- Bitcoin trades at $99,646 with a $1.97 trillion market cap and $83B in 24-hour trading volume.

- Whale accumulation hits $2 billion, signaling strong institutional interest.

Bitcoin (BTC) currently trades at $99,646.29, marking a 1.38% increase in the past 24 hours. Its market cap stands at $1.97 trillion, with a 4.23% volume-to-market cap ratio. Trading volume surged by 32.01% over 24 hours, reaching $83.23 billion.

Whale accumulation remains strong as 20,000 BTC, valued at $2 billion, were purchased within the same period. Bitcoin’s market cap soars to $2 trillion, making it the 7th largest asset globally. Bitcoin spot ETFs reported significant inflows of $377 million on December 6.

BlackRock’s ETF IBIT led with $257 million per day, followed by Fidelity’s FBTC at $120 million daily. The total net inflow for spot ETFs continued for seven consecutive days. Short-term holders highlight the critical level of $112,926 as the next potential local top, calculated as one standard deviation above their cost basis.

On-chain metrics revealed notable whale transactions. Over 1,012 BTC worth $101.7 million moved between unknown wallets. Another 2,024 BTC, valued at $205.6 million, followed. Transfers included 553 BTC ($56.1 million) from PayPal wallets and 771 BTC ($76.6 million) from Gemini to Coinbase. These activities suggest increased liquidity and strategic positioning.

Will BTC Sustain It’s Bullish Momentum?

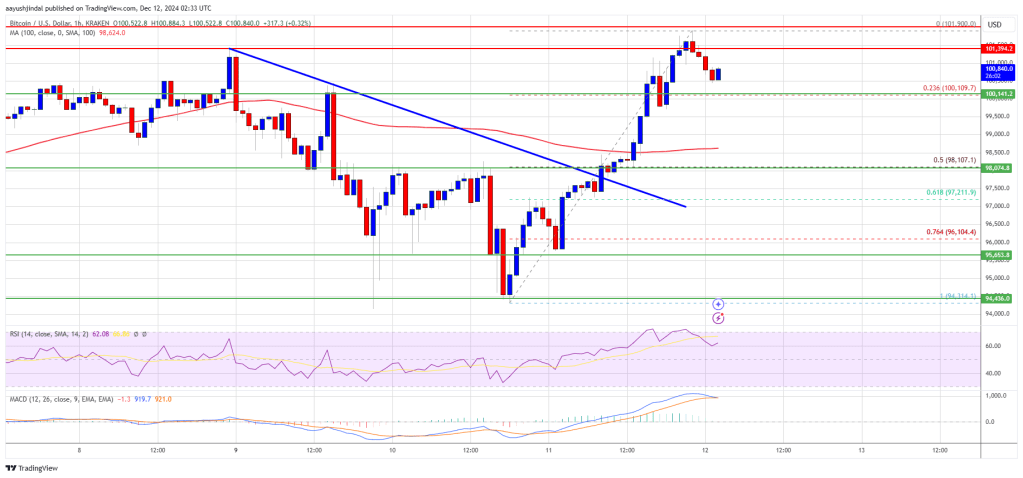

The chart indicates Bitcoin faces resistance near $105,000 and support around $95,000. If the price breaks above $105,000, it could target $112,000. A fall below $95,000 might test $90,000 as the next support.

The Relative Strength Index (RSI) reads 66.4, signaling strong momentum but approaching overbought levels. The RSI average hovers near 63, suggesting a slightly bullish market sentiment.

The 9-day moving average (MA) stands at $97,559, while the 21-day MA is $95,946. A bullish crossover occurred earlier, where the shorter-term MA moved above the longer-term MA, pointing to a potential upward trend. However, the price consolidates near its peak, indicating caution for traders.

Bitcoin’s bullish momentum aligns with rising ETF inflows and whale activity. While resistance at $105,000 could limit gains, breaking above this level may open a path to $112,000. If current support levels fail, prices could retreat toward $90,000. With sustained demand from institutions and retail traders, Bitcoin’s outlook remains positive.

Highlighted Crypto News Today

XDC and ArchaX Partnership Lead to 30% XDC Price Surge