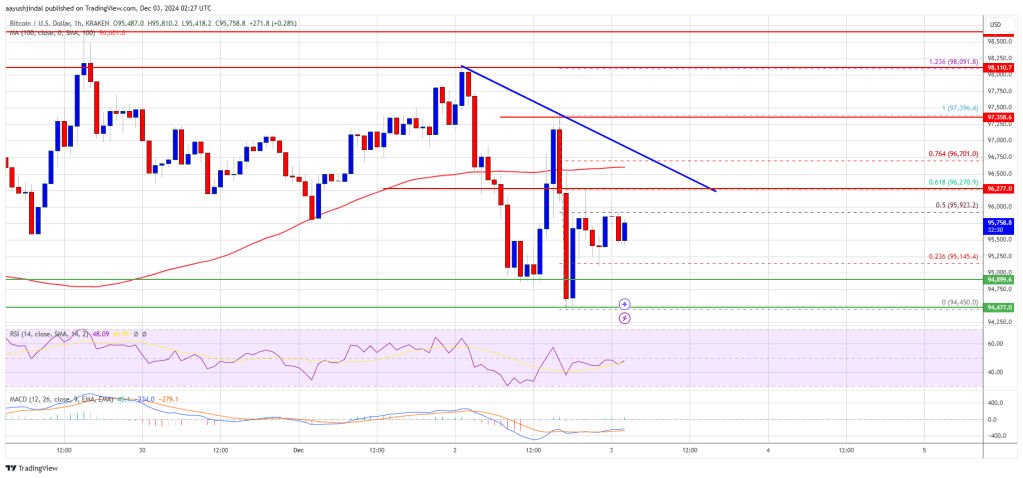

As the Bitcoin price consolidates just below its all-time high of $99,540, a significant move by the US government has raised concerns among investors. The government has transferred a substantial amount of its seized Bitcoin holdings to Coinbase, potentially signaling intentions to sell. This echoes similar actions that had previously impacted the market earlier this year.

According to market intelligence firm Arkham, the US government moved approximately 10,000 Bitcoin, worth around $1.92 billion at current market prices, to two separate wallets.

One wallet contains Bitcoin valued at $969 million, while the other holds approximately $949 million. This strategic allocation has drawn attention, especially given the government’s history of selling seized Bitcoin, which can create notable selling pressure in the market.

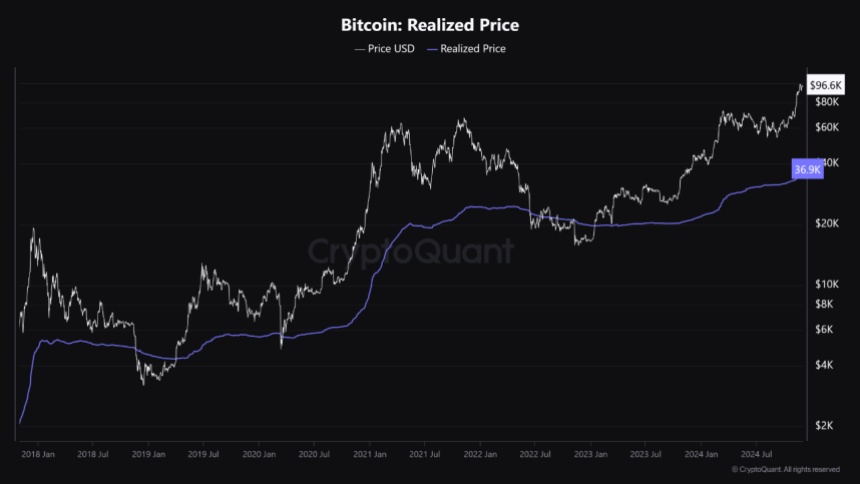

Data from crypto analytics firm Dune indicates that the US government currently holds a staggering 183,422 BTC, valued at over $17.6 billion. This accounts for roughly 0.93% of the total Bitcoin supply.

Should the government decide to sell a portion of these holdings, it could exert significant downward pressure on Bitcoin’s price, reminiscent of previous sell-offs that followed major transfers.

Historically, such actions have led to increased volatility. For instance, NewsBTC reported in April, when the Bitcoin price peaked at $73,700, that the government transferred over 30,000 Bitcoin seized from the Silk Road marketplace.

This followed a previous seizure of more than 50,000 BTC from James Zhong, who allegedly obtained these funds through illegal means related to the Silk Road in 2012. Following these transfers, Bitcoin experienced substantial price fluctuations and a downward trend over the subsequent months.

In 2022, the government also sold 9,800 BTC, with plans to divest an additional 41,500 Bitcoin. This history raises concerns that the latest transfer could lead to a similar outcome, potentially jeopardizing Bitcoin’s recent upward price momentum. However, there are emerging hopes that such moves could be curtailed in 2025.

President-elect Donald Trump is expected to assume office on January 20, and he has proposed a strategy that includes making Bitcoin a strategic reserve asset for the US.

This approach would involve the government purchasing nearly 1 million BTC rather than selling its current holdings, with plans to use these assets to help reduce the nation’s $36 trillion national debt.

This proposal has been introduced in Congress by US Republican Senator Cynthia Lummis under “the Bitcoin Act,” which has garnered bipartisan support. With the recent shift in leadership from Democrats to Republicans securing a majority in the House, there is optimism that this bill could come into effect in the second or third quarter of 2025.

At the time of writing, BTC is trading at $96,000, down 0.7% over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com

US Government’s Bitcoin Transfer

According to market intelligence firm Arkham, the US government moved approximately 10,000 Bitcoin, worth around $1.92 billion at current market prices, to two separate wallets.

One wallet contains Bitcoin valued at $969 million, while the other holds approximately $949 million. This strategic allocation has drawn attention, especially given the government’s history of selling seized Bitcoin, which can create notable selling pressure in the market.

Data from crypto analytics firm Dune indicates that the US government currently holds a staggering 183,422 BTC, valued at over $17.6 billion. This accounts for roughly 0.93% of the total Bitcoin supply.

Should the government decide to sell a portion of these holdings, it could exert significant downward pressure on Bitcoin’s price, reminiscent of previous sell-offs that followed major transfers.

A Halt To Government Sales In 2025?

Historically, such actions have led to increased volatility. For instance, NewsBTC reported in April, when the Bitcoin price peaked at $73,700, that the government transferred over 30,000 Bitcoin seized from the Silk Road marketplace.

This followed a previous seizure of more than 50,000 BTC from James Zhong, who allegedly obtained these funds through illegal means related to the Silk Road in 2012. Following these transfers, Bitcoin experienced substantial price fluctuations and a downward trend over the subsequent months.

In 2022, the government also sold 9,800 BTC, with plans to divest an additional 41,500 Bitcoin. This history raises concerns that the latest transfer could lead to a similar outcome, potentially jeopardizing Bitcoin’s recent upward price momentum. However, there are emerging hopes that such moves could be curtailed in 2025.

President-elect Donald Trump is expected to assume office on January 20, and he has proposed a strategy that includes making Bitcoin a strategic reserve asset for the US.

This approach would involve the government purchasing nearly 1 million BTC rather than selling its current holdings, with plans to use these assets to help reduce the nation’s $36 trillion national debt.

This proposal has been introduced in Congress by US Republican Senator Cynthia Lummis under “the Bitcoin Act,” which has garnered bipartisan support. With the recent shift in leadership from Democrats to Republicans securing a majority in the House, there is optimism that this bill could come into effect in the second or third quarter of 2025.

At the time of writing, BTC is trading at $96,000, down 0.7% over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com