- Bitcoin struggles amid declining whale activity and institutional demand slowdown.

- A potential rally to $168K hinges on sentiment and market dynamics.

Bitcoin (BTC), the world’s largest cryptocurrency, has witnessed a 7% drop in value over the past week, trading at $94,159 at the time of writing. This marks its fourth consecutive day of decline, driven by macroeconomic concerns and reduced interest from institutional investors. Despite hitting a peak of $108,245 earlier this month, Bitcoin now hovers below the critical $100,000 level.

BTC Price Chart, Source: Santiment

Market analysts attribute this drop to a combination of profit-taking and hawkish signals from the U.S. Federal Reserve, which recently announced a slower pace of rate cuts than anticipated. The central bank’s decision led to a reassessment of speculative asset investments, impacting Bitcoin and related crypto markets.

Moreover, whale activity has notably slowed, adding to the bearish sentiment. According to data, net flows among large holders have dropped by 116% over the past week. High-value Bitcoin transactions—ranging from $100,000 to $10 million—have decreased significantly, indicating a lack of buying pressure from key investors.

However, regional dynamics offer contrasting perspectives. Korean investors have ramped up their Bitcoin purchases, as reflected in a surge to 5.26 in the Korean Premium Index, signaling heightened demand. Meanwhile, U.S. investors show reduced activity, with the Coinbase Premium Index remaining in negative territory.

Will BTC Make Christmas Wish True?

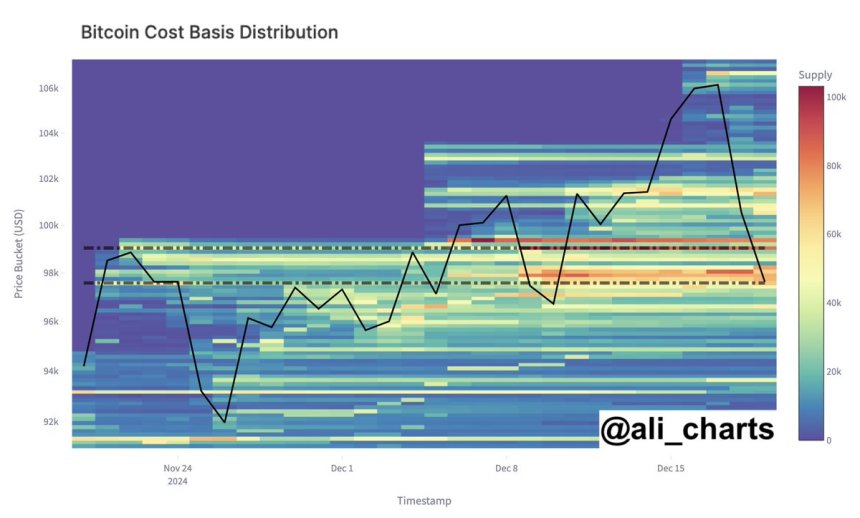

Technical indicators present a mixed outlook. The Relative Strength Index (RSI) stands at 54, suggesting a neutral market stance. Analysts point to support levels around $95,690, warning that a break below this threshold could push Bitcoin toward $85,721. Conversely, a revival in whale activity or institutional interest could spark a recovery toward previous highs.

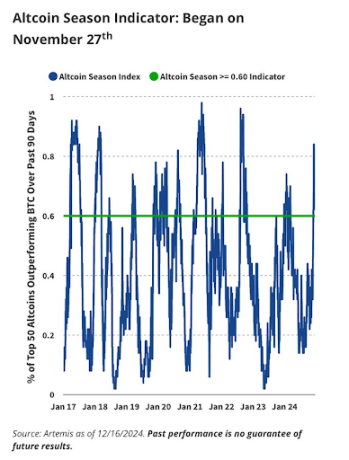

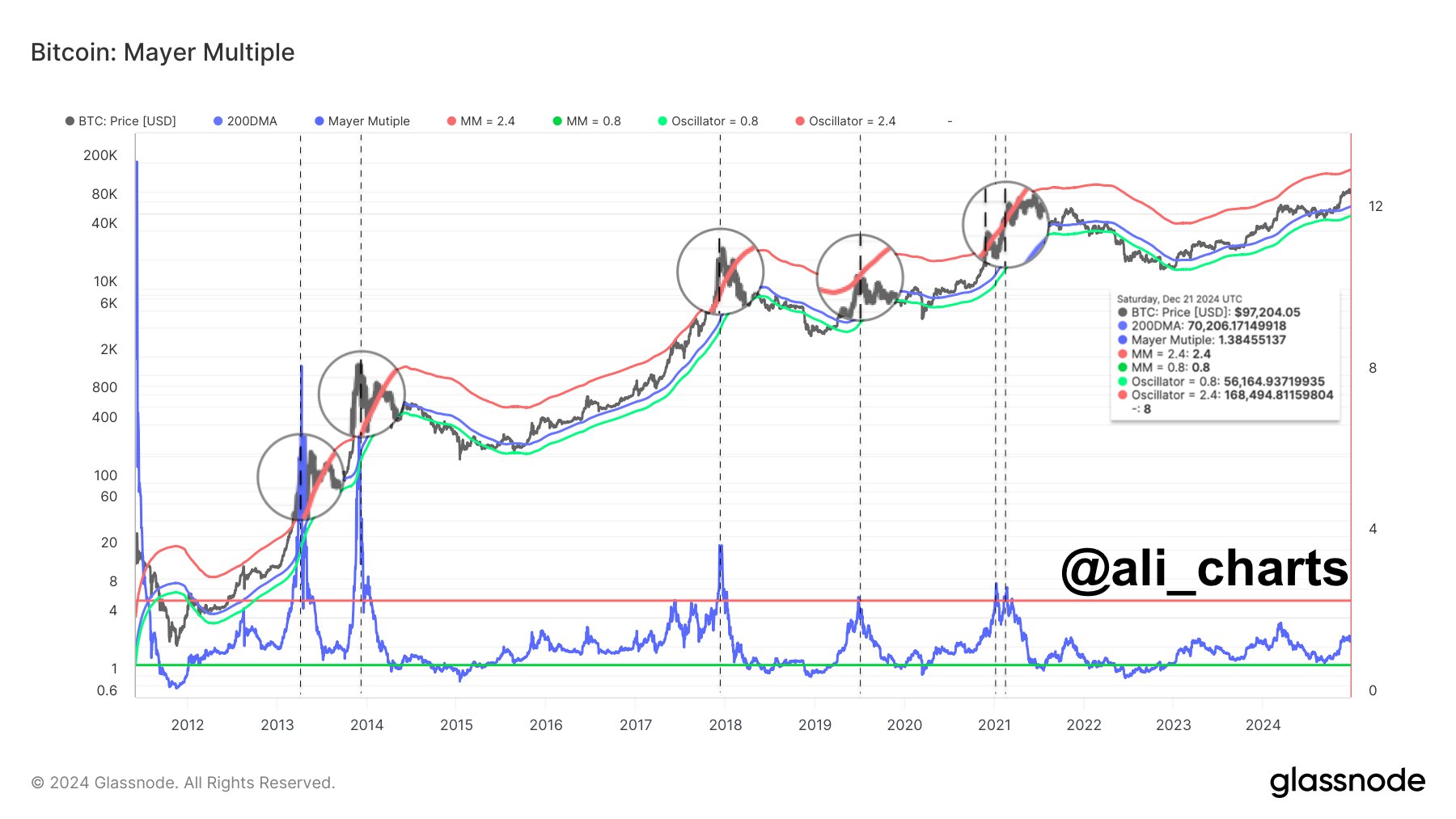

Despite the pullback, some experts remain optimistic. Analyst Ali Charts predicts Bitcoin could rally to $168,000, citing the Mayer Multiple, a metric comparing current prices to the 200-day moving average. Institutions also continue to show long-term interest, with their share of Bitcoin holdings rising from 14% to 31% in the past year.

Highlighted News Of The Day

Why Trump Said Elon Musk Can’t Run for President?