- Bitcoin trades at $62,046.34, up 2.83% in the past day.

- A recent Federal Reserve rate cut by 50 bps historically impacts Bitcoin.

Bitcoin (BTC) is currently trading at $62,046.34, showing a 2.83% increase in the past day. The leading cryptocurrency maintains a market cap of $1.23 trillion, securing its position as the top digital asset in the market. Over the last 24 hours, the trading volume reached $46.08 billion, reflecting a 17.22% surge, while the volume-to-market cap ratio stands at 3.73%. The Coin’s circulating supply is 19.76 million BTC, representing 94.08% of its total and maximum supply cap of 21 million BTC. Despite the recent fluctuations, the cryptocurrency remains resilient, reflecting strong investor interest.

The Federal Reserve recently cut interest rates by 50 basis points (bps), a decision that has historically influenced Bitcoin prices. Over the past decade, rate cuts typically led to increased liquidity in financial markets, often driving investors towards riskier assets like Bitcoin. This time, however, the market’s reaction was mixed. Analysts suggest that lower rates usually boost asset prices. However, current economic uncertainty and tightening liquidity could limit Bitcoin’s potential upside. Historically, Bitcoin often rallies after rate cuts. Yet, ongoing global economic pressures may make its response more subdued.

Bitcoin Faces Mixed Signals

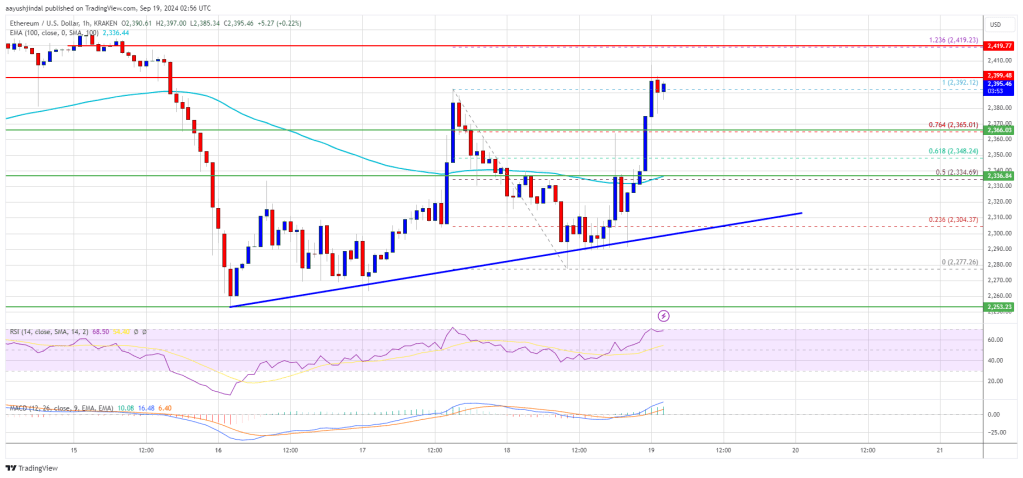

Technical analysis of the coin reveals mixed signals. Key resistance is set at $62,124, with support around $61,900, indicating a tight trading range.

Bitcoin Price Chart (Source: TradingView)

The Relative Strength Index (RSI) currently sits at 65.59, suggesting overbought conditions, while the RSI average is 68.28, reinforcing cautious optimism. Bitcoin’s moving average stands at $62,082, positioning just below the current price, which aligns with a potential pullback scenario.

The latest data shows a negative net flow of $52.7 million for ETFs, marking a downturn after four consecutive days of inflows. This recent shift, with 10 out of 11 Bitcoin ETFs experiencing non-positive flows led by 21Shares (ARKB) highlights a cooling investor sentiment. ETF outflows signal caution among institutional investors, potentially dampening Bitcoin’s near-term price momentum. Despite the spot ETF market’s broader appeal, this pullback reflects prevailing market uncertainties. These uncertainties may continue to influence BTC’s price direction in the short term.

Highlighted Crypto News Today

US SEC Settles with Rari Capital Over Misleading Investors