Hedera Hashgraph’s native cryptocurrency, HBAR, is shining following the slight boost in the crypto market today, August 8. Hedera briefly broke through the one-month-long $0.5 resistance, climbing above $0.6, while top coins like Bitcoin bleed with losses.

Even though the overall crypto market cap gain affected many assets positively, HBAR owes most of its gains to the latest ecosystem developments and partnerships.

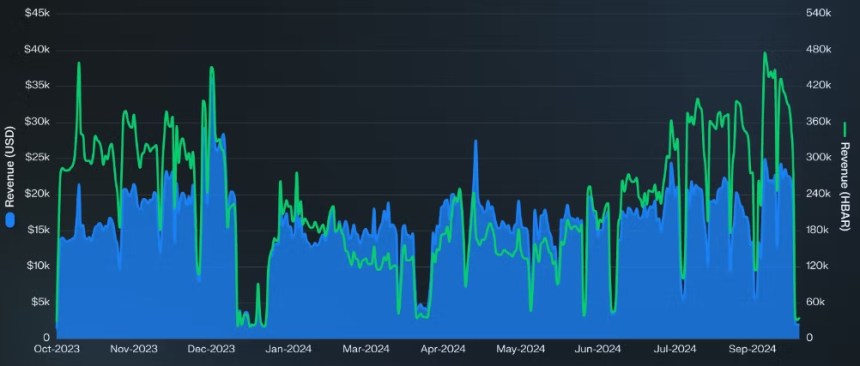

Despite a drop in trading volume, HBAR has soared over 6%, attaining a peak of $0.06032 on Tuesday morning. This sharp spike represents a nearly 10% increase from the day low of $0.05483. But the token has now receded from its peak value and currently trades at $0.05951.

Related Reading: Valkyrie Unveils Double-Barreled Approach To Launch An Ethereum ETF Alongside A Bitcoin ETF

Moreover, the HBAR price has soared over 16% in a week, bucking the bearish trend that snatched all of Bitcoin and Ethereum’s past week’s gains. The token’s value is now over 22% higher than the price recorded 30 days ago.

However, HBAR’s trading volume is south of its price trajectory. The over 16% decline in 24-hour trading volume raises questions about whether the bulls had reached saturation and capitulated to the bears even before the rally grew strong.

Hedera’s network advancements and strategic partnerships have helped to boost HBAR’s current market position. In August, the Hedera network recorded notable deals with leading banking and financial institutions and automobile companies.

On August 2, Korean automobile firms Hyundai and KIA announced the launch of a new blockchain and AI-powered Supplier co2 Emission Monitoring System (SCEMS) on the Hedera network. This integration allows Hedera to record the carbon emission data from suppliers while AI will predict future emissions following the data provided.

Similarly, on August 4, Hedera announced a partnership with FreshSupplyCoAu in a groundbreaking move that could reshape the digital finance landscape. The strategic partnership allows users to connect with conventional banking and the Mastercard network for a seamless, safe, and wider range of cross-border payments.

Through Mastercard’s payment gateway, Hedera will connect traditional banking infrastructure with decentralized finance technology, bridging the gap between blockchain and traditional finance.

These strategic partnerships mark significant milestones for the network. They could boost HBAR’s usability and trading activity as more investors adopt the token.

This move could amplify HBAR’s reach and market presence, potentially increasing network activities and the token’s price.

HBAR Market Outlook, Will The Bulls Sustain?

Hedera’s dwindling 24-hour trading volume, however, raises questions about the longevity of the ongoing rally since a trading volume decline often signifies bearish market activities.

The HBAR’s price chart reveals that technical indicators suggest a bearish trend reversal for HBAR as the token trades above the 50-day moving average, confirming the bullish momentum on its price today. But the Relative Strength Index has receded from 62 to 57, demonstrating weakening momentum as buyers exit the market.

Also, the Moving Average Convergence/Divergence has converged with the signal line and now moves below, while the faded green histogram bars have birthed red ones.

This observation shows HBAR could face downturns in the next few hours unless the bulls regain control.

Even though the overall crypto market cap gain affected many assets positively, HBAR owes most of its gains to the latest ecosystem developments and partnerships.

HBAR Price Performance Amid Impressive Ecosystem Updates

Despite a drop in trading volume, HBAR has soared over 6%, attaining a peak of $0.06032 on Tuesday morning. This sharp spike represents a nearly 10% increase from the day low of $0.05483. But the token has now receded from its peak value and currently trades at $0.05951.

Related Reading: Valkyrie Unveils Double-Barreled Approach To Launch An Ethereum ETF Alongside A Bitcoin ETF

Moreover, the HBAR price has soared over 16% in a week, bucking the bearish trend that snatched all of Bitcoin and Ethereum’s past week’s gains. The token’s value is now over 22% higher than the price recorded 30 days ago.

However, HBAR’s trading volume is south of its price trajectory. The over 16% decline in 24-hour trading volume raises questions about whether the bulls had reached saturation and capitulated to the bears even before the rally grew strong.

Strategic Partnerships Drive HBAR’s Rally

Hedera’s network advancements and strategic partnerships have helped to boost HBAR’s current market position. In August, the Hedera network recorded notable deals with leading banking and financial institutions and automobile companies.

On August 2, Korean automobile firms Hyundai and KIA announced the launch of a new blockchain and AI-powered Supplier co2 Emission Monitoring System (SCEMS) on the Hedera network. This integration allows Hedera to record the carbon emission data from suppliers while AI will predict future emissions following the data provided.

Similarly, on August 4, Hedera announced a partnership with FreshSupplyCoAu in a groundbreaking move that could reshape the digital finance landscape. The strategic partnership allows users to connect with conventional banking and the Mastercard network for a seamless, safe, and wider range of cross-border payments.

Through Mastercard’s payment gateway, Hedera will connect traditional banking infrastructure with decentralized finance technology, bridging the gap between blockchain and traditional finance.

These strategic partnerships mark significant milestones for the network. They could boost HBAR’s usability and trading activity as more investors adopt the token.

This move could amplify HBAR’s reach and market presence, potentially increasing network activities and the token’s price.

HBAR Market Outlook, Will The Bulls Sustain?

Hedera’s dwindling 24-hour trading volume, however, raises questions about the longevity of the ongoing rally since a trading volume decline often signifies bearish market activities.

The HBAR’s price chart reveals that technical indicators suggest a bearish trend reversal for HBAR as the token trades above the 50-day moving average, confirming the bullish momentum on its price today. But the Relative Strength Index has receded from 62 to 57, demonstrating weakening momentum as buyers exit the market.

Also, the Moving Average Convergence/Divergence has converged with the signal line and now moves below, while the faded green histogram bars have birthed red ones.

This observation shows HBAR could face downturns in the next few hours unless the bulls regain control.