2.10.

This variation suggests that Bitcoin does hold a window of opportunity to reinstate its bull run. Additionally, the RSI standing at a neutral 62.32 further highlights this analysis. On the other hand, a continuation of selling can endanger the bull run and lead to Bitcoin dropping further.

Meanwhile, as aforementioned, altcoins such as Ethereum and Chainlink have shown price increases.